Silver

Silver markets initially fell during the week, but turned around to form a massive hammer by the time we closed on Friday. We bounced off the $17 level underneath, and found resistance at the $17.50 level above. By forming a hammer, I suggested that we should continue to go higher, and move above the $17.55 level should send this market looking for the $18 level. I also believe that buying on the pullbacks will be the way to go.

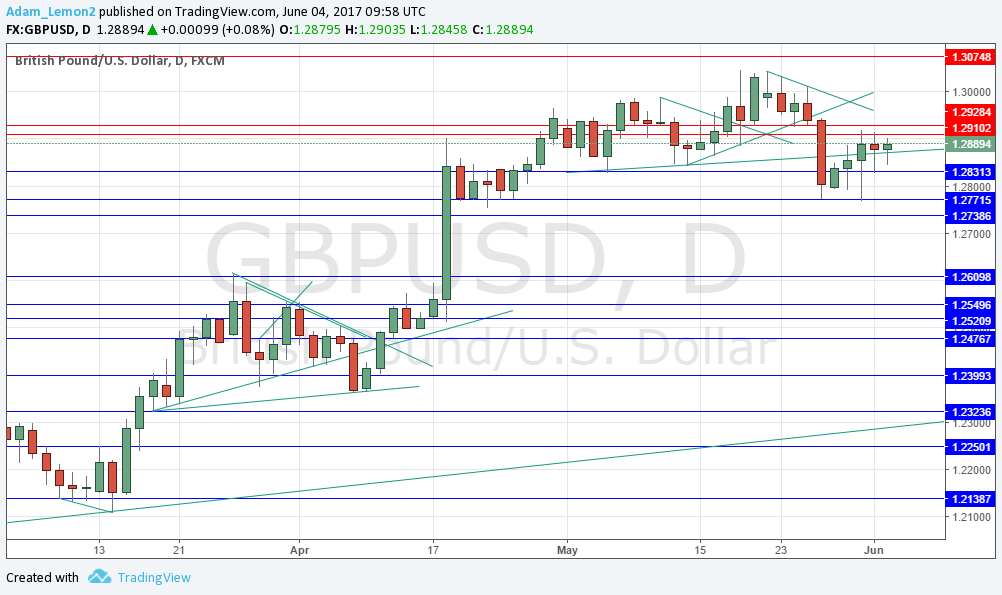

GBP/USD

The British pound fell initially during the week but found enough support at the 1.2750 level again to bounce and test the 1.29 handle. I believe we are essentially consolidating between the 1.2750 level on the bottom and the 1.3050 level above. Because of this, I think that short-term pullbacks will continue to be buying opportunities, and I do like the British pound although I recognize that the upside is somewhat limited in the short term.

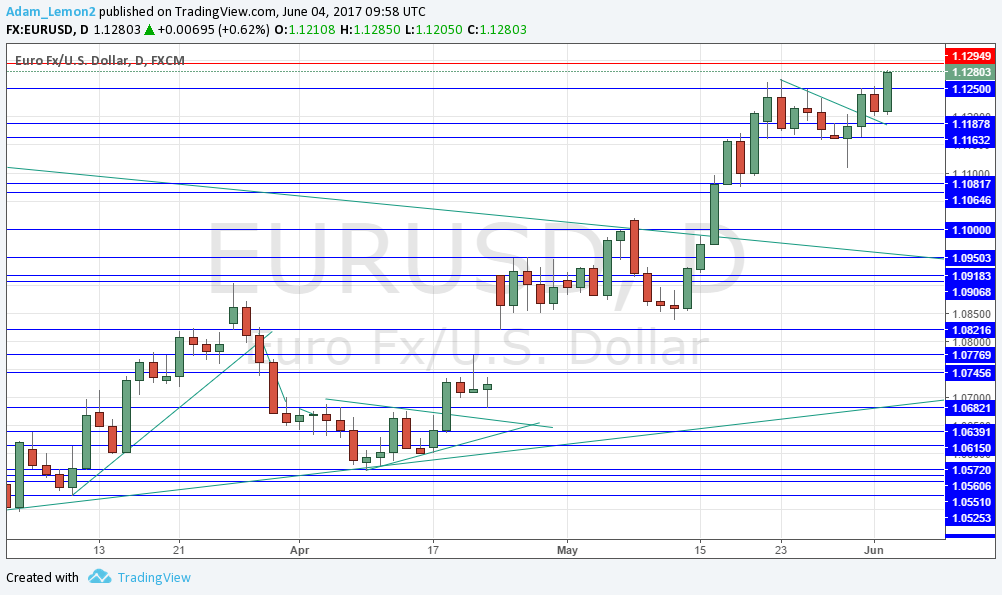

EUR/USD

The EUR/USD pair initially fell during the week, but turned around to blast through the top of the shooting star from the previous week. That is an extraordinarily strong sign, especially considering that we closed at the very top of the range. I believe that every time this market pulls back, there will be buyers waiting below to take advantage of value.

S&P 500

The S&P 500 initially fell during the week but found support at the 2400 level, an area that had been resistance in the past. What I find most telling is that the Friday session saw a massive selloff, only to turn around and go to the upside and close at all-time highs. Buying on the dips is the obvious solution.