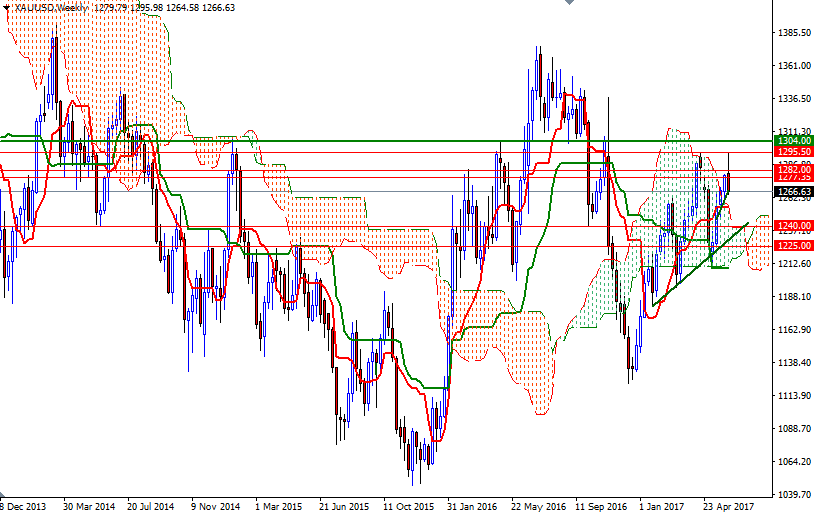

Gold prices settled at $1266.63 an ounce on Friday, suffering a loss of 1.03% on the week, as uncertainty in financial markets fueled by the British election and tensions in the Middle East was not enough for the bulls to overtake the bears. Investors were also taking profits after four consecutive weeks of gains. The XAU/USD pair initially challenged the resistance at $1295.50, but the failure to breach this key level weighed on the market and fuel downside momentum as expected, a case I highlighted in my monthly analysis.

The U.S. central bank will be in focus again this week as a two-day meeting of its policy-setting committee kicks off on Tuesday. Gold tends to get weaker ahead of FOMC gatherings but potential downside may be limited if volatility returns to world stock markets. From a chart perspective, the tall upper shadow of the weekly candle suggests that there will be more downside price action this week. The short-term charts are slightly bearish at the moment, with the market trading below the Ichimoku clouds on the H1 time frame.

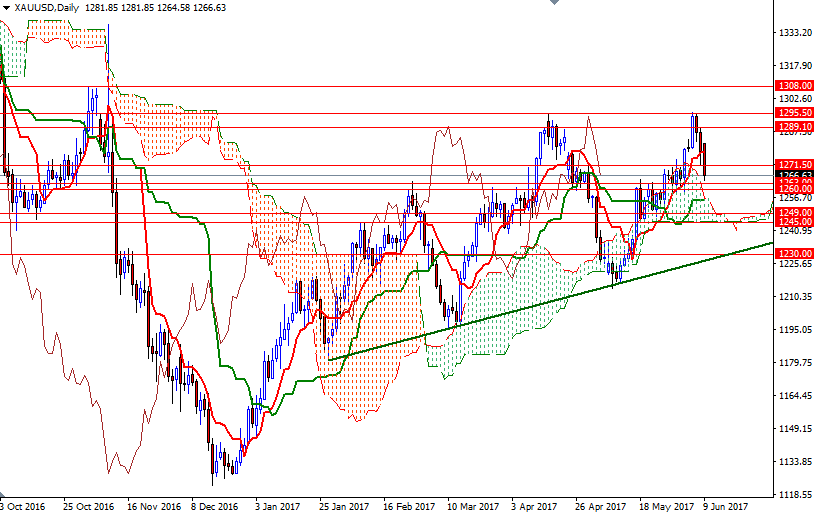

However, the market found some support in the 1265.60-1263 zone, the confluence of the bottom of the 4-hourly cloud and short-term bullish trend line, so we need to get below there to test 1260/59. If this support is broken, then the bears will be targeting 1254.50 and 1250.70-1249 next. The bears will have to drag prices below the 1245 level, which happens to be the bottom of the daily cloud sits in order to make a move towards the critical 1230 level. To the upside, there are hurdles such as 1271.50 and 1277.50-1275. If the bulls can push prices back above 1277.35, it is likely that the market will challenge 1283/2 (the top of the 4-hourly cloud). Closing above 1283 on a daily basis could provide the bulls extra power they need to lift price to the 1289.10-1288 area.