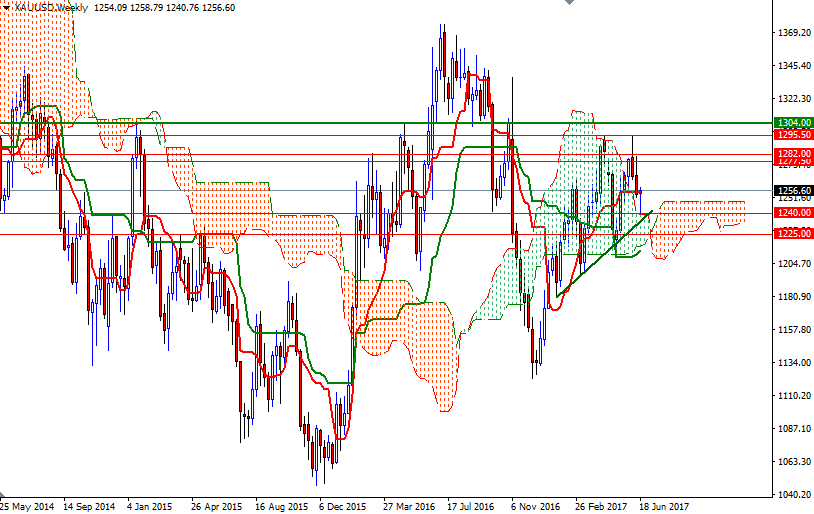

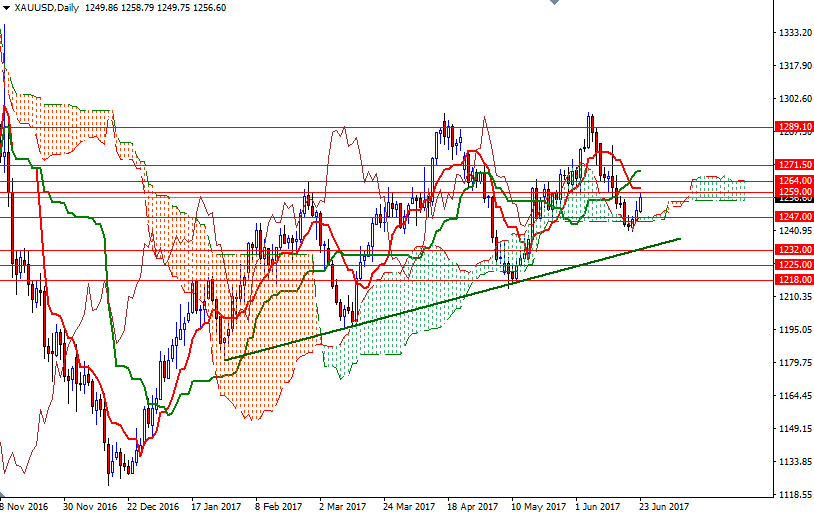

Gold snapped a two-week losing streak as the dollar failed to extend its latest gains after a few Fed officials said that the U.S. central bank should hold off raising interest rates further until it was clear inflation accelerated. The precious metal was also supported by economic and political uncertainty around the world. XAU/USD retreated to the $1240 level earlier in the week but found enough support there to reverse its course, creating a long lower shadow on the weekly candle.

From a chart perspective, the bulls still have the medium-term technical advantage, with the market trading above the Ichimoku clouds on the weekly and the daily time frames, but I wouldn’t rule out the possibility of a drop towards the bullish trend-line until the market anchors above the 1273.50-1271.50 area. In order to challenge that barrier, the bulls have to clear nearby resistances such as 1260/59 and 1264 and hold prices above the 4-hourly cloud. If XAU/USD passes through 1273.50-1271.50, then 1277.50 and 1282 will probably be the next targets.

However, if the Ichimoku cloud on the H4 chart continues to offer resistance and prices break down below the 1249/7 area, I think the market will revisit 1240/39, the top of the weekly cloud. Closing below the 1239 level would be negative sign and open a path to 1232/0. The bears have to capture this key support so that they can make an assault on the 1225 level.