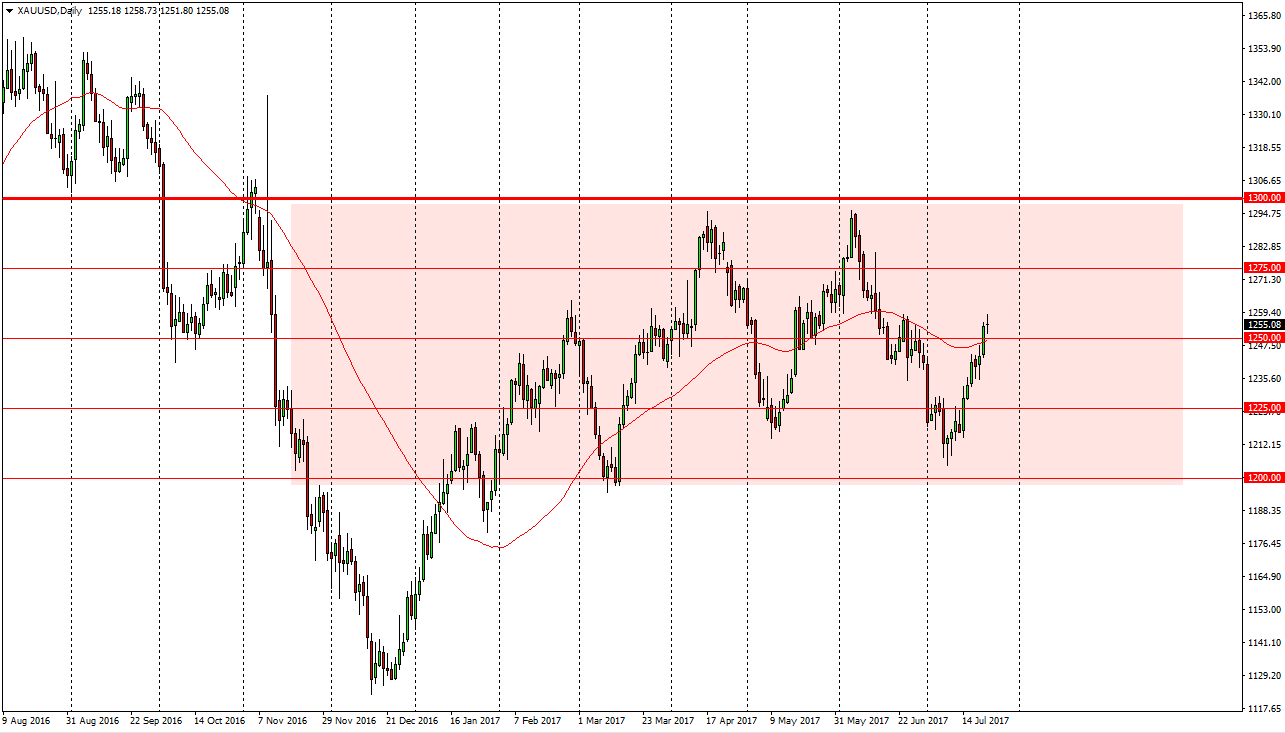

Gold markets had a choppy session on Monday, as we went back and forth in early trading, and eventually settled near the $1255 level. What I find interesting about this is that the market went sideways, after a very explosive moved to the upside. I feel that this market probably needs to pull back, as the bullish pressure can’t run forever. When you look at the 50-day exponential moving average, it’s very flat, so I think we continue the overall consolidation. This means that the market could find its way towards the $1300 level, but since we are overextended currently, I think there’s a good chance that we may pull back to build up more momentum.

Binary trade

Ultimately, this is a binary trade as far as I can see. If we can break above the $1260 level, that would break the top of the consolidate of candle during the day on Monday, and send this market looking towards the $1275 level. Alternately, if we break below the $1250 level, I think we will go looking for support, perhaps somewhere near the $1240 level. This market is highly influenced by the US dollar and of course with the Federal Reserve may or may not be doing, so keep that in mind as well. Right now, it appears that markets are starting to think that perhaps the Federal Reserve cannot be as hawkish as they once were thought to be. I believe the following the technicals will be the best way to go going forward, but as we are in “no man’s land”, it’s likely that we could go in either direction short term. Honestly, I feel much more comfortable going long in this market in shorting, but I recognize that a pullback might be necessary to build up the momentum to do so.