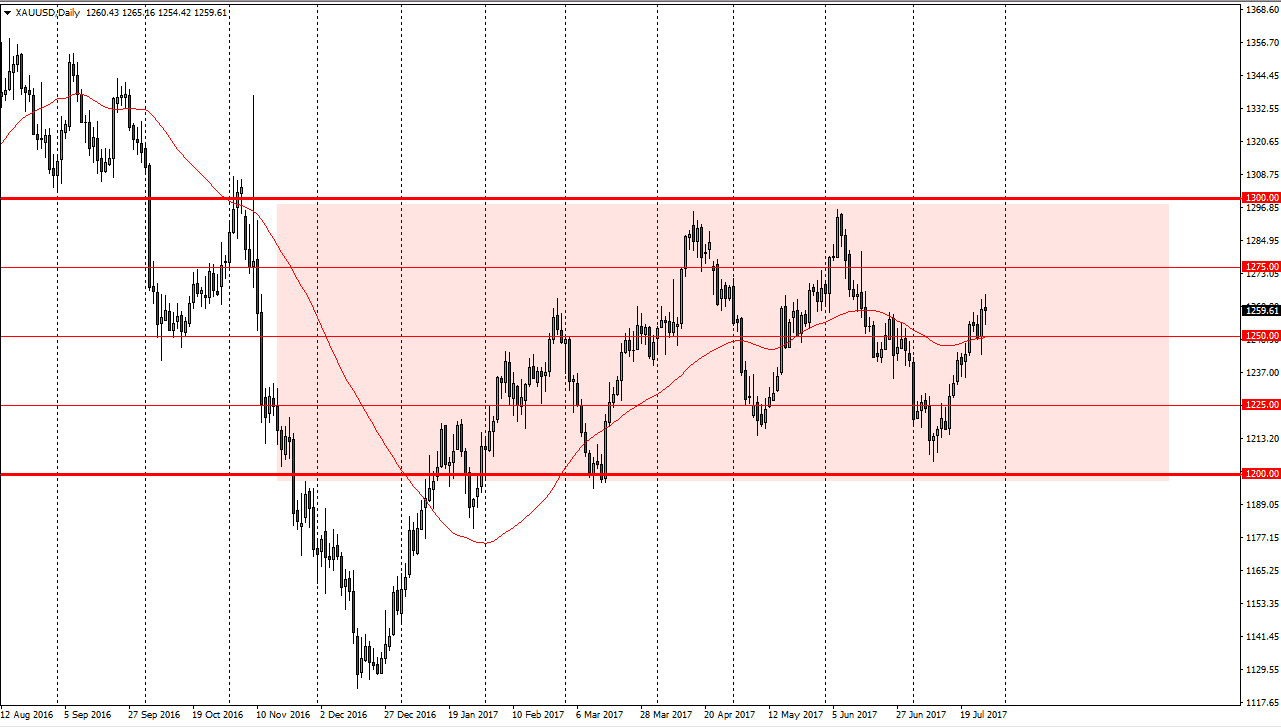

Gold markets went back and forth on Thursday in rather wild trading as Wall Street was out-of-control to say the least. We saw a massive selloff based upon a large futures order placed in the NASDAQ 100. It ended up forming a bit of a knock-on effect in other markets, and by the end of the day the currency markets, the stock markets, and the futures markets in the commodities realm all had remarkable turnarounds. By forming this neutral candle, I think that we are probably going to pull back slightly, but I would expect the $1250 level to be supportive.

Buying dips

I think that the Federal Reserve has made it clear that they are going to be somewhat dovish, and that should be good for gold. I don’t know that were necessarily going to break out to the upside, but I do think that a return to the $1300 level would not be out of the question. If we do breakdown, I think it’s not until we slice below the $1240 level that you can consider selling this market, as it would probably roll over towards the $1225 level. I think that there is a lot of volatility just waiting to happen, but when you look at the overall market, it’s obvious that we have been consolidating for several months. I believe that we still have a range of $1200 on the bottom, and $1300 on the top. That has not changed, so I can only assume that since we are above the middle point, we will continue to see bullish pressure, especially considering that the Federal Reserve has already made it clear that they are going to be very slow in tightening monetary policy. That’s not to say that this will be an easy trade, but I think we do chop around with an upward bias.