The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 25th June 2017

Last week, I passed on making any prediction regarding a best trade for the week. This was probably a wise idea as the market was hit by some surprising developments and an unexpectedly higher level of volatility. I did highlight potential long trade opportunities in Crude Oil and Natural Gas, both of which would now be in profit if taken.

The Forex market is now in a more settled mood, with higher volatility and a re-emergence of clear trends. There important input expected this week from major central banks, most notably the Federal Reserve. I forecast that the best trades this week will be long EUR/USD and GBP/USD.

Fundamental Analysis & Market Sentiment

The major element affecting market sentiment at present are a view that almost all major central banks have now indicated they are on courses of tightening monetary policy, with the notable exception of the Bank of Japan. Two central banks were seen to change their respective stances over the past week; the European Central Bank and the Bank of England. Although the Federal Reserve was the first major central bank to turn towards a tighter policy, its actions are now being overshadowed. There is a more settled bearish outlook on the U.S. Dollar, which may be either confirmed or overturned this week as there are plenty of major U.S. data releases due, including Non-Farm Payrolls and the FOMC Meeting Minutes.

Technical Analysis

USDX

The U.S. Dollar printed a large, bearish engulfing candlestick this week, making a new 6-month low price. The rhythm of the pattern is conclusively bearish. The bullish trend line is broken and has been rejected bearishly from the broken side, with a resistance level at 12289. The price is established convincingly well below the formerly supportive level at 12203, and is held by a strong bearish trend line. The price is now below its historic levels from 3 months and 6 months, so has a long-term bearish trend. The signs are conclusively bearish, but there is key support within reach at 12012.

EUR/USD

This pair printed a very strongly bullish candlestick, closing near its high and making a new 1-year high price. There is a clear long-term bullish trend. The main problem for bulls is that although the price has made a new high, it is still within a price zone that has been strong resistance for more than 2 years, so it may be difficult for the price to rise much higher very quickly.

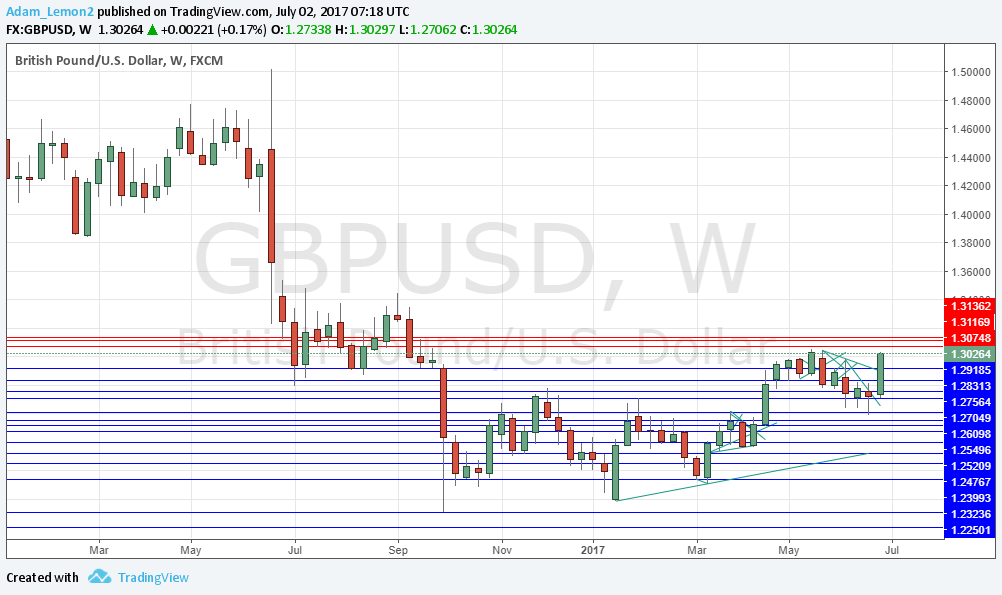

GBP/USD

This pair printed a very strongly bullish candlestick, closing near its high and almost making a new 6-mnth high price. There is a clear long-term bullish trend, with the price above its levels of both 3 and 6 months previously. Although the area around 1.3000 is a key psychological number which has acted as resistance previously, it looks as if the price has room to rise further over the near future.

Conclusion

Bullish on the Euro and British Pound against the U.S. Dollar.