The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 23rd July 2017

Last week, I saw the best possible trades for the coming week as long EUR/USD and AUD/USD, and short USD/CAD. Each of these components were profitable: the EUR/USD rose by 1.73%, the AUD/USD rose by 1.13%, and the USD/CAD fell by 0.86%, producing an overall positive averaged winning result of 1.24%.

The Forex market remains in a settled mood, with a re-emergence of clear trends, and breakouts into multi-month or even multi-year highs on a few Forex pairs, all against the U.S. Dollar. This comes as sentiment continues to be sour on the U.S. Dollar following more dovish than expected testimony by Janet Yellen, Chair of the Federal Reserve, before Congress two weeks ago. A bullish meeting minutes release by the Reserve Bank of Australia and a hint that a roll-back of QE will begin in October from the European Central Bank helped boost both of those currencies.

This week I forecast that the highest probability trades will be long of the Canadian and New Zealand Dollar, as well as the Euro, and short of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major element affecting market sentiment at present is the view that almost all major central banks have now indicated they are on courses of tightening monetary policy, but with much more pessimism concerning the U.S. Dollar as the Federal Reserve has now signaled a slower pace of monetary tightening. This has left the U.S. Dollar with clear weakness in the Forex market, which has been reinforced by recent weak economic data which boosted the dovish case. Crucially, this week we will see a meeting minutes release from the FOMC, which could affect sentiment concerning the greenback. As the Dollar is in a clear and strong bearish trend, it could be wise to expect that an “accident happens along the line of least resistance”, justifying a short USD position in advance.

The Canadian Dollar has been particularly strong this week following a quarter-point rate hike by the Bank of Canada two weeks ago, while the Euro and the New Zealand Dollar have printed new multi-month highs over the past week.

It should also be noted that the British Pound is weak, being one of the few currencies to fall in value against the U.S. Dollar over recent days.

Technical Analysis

U.S. Dollar Index

This pair printed another strongly bearish candlestick, closing right on its low and making a new 9-month low price. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. Furthermore, the former key support level at 12012 has been decisively broken, and there are no obvious support levels anywhere nearby.

EUR/USD

This pair printed a strongly bullish candlestick, closing near its high and making a new 23-month high price. There is a clear long-term bullish trend and the price is trading in “blue sky”. However, there are two key long-term resistance levels including a major multi-year high not far ahead which may prevent the price from rising much further, at least over the short-term.

NZD/USD

This pair printed a strong “breakout” bullish candlestick, closing right on its high and making a new 10-month high price. There is a long-term bullish trend and the price is trading in “blue sky”. However, there is a key inflection point of 0.7485 just ahead which may act as resistance and prevent the price from rising much further, at least over the short-term. It is a 2-year high price. Nevertheless, technically, this upwards movement looks as if it has further to run in the near term.

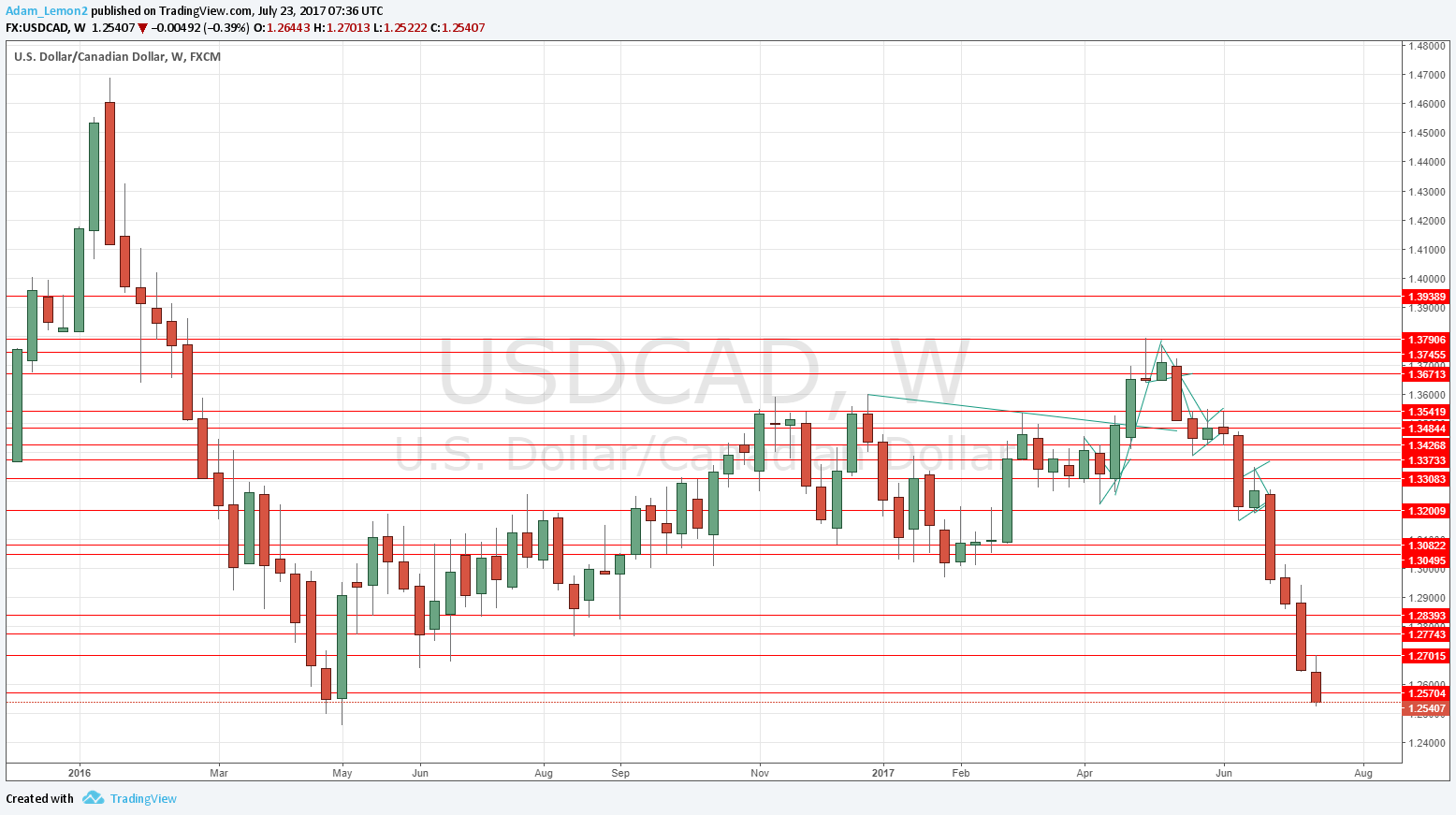

USD/CAD

This pair printed another strong bearish candlestick, closing right on its low and making a new 14-month low price. There is a clear long-term bearish trend with the movement of the past few weeks being of good bearish quality. The price has almost reached “blue sky”. However, there is a key inflection point of 1.2461 not far away which may act as support and prevent the price from falling much further, at least over the short-term.

Conclusion

Bullish on the Euro, New Zealand and Canadian Dollars; bearish on the U.S. Dollar.

.png)