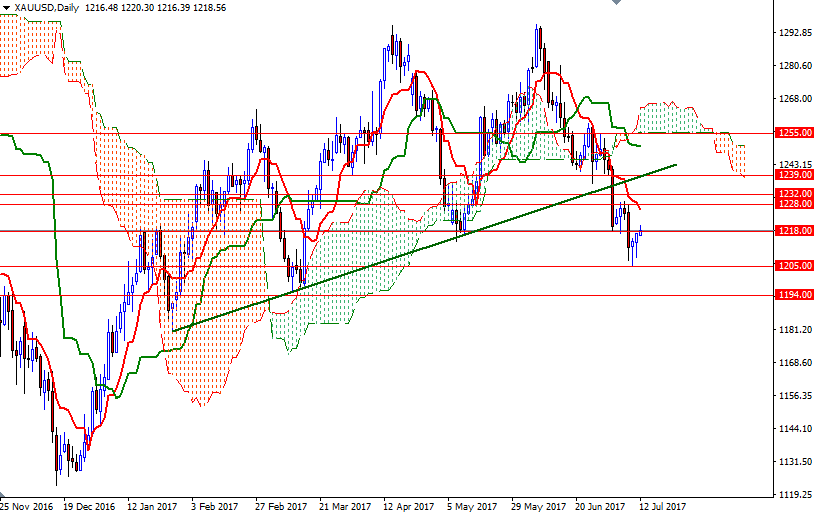

Gold prices rose yesterday, edging further away from a 4-month low struck earlier this week, as the dollar weakened ahead of an appearance by Federal Reserve chair Janet Yellen in front of a congressional committee. Despite the negative outlook, daily charts show a short-term bottoming out above the $1208-$1205 area.

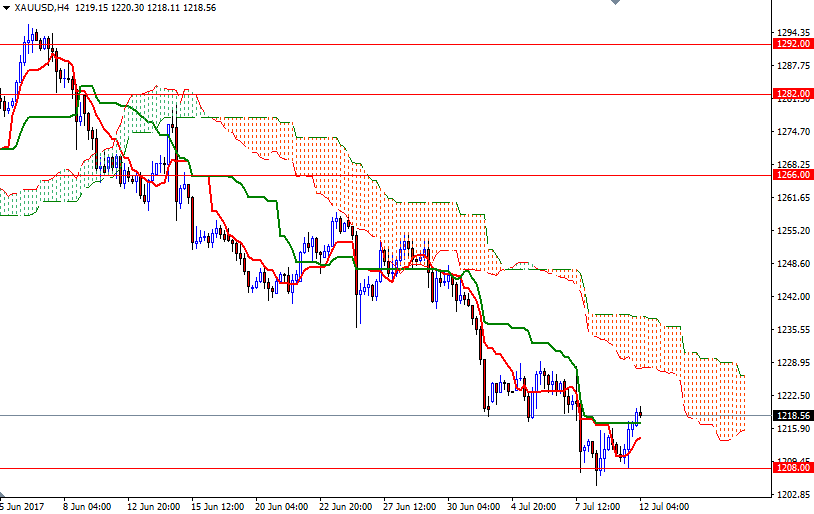

XAU/USD is trading above the Ichimoku clouds on the 1-hour and 30-minute charts. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on both time frames. If the bulls successfully penetrate the initial barrier in the 1220/18 area, we may see a push up to the 1228 level, which happens to be the bottom the 4-hourly cloud. A break through there brings in 1232.

However, if XAU/USD breaks down below 1208/5 and takes out Monday's low, then the market will probably head towards the 1197/4 area afterwards. Falling through this key support could trigger a drop to 1188. A daily close below 1188 implies that the market is ready to test the 1180 level.