Gold prices rose for a third consecutive session on Tuesday, hitting the highest level since July 3, as the dollar came under fresh pressure after Republican lawmakers abandoned their effort to replace Obama’s Affordable Care Act. XAU/USD traded as high as $1244.50 an ounce after breaching the resistance at $1239 provided extra momentum as expected. Market participants will turn their focus to the upcoming European Central Bank and Bank of Japan policy meetings

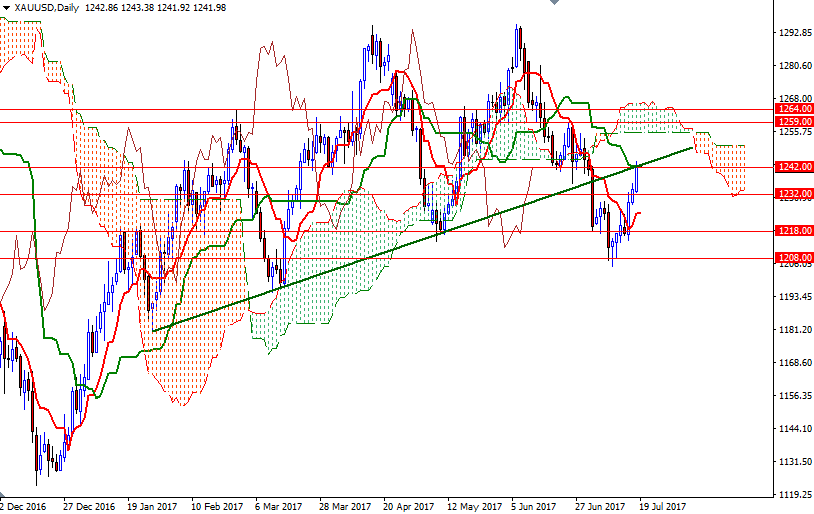

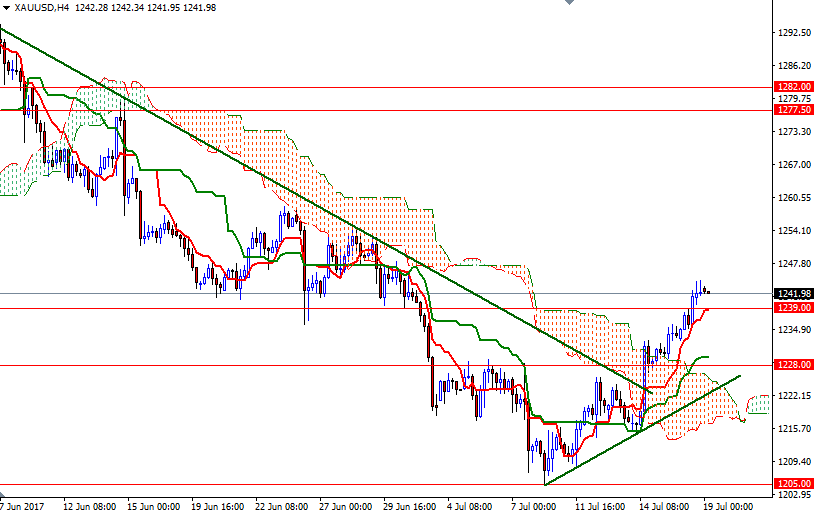

Trading above the Ichimoku clouds on the 4-hour time frame, along with positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), indicates that the bulls still have the near-term technical advantage. However, it would not be surprising if prices stalled ahead of the central bank meetings in Europe and Japan. At this point, I think the resistance at 1242 will play an important role as well. The daily Kijun-sen and a broken bullish trend line converge in this area so expect to see some long-side profit taking.

If that is the case, XAU/USD may test the support in the 1239/8 zone. A break down below there implies that the market will tend to approach the hourly cloud. The top of the hourly cloud sits at 1235 so the bears will to pull prices back below there to make an assault on the 1232/1 region. On the other hand, if XAU/USD breaks up above 1232 and take out yesterday’s high, then the market will probably visit the 1250.30-1248 area next. Once above 1250.30, the bulls will be aiming for 1255 and 1259.