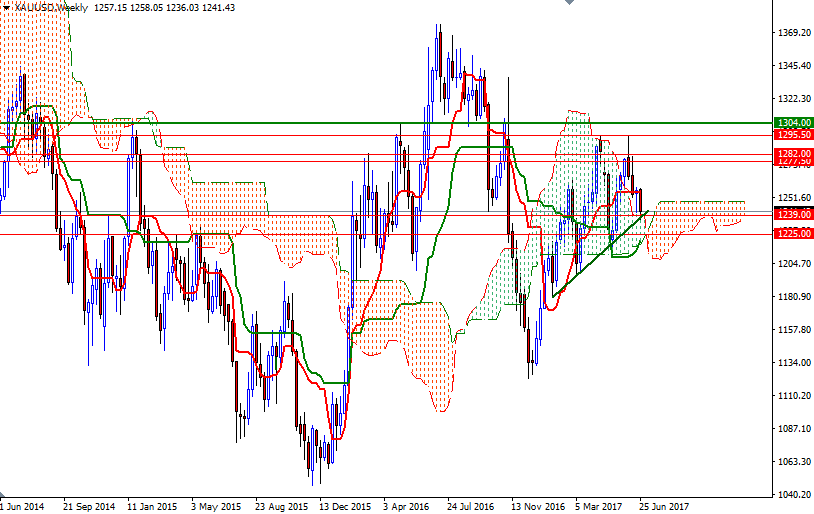

Gold prices settled at $1241.43 an ounce on Friday, suffering a loss of 1.25% on the week and 2.17% over the month. The precious metal’s losses were mainly driven by expectations that several major central banks around the world are getting set to increase borrowing costs as well as continued uptrend in global equity markets. The failure to breach the key resistance at $1295 also weighed on prices. The downside momentum got stronger after XAU/USD dropped below the Ichimoku clouds on the 4-hour time frame.

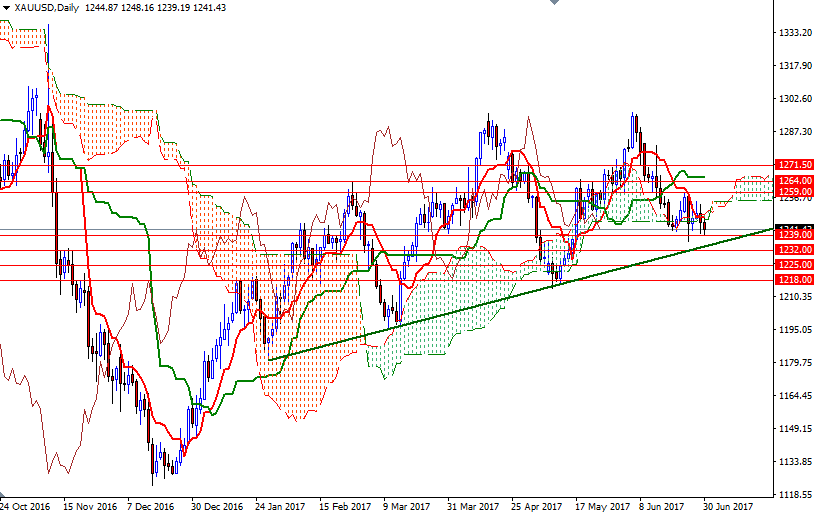

There has been a lack of new, bullish fundamental inputs for gold recently and consequently it is struggling to make it out of the 1239-1260 range. From a technical point of view, I think the market is at a crossroads. Down below, we have the supportive trend line originating in late January and the top of the weekly cloud. On top of us, there are the daily and the 4-hourly clouds. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) resides below the clouds (on both time frames).

If the bears successfully push prices below the 1232/0 area, look for further downside with 1225 and 1218/5 as targets. A break below 1215 opens up the risk of a fall to 1196/4. On its way down, support can be seen in the 1208/5 zone. To the upside, the area between 1259 and 1264 stands out. Breaking through there would be a bullish sign and shift my attention back to the long-side of the trade. In that case, I think the 1282-1277.50 area will be the next port of call. If this resistance is broken, then we are likely to proceed to 1295.50.