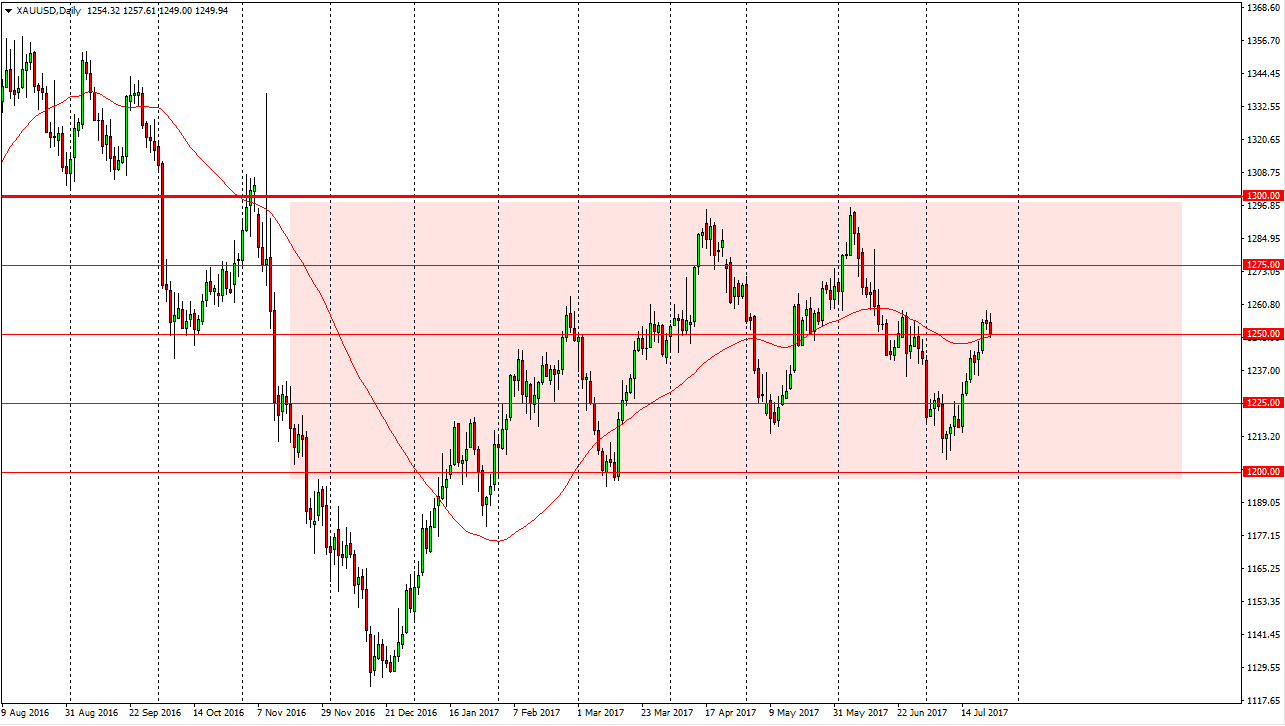

Gold markets had a slightly negative session during the Tuesday session as we crashed back towards the $1250 level. We had formed a shooting star during the day on Tuesday, which show signs of negativity. However, today is the FOMC Interest Rate Statement coming out, as well as the actual decision. I believe that the market should continue to see volatility. Quite frankly, today is going to be difficult to trade, but I would point out that the 50-day exponential moving average is just below current trading and is testing the $1250 level itself. With this being the case, I expect to see a lot of volatility during the day with the headlines coming out. Because of this, I have a reasonably wide range of consolidation, but once we break out of it, I more than willing to put money to work.

Training the break out

Breaking above the $1260 level for me is a very bullish sign, and it should send this market looking for the $1275 level above, and then eventually the $1300 level after that. Alternately, if we break down below the $1240 level, I think that the gold markets will fall rather significantly, reaching down towards the $1225 level, and then eventually the $1200 level. With this being the case, I think that it’s a simple matter of waiting until after 2 PM EST, or New York time. We should see what happens as far as a reaction is concerned to the words coming out of the Federal Reserve. Once we break out of this little consolidation area though, I think it will give us an idea as to where we are going next, and I more than willing to put money to work at that point. Until then, sit tight.