By: DailyForex

Gold prices are down in late U.S. trading, as the dollar strengthened on the back of the better-than-expected U.S. data. The Conference Board’s consumer confidence index came in at 121.1, up from the previous month’s 117.3 and above expectations for a reading of 116.5. XAU/USD traded as low as $1249.04 an ounce but recovered some of its losses and climbed back above the 1250 level.

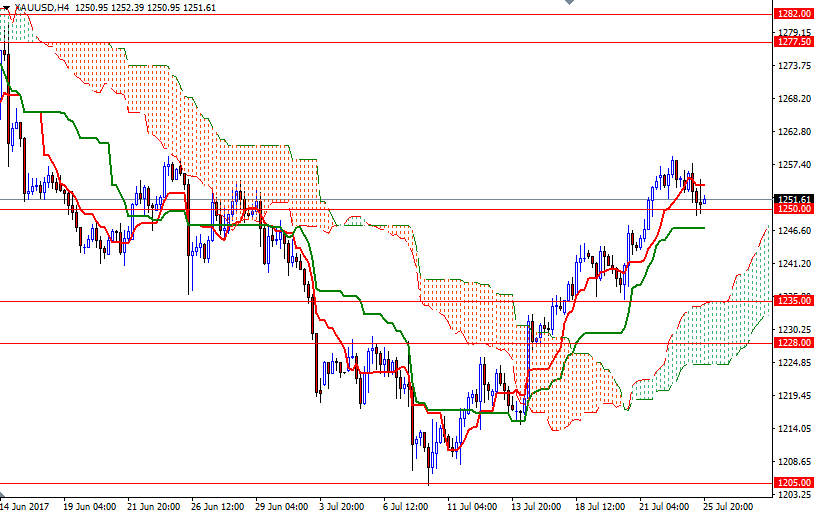

The market is currently trading within the borders of the hourly Ichimoku cloud and it appears that prices will continue to trade within a relatively narrow range until the FOMC announcement. The support at around 1250 initially held but the tall upper shadow on the 4-hourly candle suggests that it is still in danger. If the bears capture this camp, prices will probably retreat to the 1247/6 area, where the Kijun-Sen (twenty six-period moving average, green line) sits on the H4 chart.

To the upside, there are hurdles such as 1253 and 1256 but I think clearing the resistance at 1259 is essential if the bulls intend to challenge the first strategic barrier at 1264, the top of the daily Ichimoku cloud. A break through there could trigger a push up to 1270.