By: DailyForex

Gold prices rose sharply in afternoon U.S. trading, erasing all of the previous day’s losses, after the Federal Reserve left short-term interest rates unchanged and indicated it would likely change its policy on its big balance sheet of U.S. securities relatively soon. However, market players are still looking for the U.S. central bank to hike rates one more time this year. XAU/USD is currently trading at $1253.62, higher than the opening price of $1250.10.

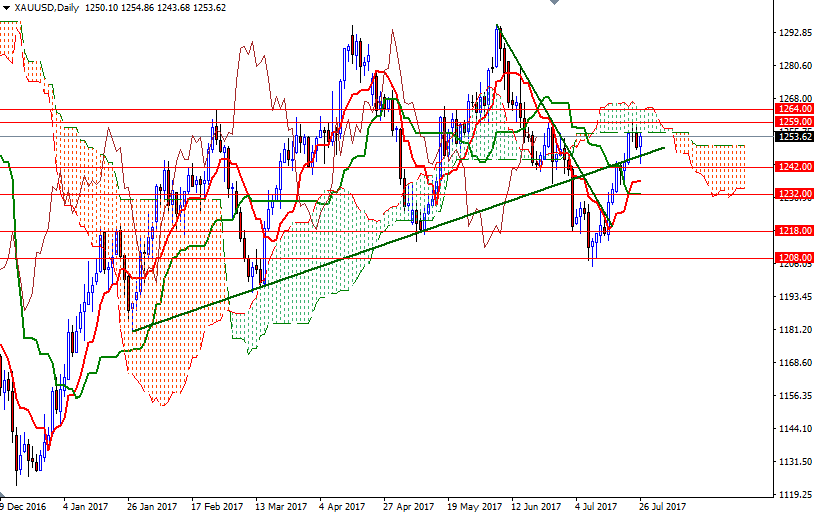

Prices are back above the Ichimoku clouds on the H1 and M30 charts, realigning with the 4-hourly and the weekly charts. This suggests that we are going to continue to the upside and ultimately challenge the 1264 level, where the top of the daily cloud resides. In case we reach there today, I would expect to see some profit taking. However, if the market anchors somewhere beyond 1264, then the 1270 level will probably be the next target. Ichimoku clouds on the H1 and the M30 time frames overlap in the 1251-1247 area, so the bears will have to drag prices below there to have another chance to tackle the 1242 level.