Gold started the week on the back foot, testing the $1208-$1205 area, but managed to recover its earlier losses and ended the day up $1.55 at $1214.09 an ounce. Gold has come under renewed pressure in recent days, as investors recalibrated their outlook on U.S. monetary policy in the light of recent economic data.

The U.S. economic calendar is relatively light for the next couple of days and market players will probably sit on the sidelines ahead of Fed Chair Janet Yellen’s testimony. Yellen is scheduled to appear before the House of Representatives Financial Services Committee on Wednesday.

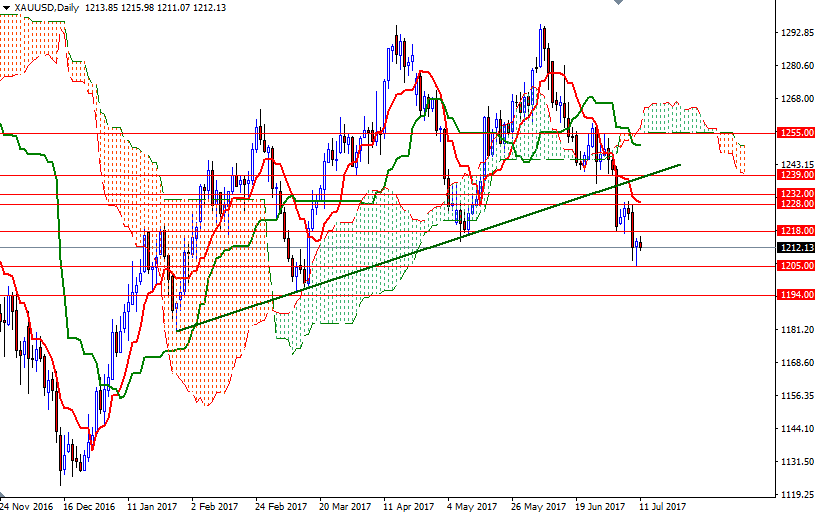

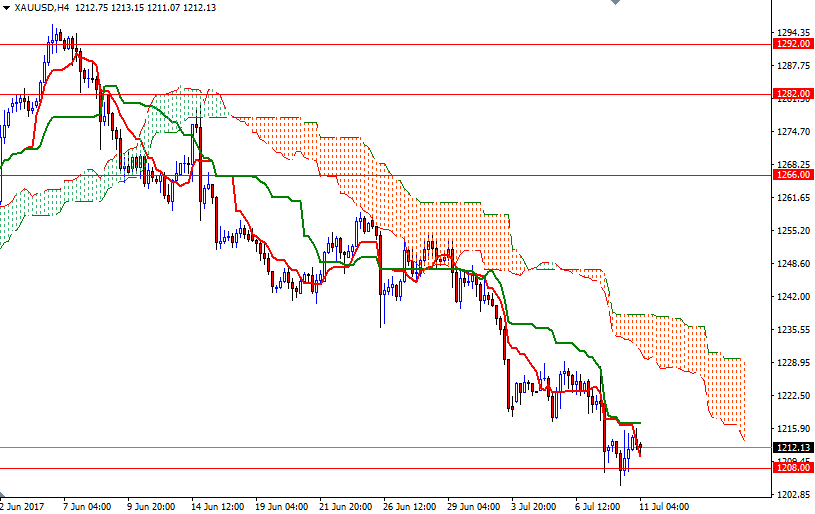

The key levels remain unchanged, as the market continues to move between the 1220/18 area on the top and the 1208/5 area on the bottom. Short-term charts suggest that the bears still have a firm grip on the market and a test of 1197/4 is possible if XAU/USD successfully drops through 1208/5. To the upside, the aforementioned 1220/18 area stands out an initial barrier. The bulls will have to capture this strategic camp in order to gather momentum for 1228, where the bottom of the 4-hourly Ichimoku cloud sits. Beyond there, the bears will be waiting at 1232 and 1236 (the top of the 4-hourly cloud).