Gold prices rose $3.39 an ounce on Thursday, benefitting from a drop in the U.S. dollar index. The euro surged to its highest level in more than two years after European Central Bank President Mario Draghi said the central bank will discuss when to trim its massive bond purchases in the autumn. Weaker equity markets in the U.S. also worked in favor of the safe-haven metal.

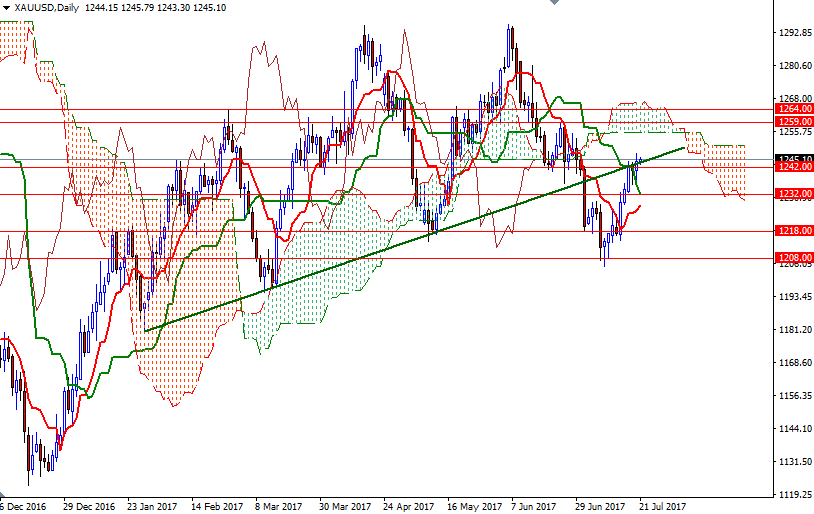

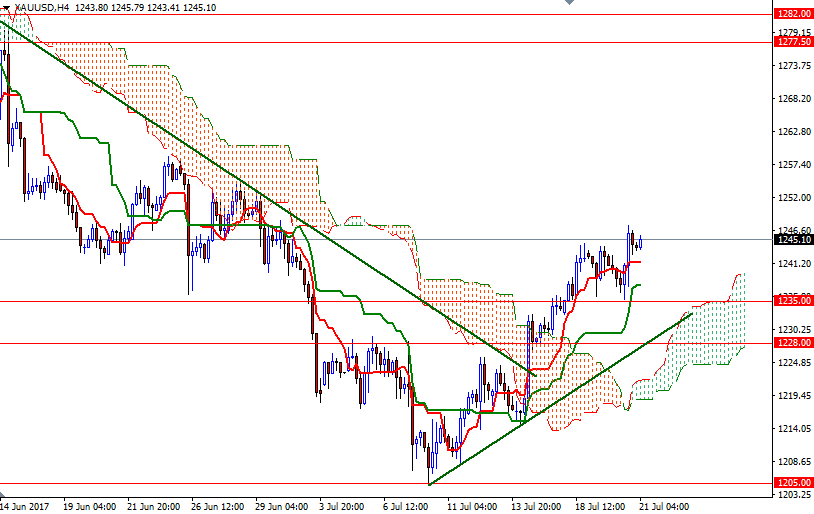

XAU/USD initially tested the support around the 1235 level before heading higher. The bulls still have the short-term technical advantage, with the market trading above the Ichimoku clouds on the 4-hourly chart, but right on top of us there is an anticipated resistance zone that stretches from 1248 to 1250.30. So the bulls have to lift prices above there to gather momentum for 1255.10, the bottom of the daily cloud.

If the bears don’t intend to give up, they will need to drag prices the 1242/1 area where the Tenkan-Sen (nine-period moving average, red line) sits on the H4 chart. In that case, they may have a chance to challenge the bulls waiting in the 1237/5 region. A break down below 1235 indicates that the market is ready to test 1232.