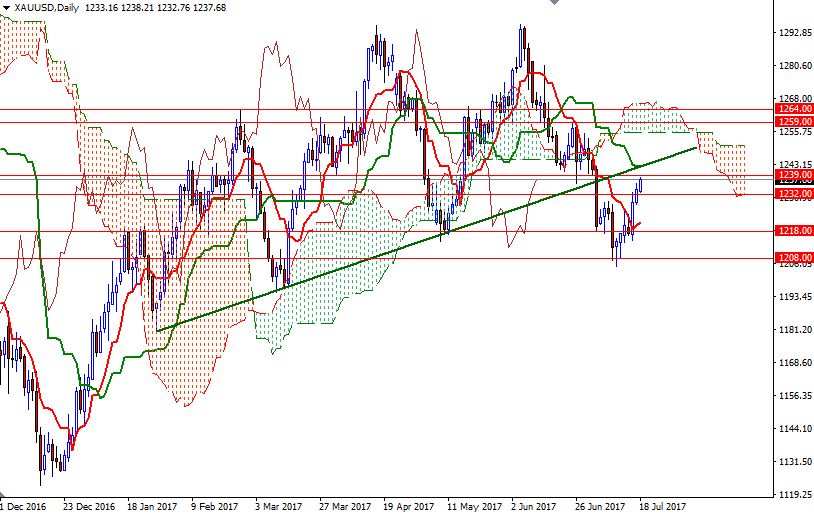

Gold prices ended Monday’s session up 0.4% at $1233.76 an ounce on growing perception that the U.S. central bank may be less willing to lift borrowing costs for a third time this year. Confirming that the previous resistance at $1228, which was broken on Friday, now flipped to support encouraged buyers and pushed prices higher in the Asian session today. XAU/USD broke through $1232 and headed to the $1239 level as anticipated.

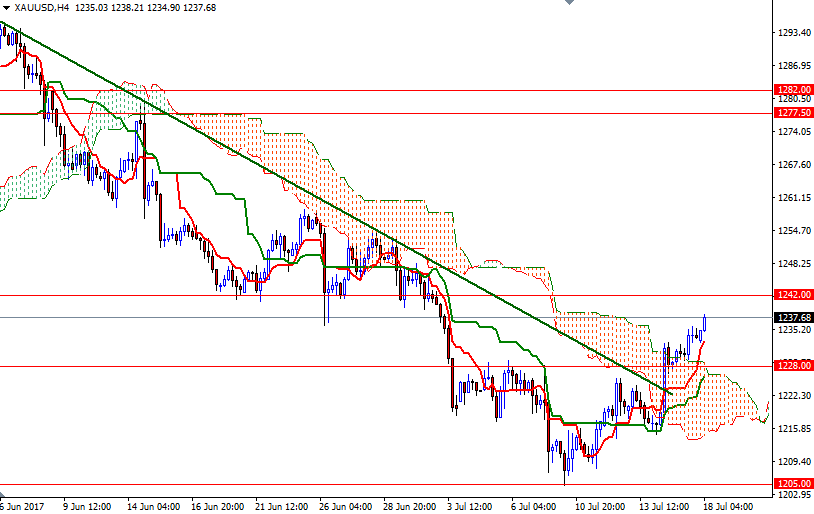

XAU/USD is currently trading above the 4-hourly Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. If the bulls can push prices above 1239, it is likely that the market will challenge the first strategic barrier in the 1242.61-1242 area, the confluence of a broken bullish trend line and the daily Kijun-sen. A break through there could trigger a push up to 1250.30-1248.

However, if the aforementioned resistance in the 1242/39 region remains intact, the market may return to the 1228/6 zone. The bears will have to drag prices below 1226 area so that they can tackle 1222. A daily close below 1222 implies that XAU/USD will retreat to 1218/4, the bottom of the 4-hourly cloud.