Gold prices rose $10.65 an ounce on Wednesday, hitting the highest level since July 15, as the dollar slipped after the Federal Open Market Committee kept interest rates unchanged. The U.S. central bank also signaled that it could launch its plan to start winding down its massive holdings of bonds. “The Committee expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated,” the Fed said in its statement.

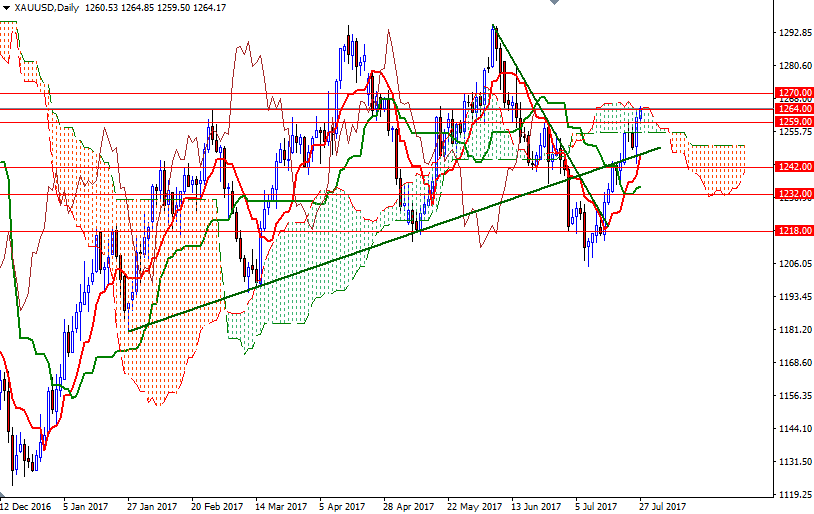

While the 1264 level triggered some profit taking as expected, the market is challening this barrier again today. The short-term charts are bullish, with the market trading above the 4-hourly and the hourly Ichimoku clouds. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is now above prices.

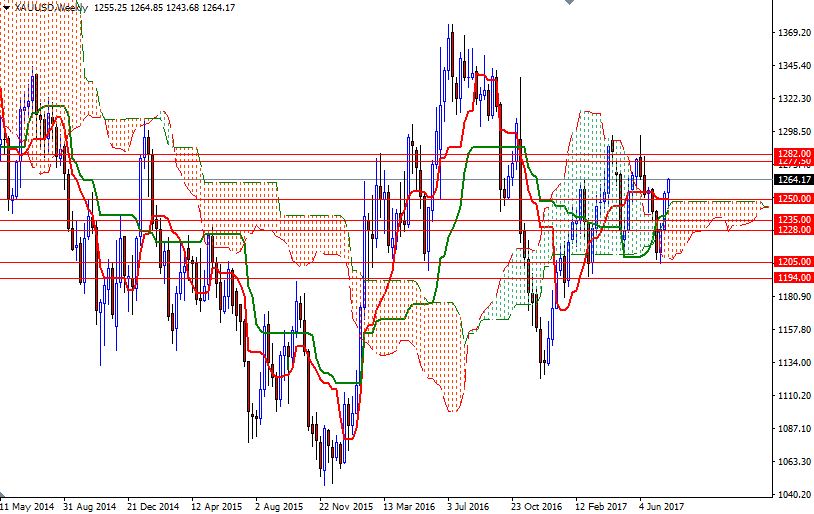

However, penetrating the daily cloud is essential for a bullish continuation towards the 1170 level. A daily close above 1270 would make me think that XAU/USD is on its way to test the key resistance in the 1282-1277.50 area. If the bulls run out of fuel and prices start to fall, we could see a test of the 1259 level. A successful break below 1259 would imply that the intra-day support in the 1256/5 zone will be visited.