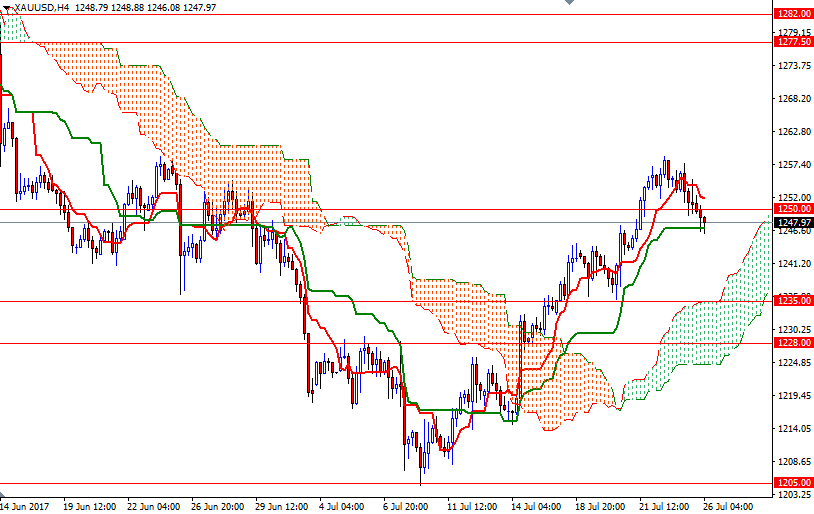

Gold prices fell $5.03 an ounce on Tuesday as equities gained and the dollar rallied after the Conference Board reported that its consumer confidence index jumped to 121.1 from 117.3 the prior month. The support at 1250 initially held yesterday but finally was broken. Consequently, XAU/USD retreated to test the 1247/6 as anticipated. Focus is on the Federal Reserve’s Open Market Committee meeting that began yesterday.

No rate hike is expected, but the central bank could use this meeting to provide more clarity on the timing of reducing its big balance sheet. The short-term charts are slightly bearish at the moment, with the market trading below the Ichimoku cloud on the H1 and the M30 time frames, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line).

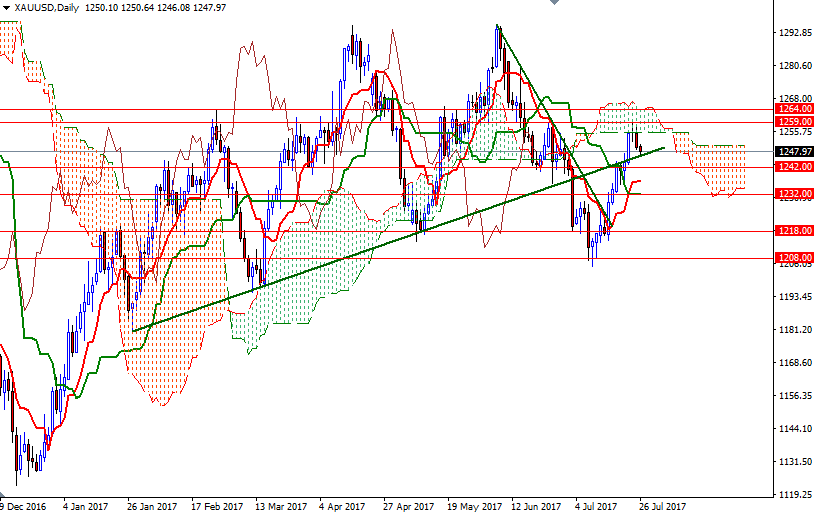

If XAU/USD breaks down below the 4-hourly Kijun-Sen, prices may head towards the 1243/2 zone. This a strategic camp for the bears to capture as it holds the key to the 1237/5 area, where the daily Tenkan-Sen resides. To the upside, the 1252/0 area stands out and the bulls will need to push prices beyond there in order to make a fresh assault on the 1259 barrier ahead. Once above there, the bulls will be aiming for 1264, the top of the daily cloud.