Gold prices ended Wednesday’s session down $2.32 as the dollar recovered some of its recent losses ahead of announcements from the Bank of Japan and the European Central Bank. Failing to sustain a push above the $1242 level also weighed on the market. It seems that investors don’t want to make large bets ahead of central bank policy decisions.

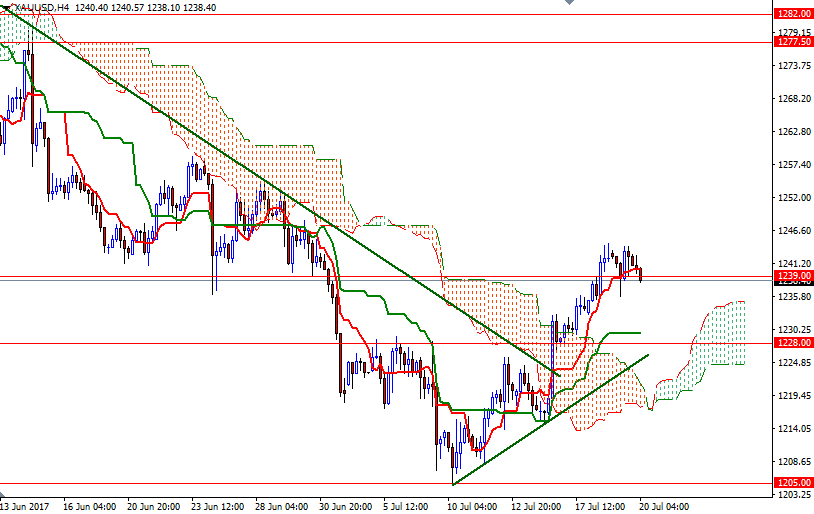

The key levels remain the same as the market is stuck within the range of the past 3 sessions. The resistance between the 1244.50 and the 1242 levels prevents market from going higher, and down below we have the Ichimoku cloud on H1 chart acting as a support. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are flat, indicating lack of momentum.

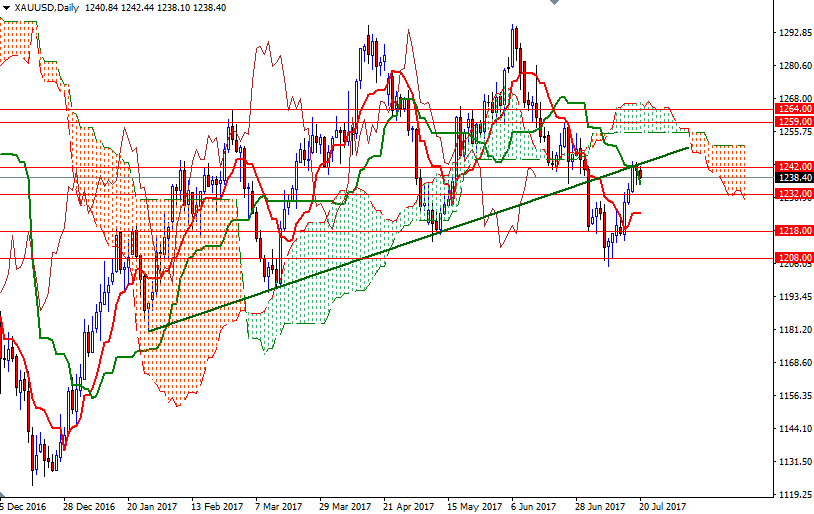

If the support at 1235 is broken, prices will tend to retreat to the 4-hourly cloud. In that case, 1232/1 and 1228/6 could be the next targets. We have a confluence of horizontal support and a short-term bullish trend line in the 1228/6 region. So the bears will need to capture this camp to make an assault on the 1221.90-1218 zone occupied by the 4-hourly cloud. On the other hand, if XAU/USD manages to climb and hold above 1244.50, we may see a bullish attempt targeting 1250.30-1248. Clearing this resistance could extend gains and pave the way towards the daily cloud.