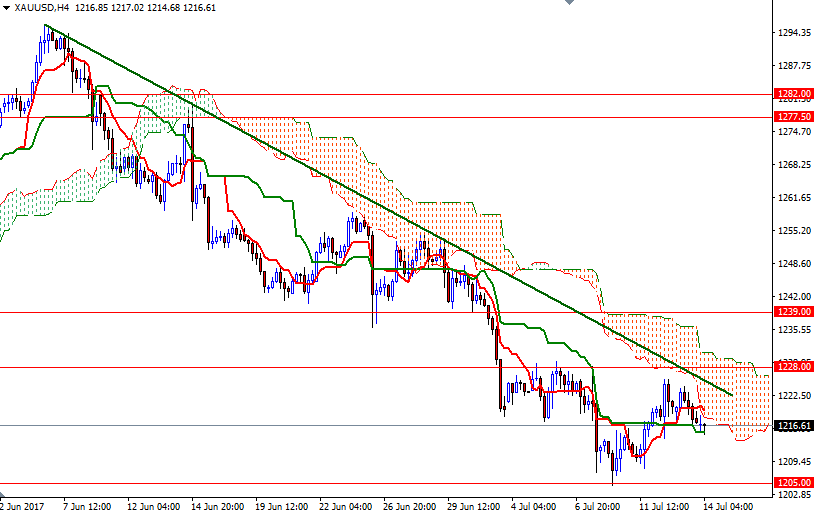

Gold prices ended Thursday’s session down $2.32 after Federal Reserve Chair Janet Yellen said she believed a recent slowdown in inflation won’t last. Upcoming inflation data will be closely watched as a recent softness in consumer prices has been of concern among Fed officials who want to see further evidence of continued toward the central bank’s 2% target. XAU/USD is trading at $1216.61 an ounce, trying to hold above the support at around $1216, where the Kijun-sen (twenty six-period moving average, green line) on the 4-hour chart sits.

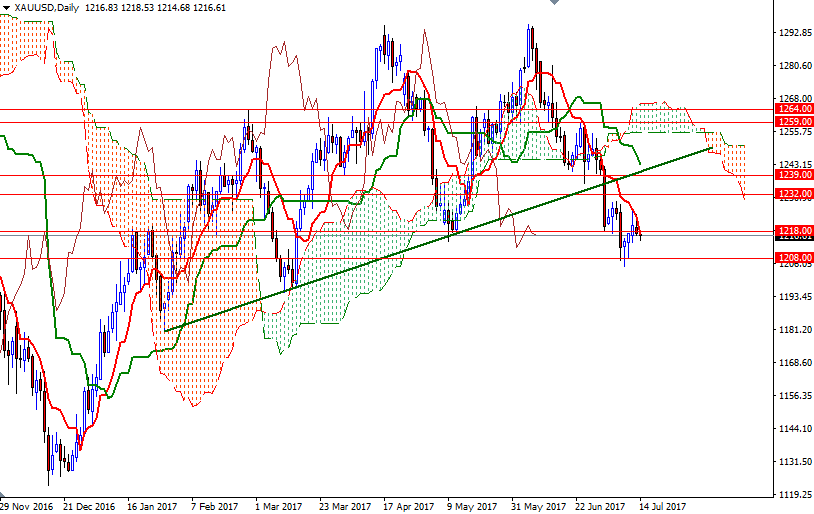

The Ichimoku cloud on the 4-hour time frame and a bearish trend line continue to act as resistance while the key support in the 1208/5 zone remains intact. Technically speaking, the Ichimoku cloud indicates an area of support (or resistance depending on its location) and thickness of the cloud is also relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud. With that in mind, I think the XAU/USD pair will have to either break through 1228 and challenge 1232 or drop below the 1216-1214.90 to revisit the 1208/5 area.

Note that the clouds on the H1 and the M30 charts overlap in the 1222/18 region, so the bulls have lift prices above there in order to gather momentum for 1228. Closing beyond the 1232 level would be a positive sign and suggest that the market should proceed to 1239. A break down below 1205, on the other hand, opens up the risk of a fall to the 1197/4 zone.