Gold prices ended Monday’s session nearly unchanged after shuffling between gains and losses as investors took a cautious stance ahead of the Federal Open Market Committee’s two-day policy meeting which kicks off today. The central bank is widely expected to leave rates unchanged. However, the tone of the official statement will be important for the market.

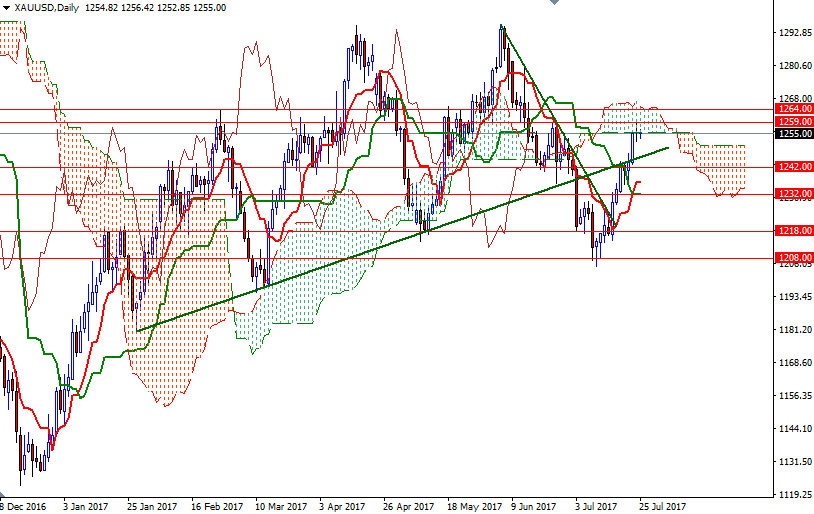

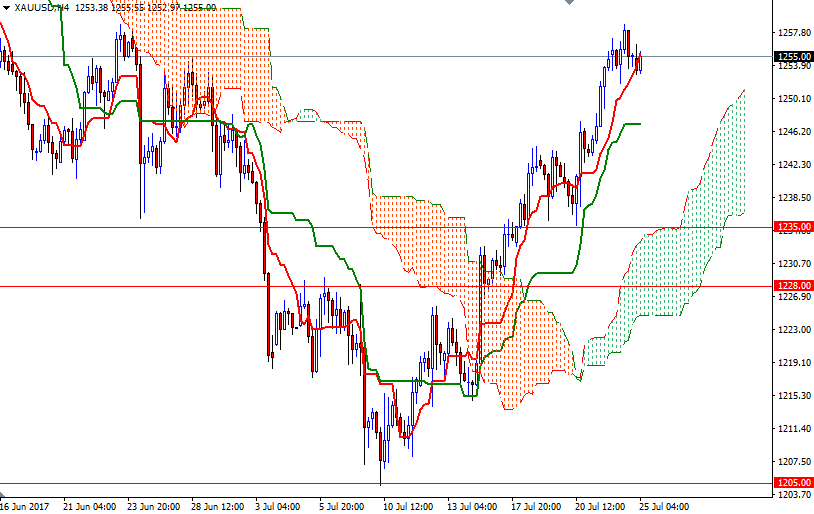

Gold is likely to remain supported with developments in Washington and the slumping dollar increasing buying demand but strength in U.S. equities may cap the metal’s upside. The market is trading above the weekly and the 4-hourly Ichimoku clouds. In addition to that, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on almost all time frames. The initial resistance sits at 1259, followed by 1264, the top of the daily cloud.

If the bulls successfully push prices beyond 1264, I think we will proceed to 1270. This will be the key level for the bulls to pass in order to challenge the bears on the battlefield in the 1282-1277.50 region. On the other hand, if the market fails to penetrate the daily cloud, then keep an eye on the 1250 level, which happens to be the weekly Tenkan-Sen. Breaking down below this support implies that the bears are on their way to visit 1247 or perhaps 1242.