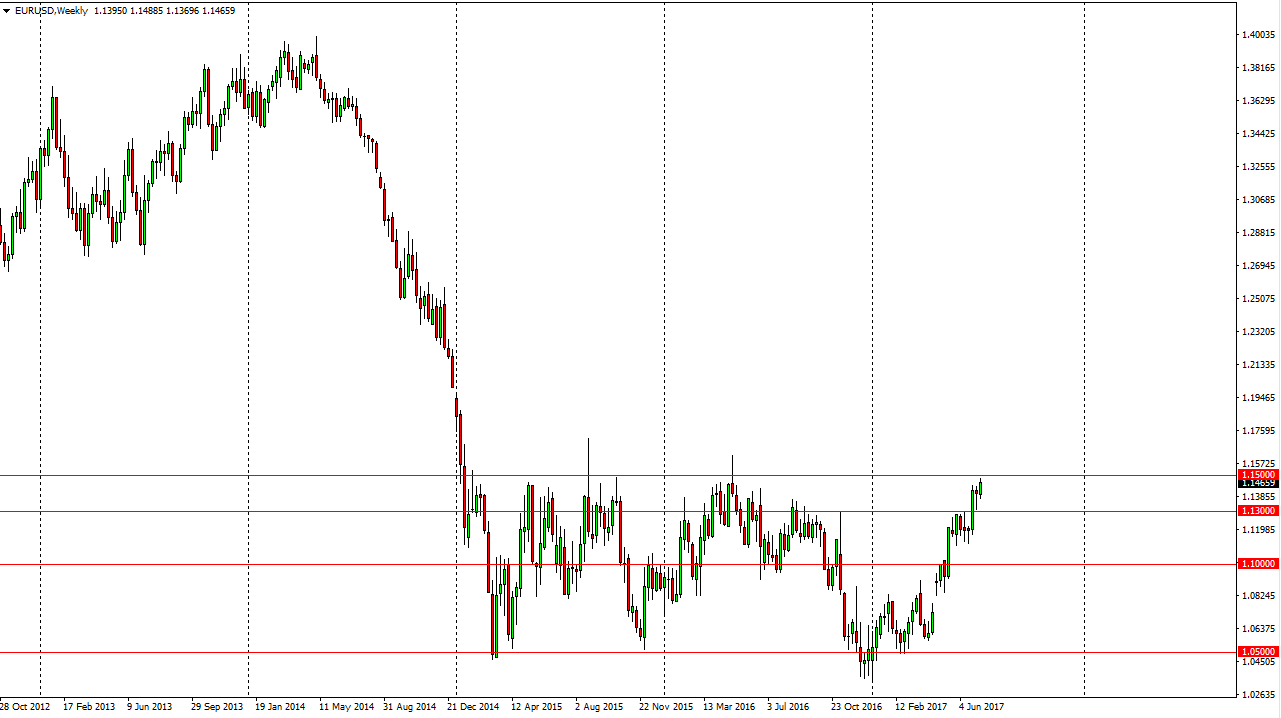

EUR/USD

The EUR continues the overall consolidation that we have seen for 2 ½ years, but we are getting very close to the top of that range, the 1.15 level. In this point, I suspect that we are going to try to break out but we need to see at the very least a daily close above that level to feel reasonably confident that we are going higher. In the meantime, I believe that short-term pullbacks will more than likely offer value.

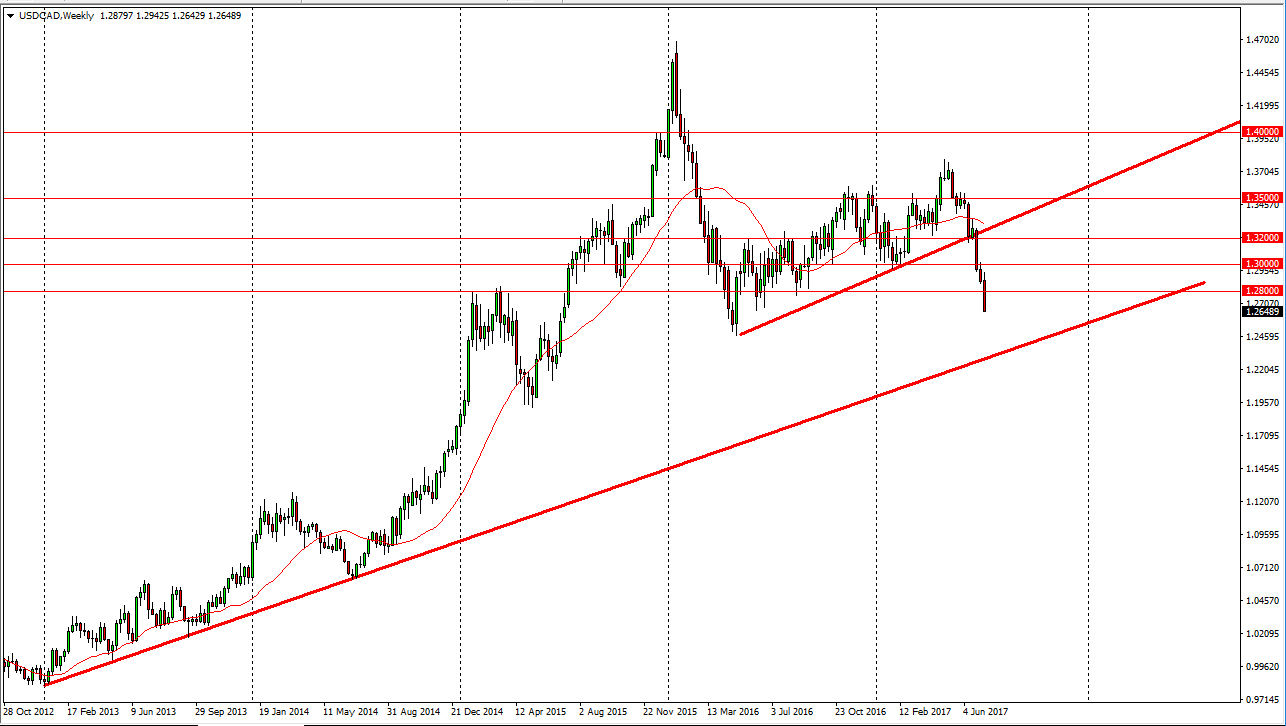

USD/CAD

The US dollar fell precipitously against the Canadian dollar during the week, as we are now approaching the 1.26 handle. The major support doesn’t reappear until 1.25, so I think that this is going to continue to be a “sell on the rallies” situation.

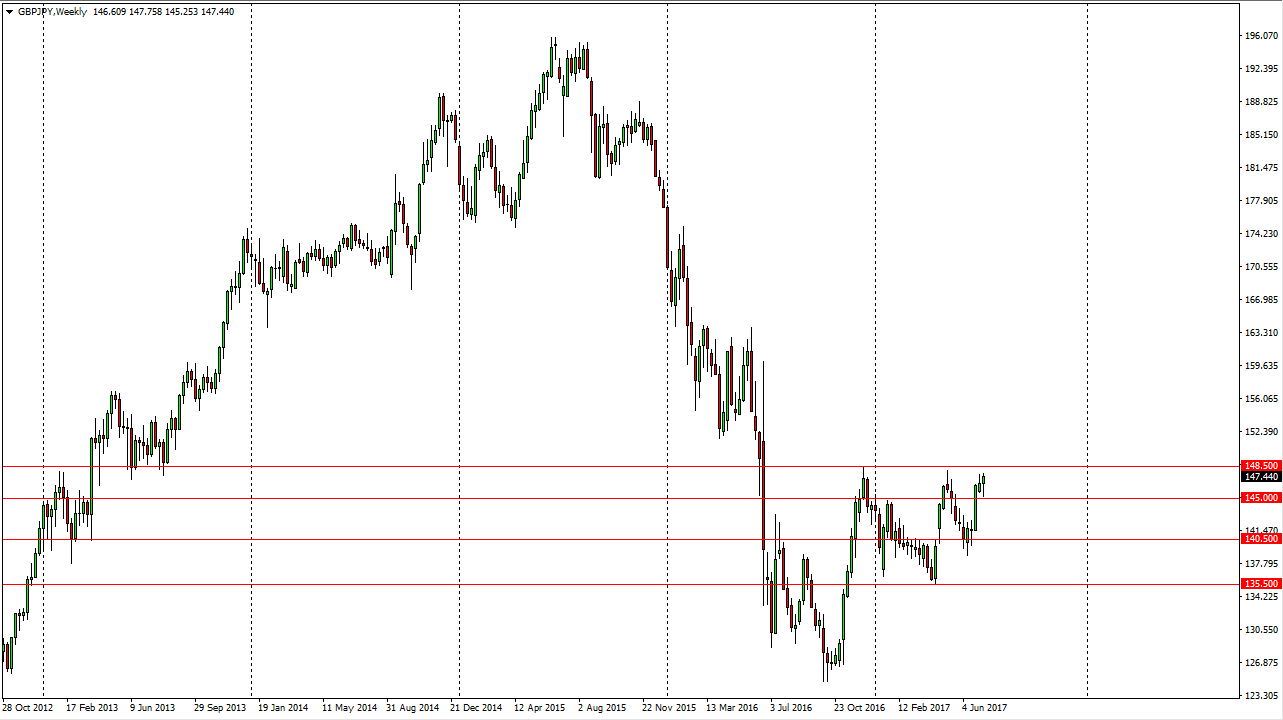

GBP/JPY

The British pound initially fell against the Japanese yen during the week, but found enough support at the 145 handle to turn around and form a very strong looking candle. If we can break above the 148.50 level, I think that this pair is going to go looking towards the 150 handle, and certainly beyond that area as well. The British pound has broken out against the US dollar and that is helping.

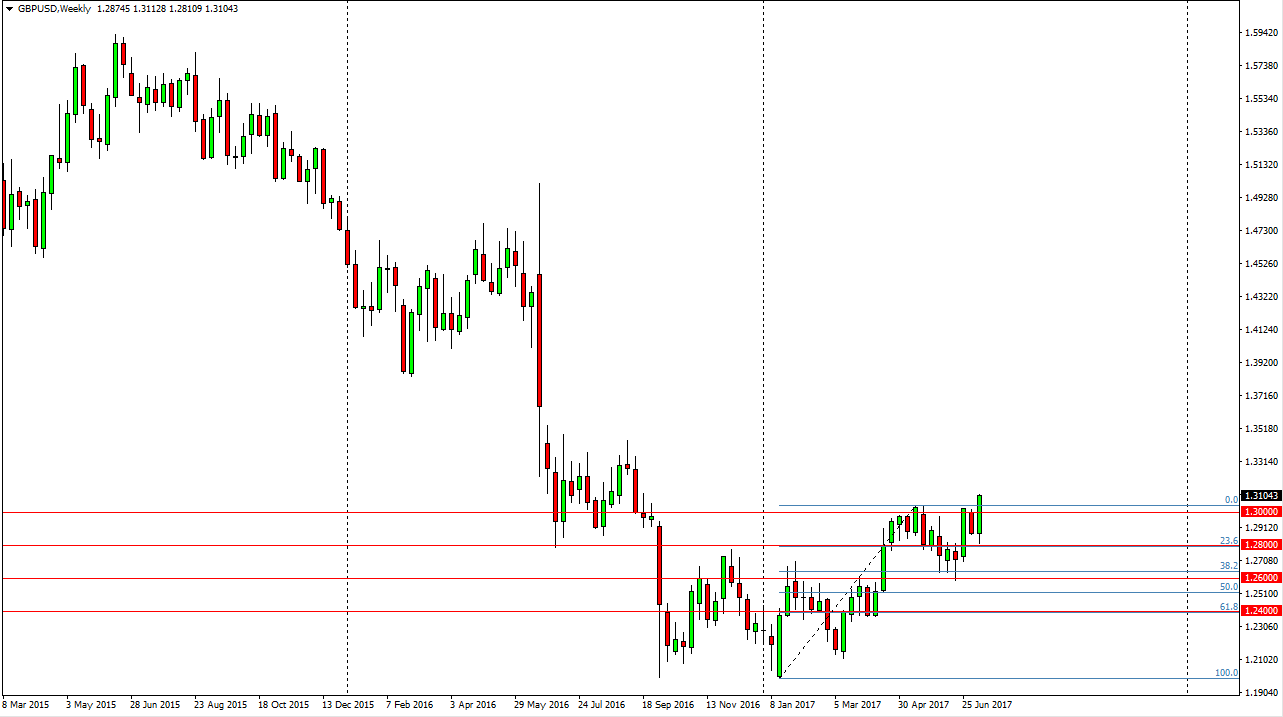

GBP/USD

Speaking of the British pound breaking out against the US dollar, we have cleared the 1.30 handle, and it now looks likely that pullbacks will be bought as we grind towards the 1.3450 level. I believe that it won’t necessarily be the easiest moved to May, but we certainly seem to have quite a bit of bullish momentum.