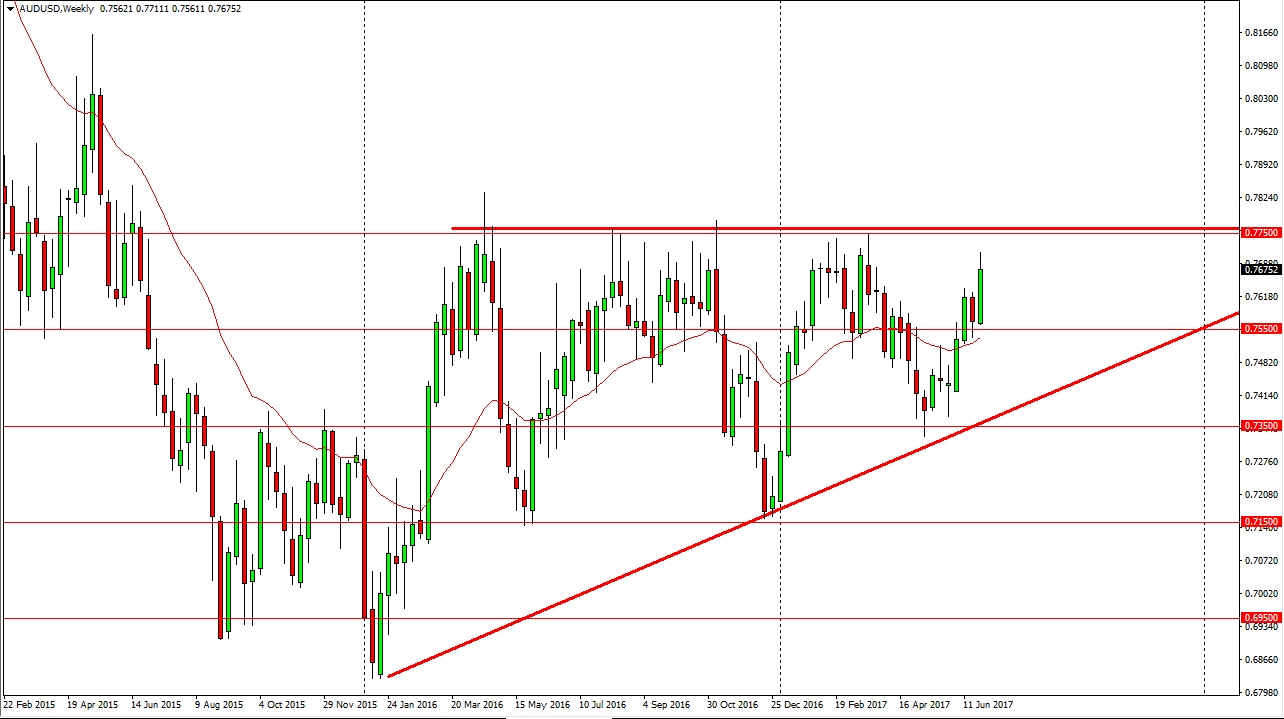

AUD/USD

The Australian dollar has rally during the week, and it now looks as if we are going to try to go towards the 0.7750 level above. If we can break above that, that’s a very bullish sign, and should send this market towards the 0.80 level after that. Short-term pullbacks continue to offer buying opportunities, and the 0.7550 level underneath is support.

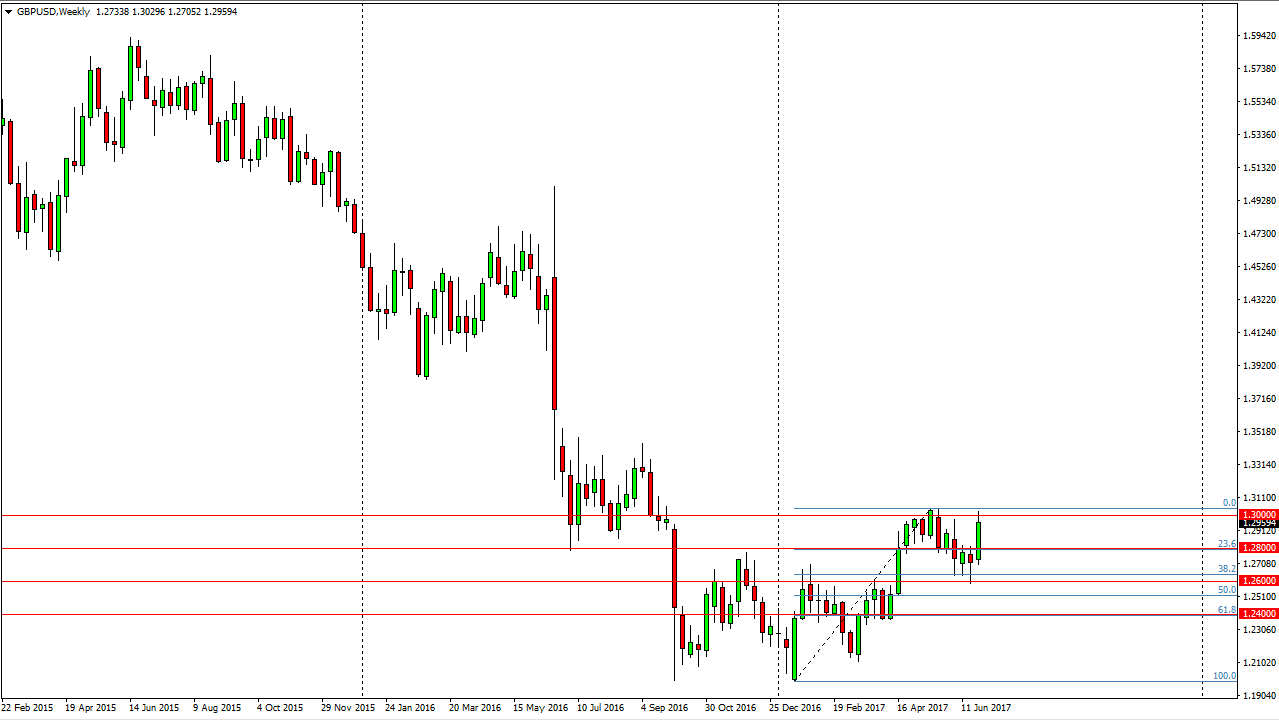

GBP/USD

The British pound rallied during the week, breaking above the top of the hammer from the previous week. The 1.30 level continues to offer resistance though, but I think we will eventually break above it. Once we clear the top of this previous week range, then I think the market can continue to go higher, offering a buy on the dip opportunity.

EUR/USD

The EUR/USD pair broke out during the week, slamming towards the 1.14 handle. The 1.15 level above is the top of the three-year consolidation area that we have been stuck in, so I would anticipate that we should see sellers under this market closer to that level. Short-term, it’s probably a buying opportunity on dips, but the 1.15 level continues to be very stringent.

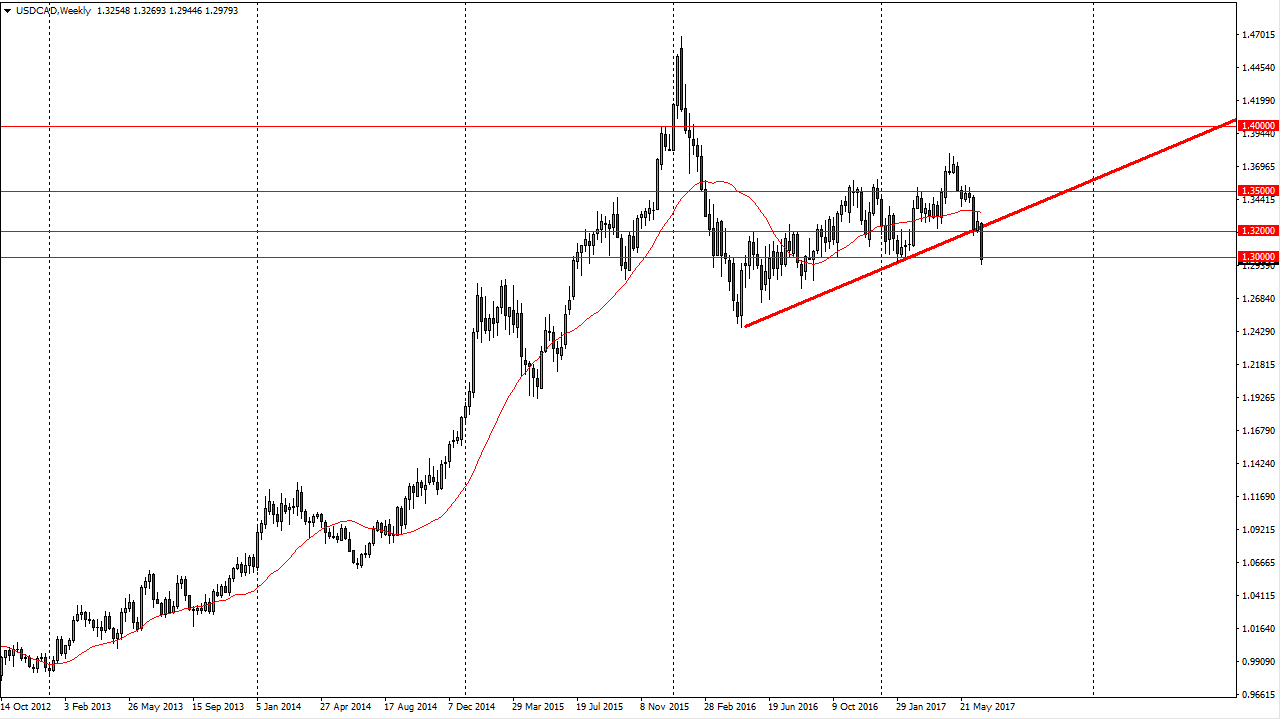

USD/CAD

The US dollar broke down against the Canadian dollar during the week, slicing through an uptrend line and slicing through the 1.32 handle. The market reached towards the 1.30 level underneath, and the market looks very likely to continue based upon the candle. However, pay attention to the oil markets because when they roll over, that should send this market back to the upside.