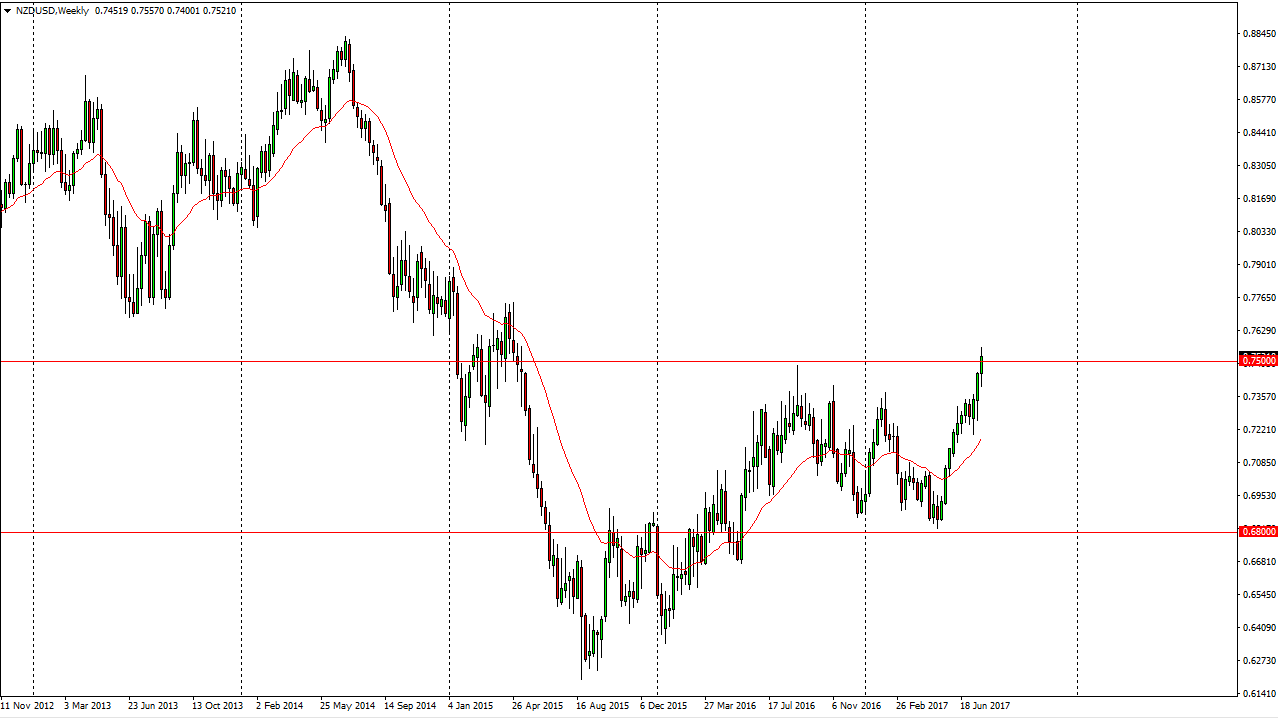

NZD/USD

The New Zealand dollar continued to show bullish pressure during the week, as we broke above the 0.75 handle. The market looks likely to continue to go much higher, and the pullback should offer buying opportunities. I believe that the 0.7350 level underneath is the “floor” in the market, so therefore every time we pull back and show signs of support, I’m a buyer.

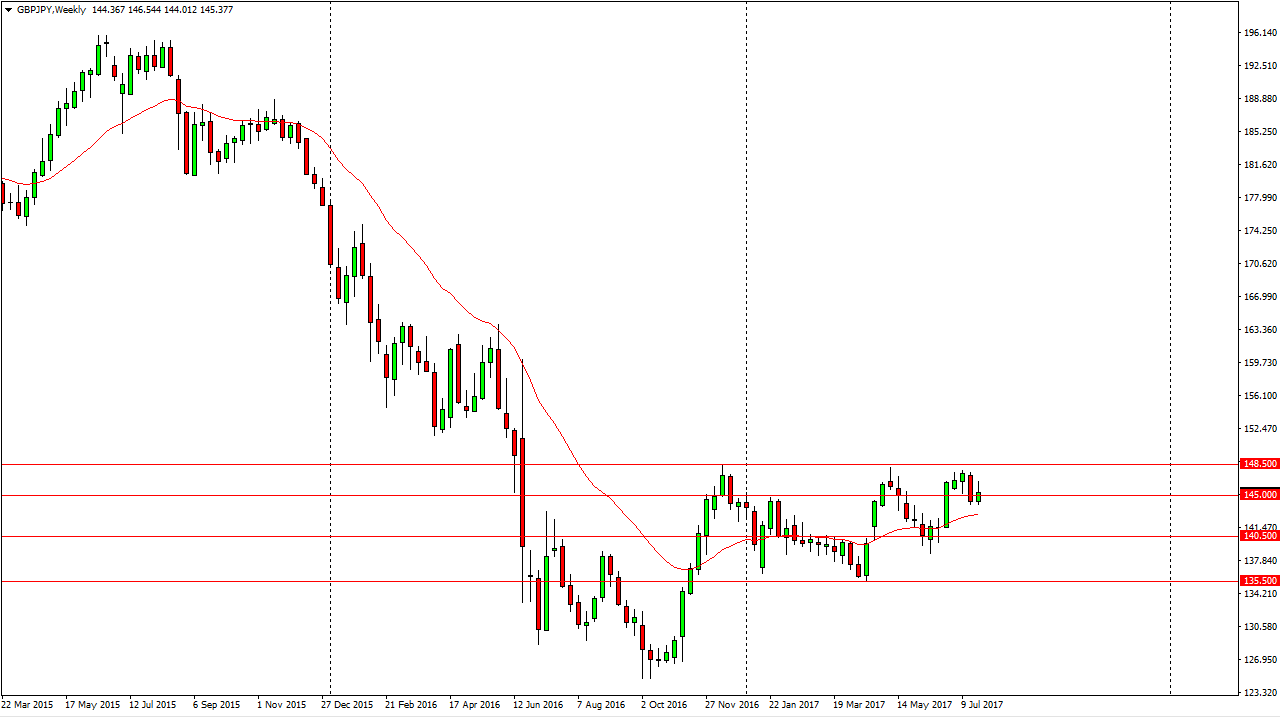

GBP/JPY

The British pound initially bounced during the week, but gave back about half of the gains. I believe that the market will eventually go to the upside though, as we are approaching a significant trend line on lower time frames. Given enough time, I think that the market should then go to the 148.50 level. A break above there should send this market to the 150 handle. I like buying pullbacks, as long as we can stay above the 144.50 handle.

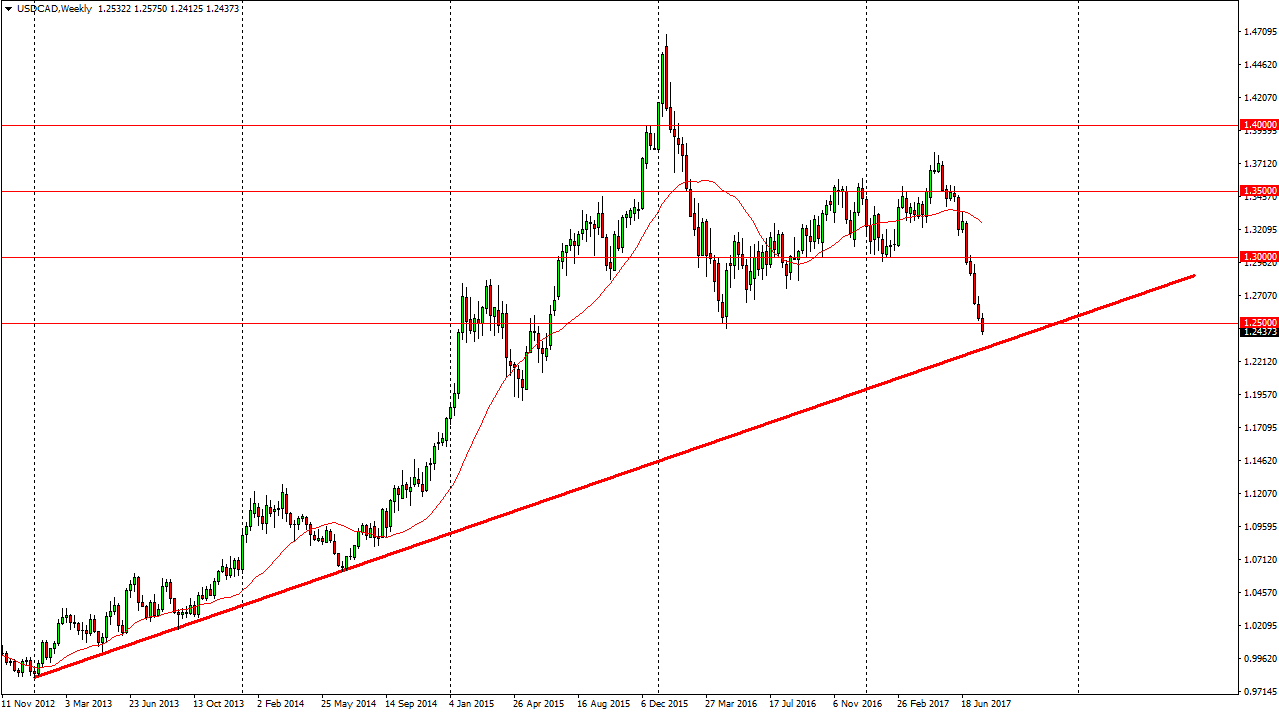

USD/CAD

The US dollar continues to follow the downward trend, as we break down below the 1.25 handle. This is an uptrend line sitting just below that could offer a bounce though, so I think that short-term traders will sell, but if we can break back above the 1.25 handle, the market should then could go to the 1.27 handle above. Either way, it’s likely that we will continue to see volatility.

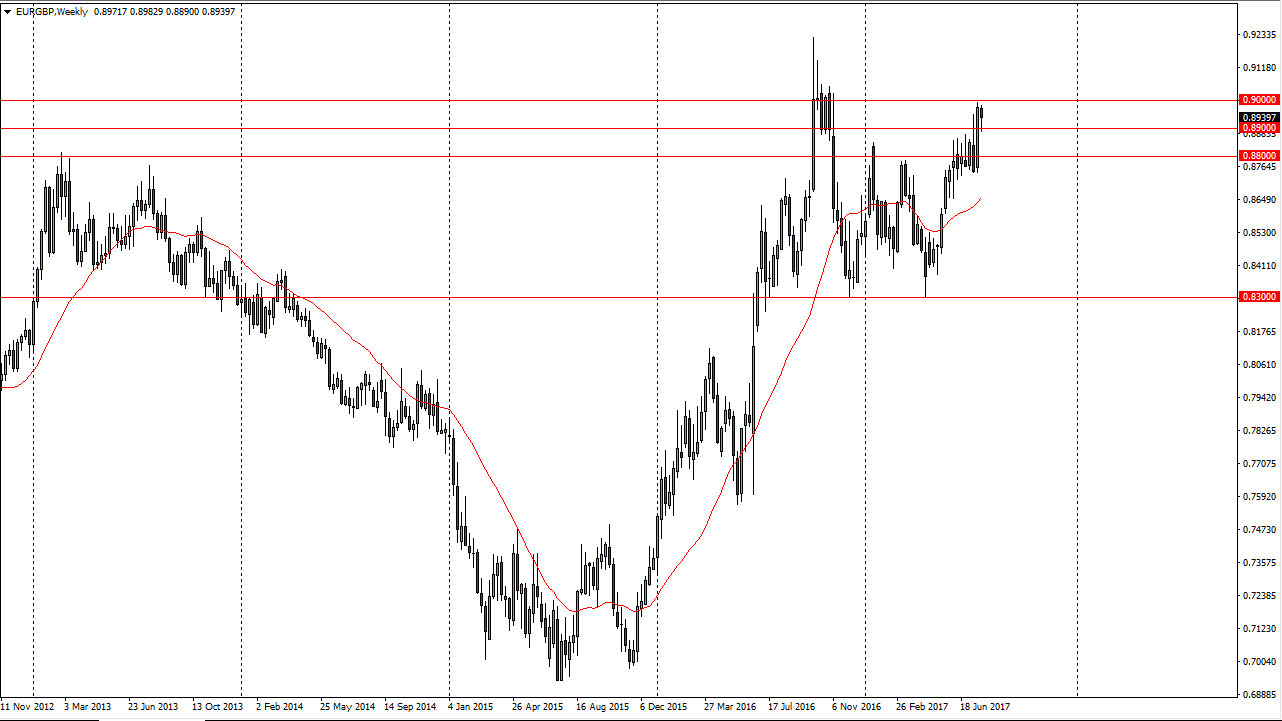

EUR/GBP

The EUR/GBP pair fell initially during the week but found enough support at the 0.89 handle. We turned around to form a hammer, and now I think if we can break above the 0.90 level, the market should then continue to go to the 0.92 handle. Ultimately, the EUR is much stronger than the GBP against the US dollar which is the overall benchmark, so it makes sense that we see strength here as well.