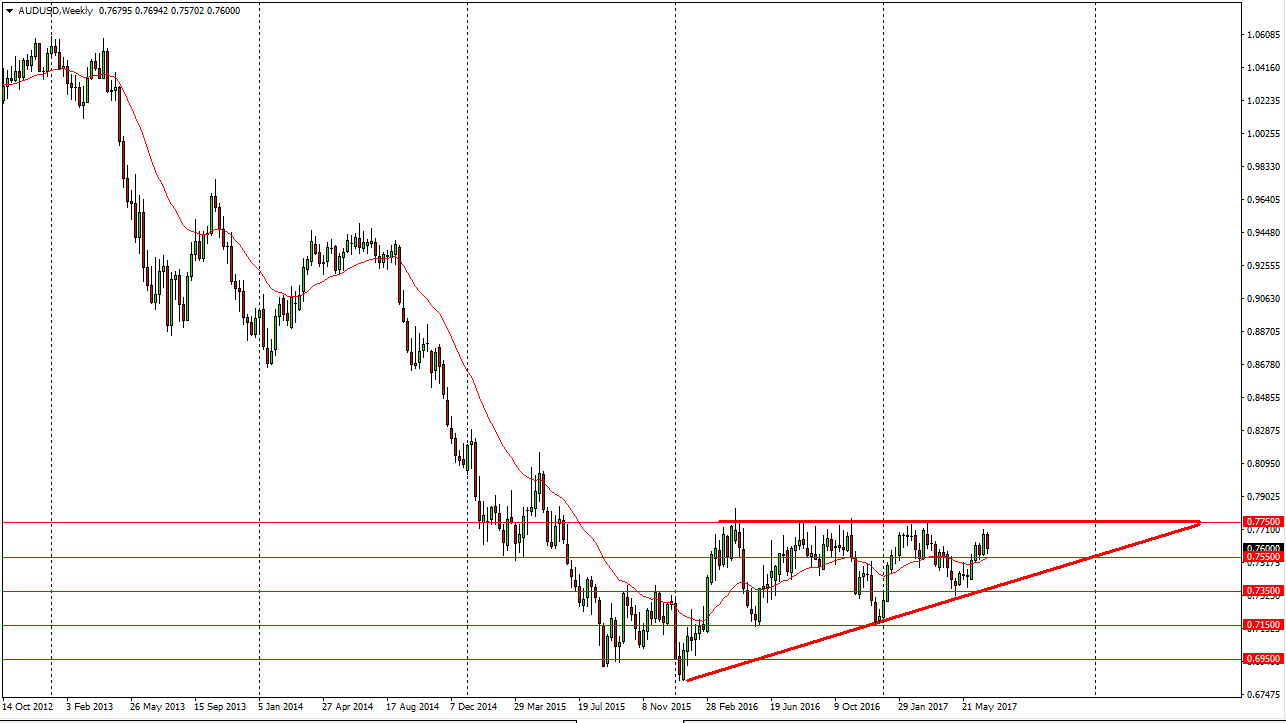

AUD/USD

The Australian dollar continues to be choppy, as the markets have been trying to form some type of ascending triangle. Ultimately, if we can break above the 0.7750 level, the market can go much higher. In the meantime, I think that short-term pullbacks may offer buying opportunities, but short-term at best.

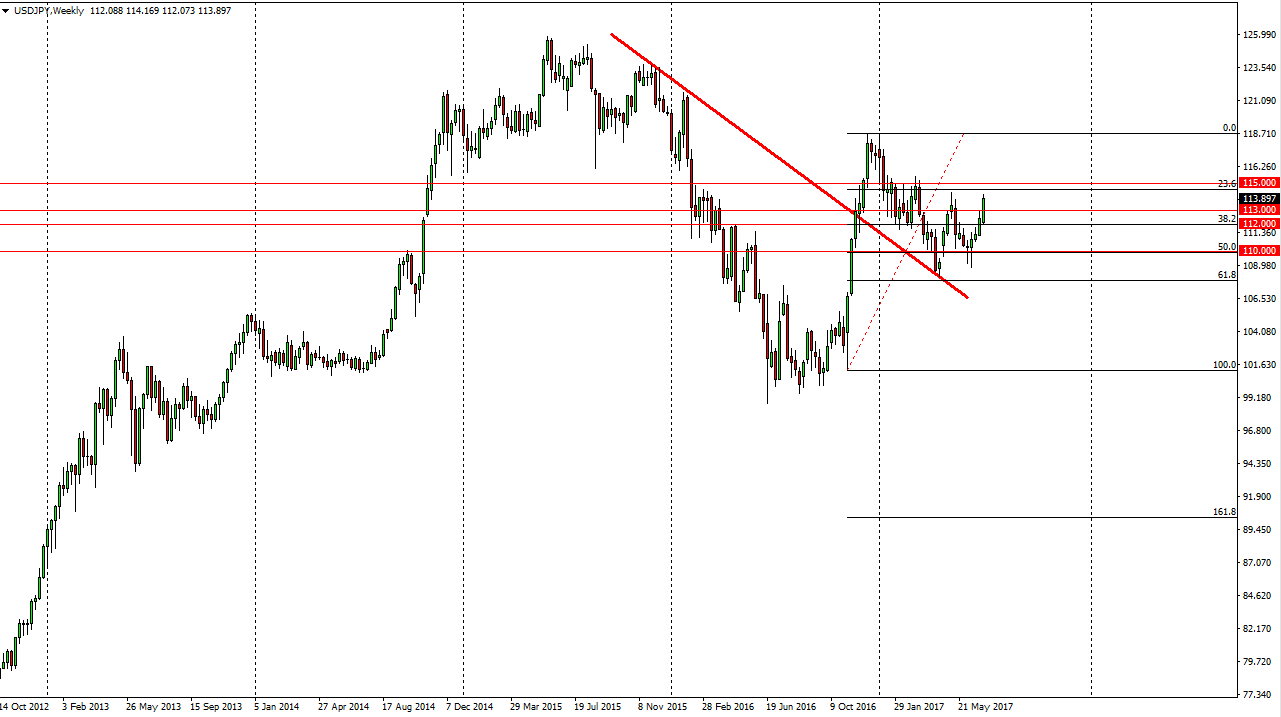

USD/JPY

The US dollar broke higher during the week, slicing through the 113 level, and even breaking through the 114 level at one point. I believe that short-term pullbacks continue to be buying opportunities, as the central banks of the United States and Japan are diverging when it comes to interest rates. Longer-term I am bullish of this market.

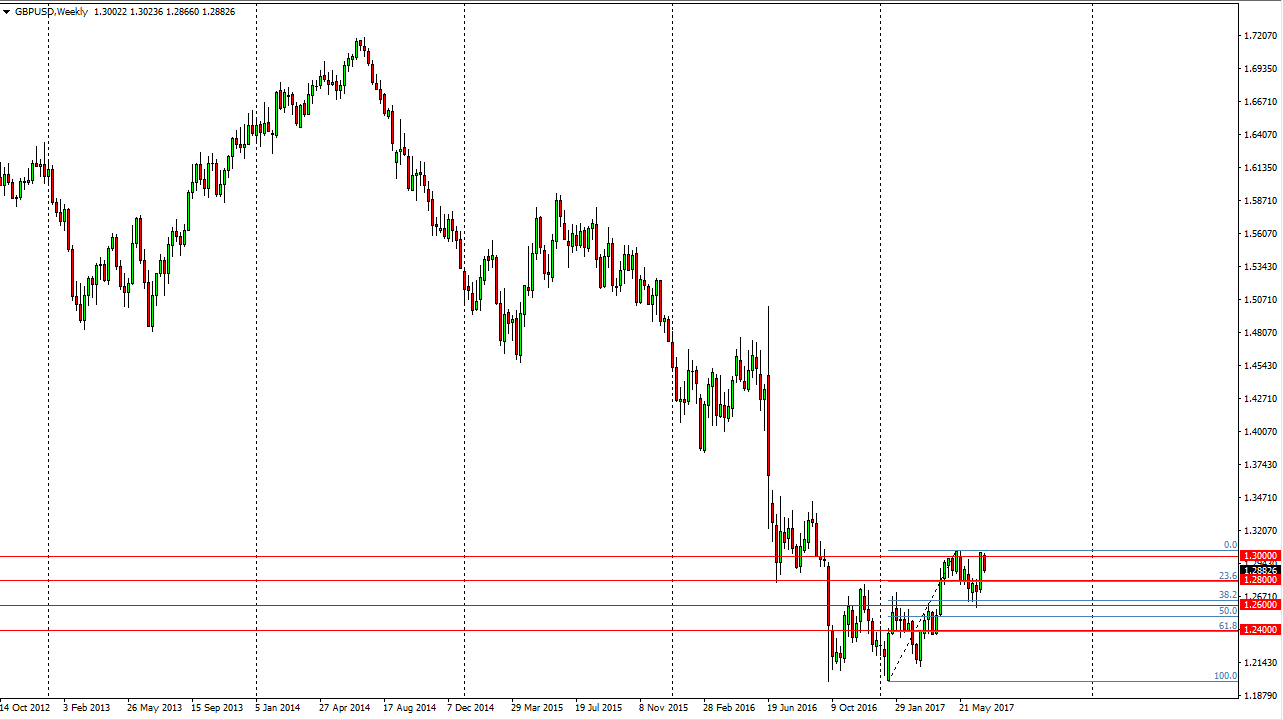

GBP/USD

The British pound fell a bit during the week, but the 1.28 level underneath should offer support. Because of this, I believe that the buyers will return sooner rather than later. I think that if we can break above the 1.3050 level, the market is free to go much higher. In the meantime, I believe it is a short-term “buy the dips” scenario.

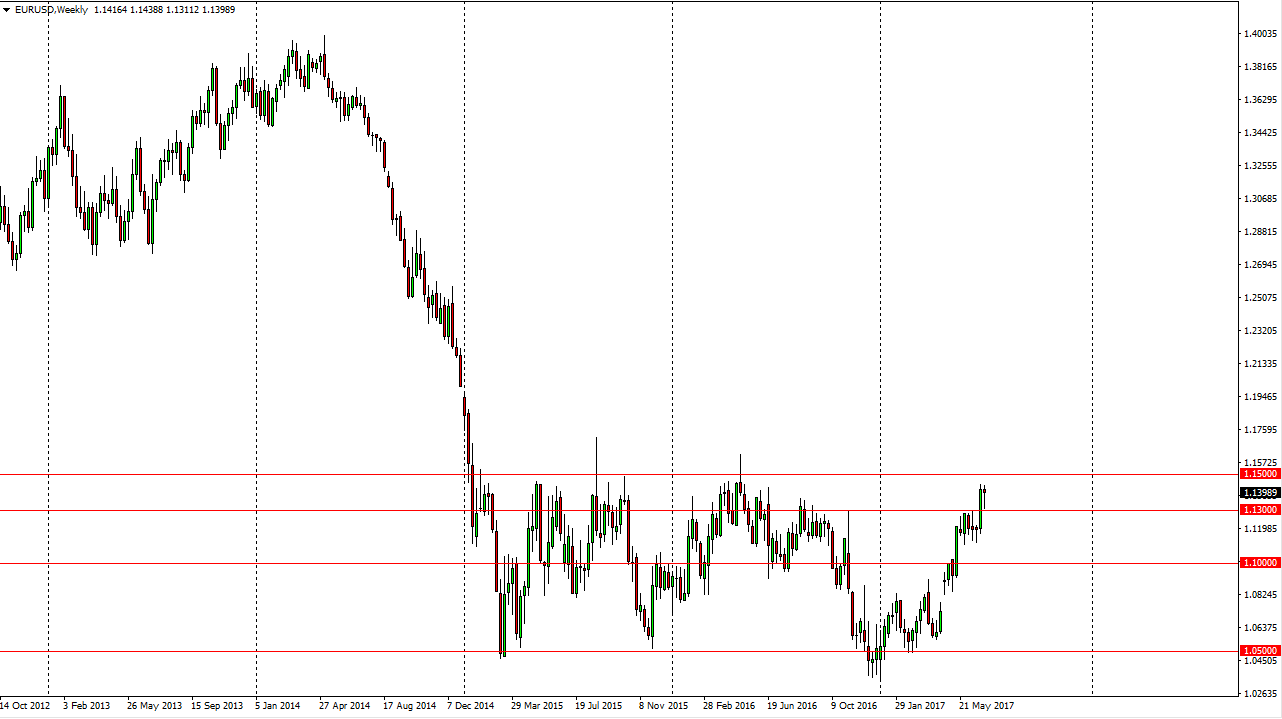

EUR/USD

The EUR fell initially during the week, but found the 1.13 level underneath to be supportive. By doing so, the market ended up forming a hammer on the weekly chart which of course is a bullish sign. However, the 1.15 level above is massively resistive, so I think we will continue to see short-term buying opportunities that show signs of volatility.