Gold prices settled at $1212.20 an ounce on Friday, suffering a loss of 2.36% on the week, as the dollar edged higher after the Labor Department reported that the economy added 222000 jobs in June, surpassing consensus estimates of 175000. Data also showed that average hourly wages increased only 0.2% but gains for the prior two months were revised up by a total 47K.

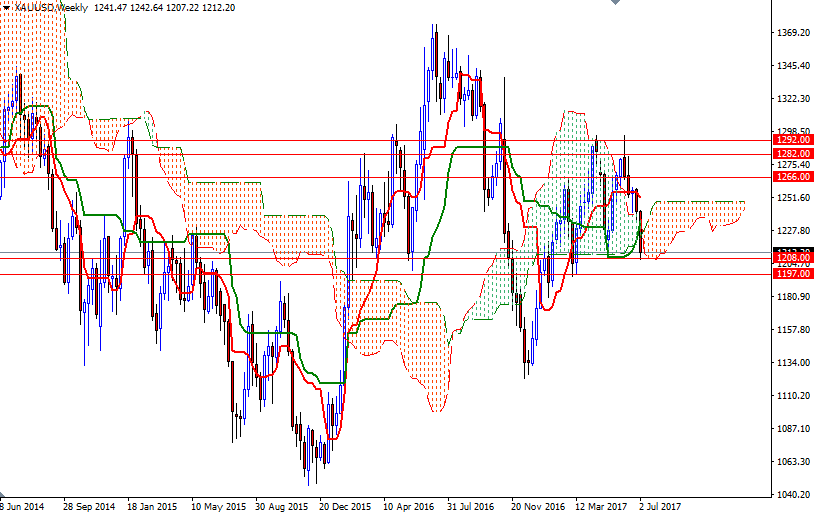

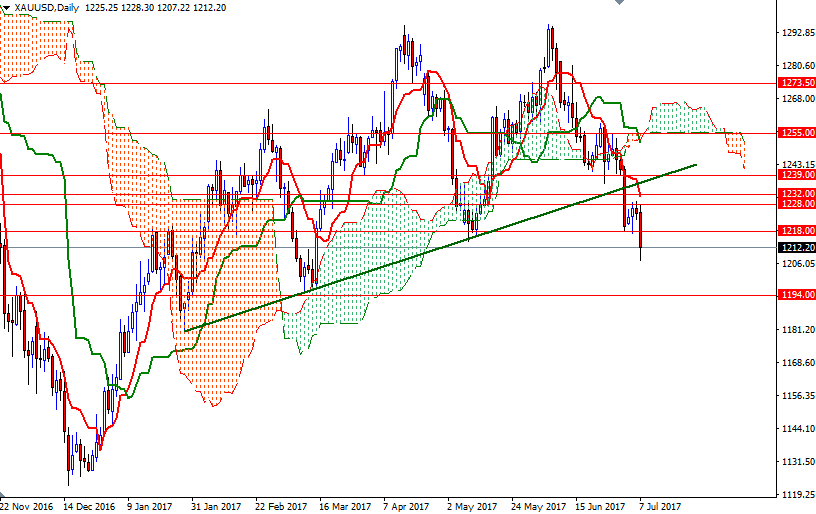

Expectations of higher interest rates and a stronger dollar as well as the bearish near-term outlook are likely to continue to weigh on the market. Last week's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 93799 contracts, from 131672 a week earlier. On the daily and the 4-hourly time frames, prices remain below the Ichimoku clouds and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, indicating that the bears still have the near-term technical advantage.

The end of last week saw acceleration in the five weeks old bearish move but the 1208/5 area was supportive. Down below there we also have a crucial area between 1297 and 1294, so it wouldn't be surprising to see these levels triggering some short-side profit taking. If XAU/USD convincingly breaks below 1194, look for further downside with 1188 and 1180 as targets. Dropping through 1180 could see a fall all the way down to 1168. The initial resistance stands in the 1232/28 area. Additionally, up at 1239 we have a confluence of horizontal resistance and a broken bullish trend line. The bulls will need to push prices beyond this barrier if they intend to take the reins and march towards the daily cloud.