Gold prices settled at $1228.82 an ounce on Friday, gaining 1.35% on the week, as the dollar fell after weaker-than-expected U.S. inflation data reduced the market’s expectations for a Federal Reserve interest rate hike by September. In a congressional testimony last week, U.S. Federal Reserve Chair Janet Yellen sounded a more dovish tone on monetary policy. Yellen said that inflation should rebound, but the central bank could alter policy if softness persisted.

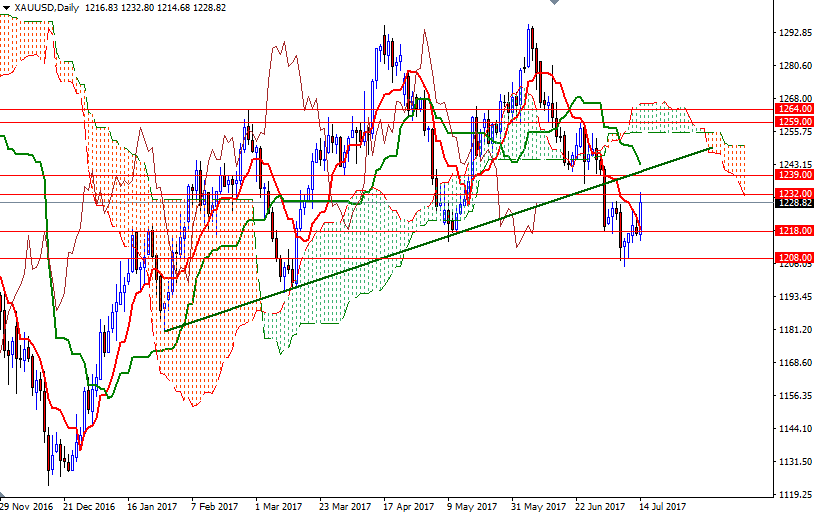

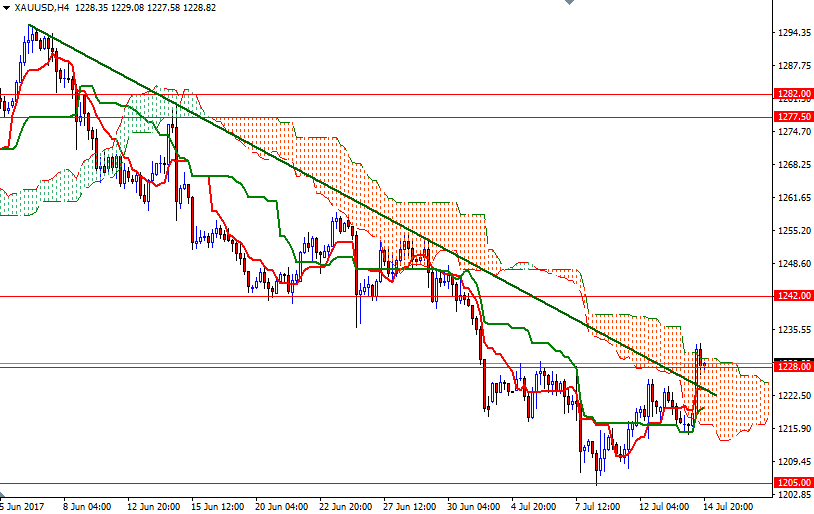

After hitting a four-month lows on Monday, the precious metal was also due for a short-covering. XAU/USD found enough support in the 1208/5 area and ultimately tried to climb above the 4-hourly Ichimoku clouds on Friday. From a chart perspective, trading below the daily clouds suggest that the risk of a fall to the 1197/4 zone still exists. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines and the Chikou span (closing price plotted 26 periods behind, brown line), which resides below the daily clouds, support this theory.

If XAU/USD drops through 1218/4 (i.e. prices get back below the 4-hourly cloud), then the market will retest the aforementioned support in the 1208/5 zone. A break down below 1205 implies the bears will be aiming for 1197/4 next. In case the bears capture this strategic camp, look for further downside with 1188 and 1180 as targets. On the other hand, beware that the short-term charts are slightly bullish. If prices successfully anchor somewhere above the 4-hourly cloud and pass through 1232, then the next stop will be 1242/39. Closing beyond 1242 on a daily basis would make me think that the market could head to the daily cloud. On its way up, expect to see resistance in the 1250.30-1248 region.