The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 20th August 2017

Last week, I saw the best possible trade for the coming week long of the Japanese Yen, the Euro, and Gold, and short of the U.S. Dollar. The result overall was negative, but not dramatically so: the USD/JPY rose by 0.02%, EUR/USD fell by 0.53%, and Gold fell by 0.38%, producing an average loss of 0.31%.

Last week saw two major developments, both of which were political: Trump administration controversy which had the result of increasing sentiment that the President may not survive a full term, and terror attacks in Europe. Both have had the effect of increasing “risk-off sentiment” and so the major movements of the week were gains in Gold and the Japanese Yen, as well as a sharp fall in stocks, especially in the U.S. market. The FOMC Minutes released on Wednesday had the effect of weakening the U.S. Dollar also, but this was neither strong nor persistent.

There is a very thin news agenda due this week, so “risk-off” is likely to persist ahead of the Jackson Hole summit next weekend. Following the current picture, I see the highest probability trade this week as long of the Japanese Yen and the Swiss Franc, and short of the U.S. Dollar. Short Gold looks unsafe as the price is at a major inflection point where, so far, it appears to be turning bearish.

Fundamental Analysis & Market Sentiment

The major elements affecting market sentiment at present is “risk-off” sentiment, although volatility is quite low and flows weak.

As we are now well into the traditionally quiet month of August, we may see a general decrease in volatility and a flattening out of the market gather strength this week, as the economic data release cycle is extremely thin.

Technical Analysis

U.S. Dollar Index

This pair printed a bearish pin candlestick, with a clear upper wick, although it should be noted this is not a high-quality pin candlestick. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. The resistance level at 12012 has been rejected, holding almost to the pip. It seems probable that the downwards movement will continue.

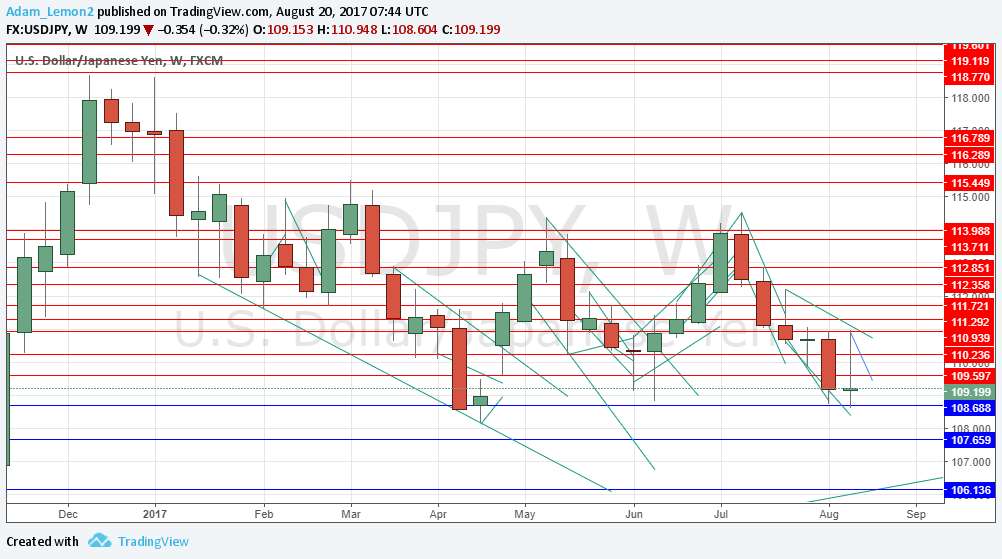

USD/JPY

This pair printed a bearish outside candlestick, closing near its low. However, there is a key support level at the low which has so far held convincingly The Yen has been performing well over the last few weeks. The outlook is bearish but the area below has been inflective, which could limit any downwards movement.

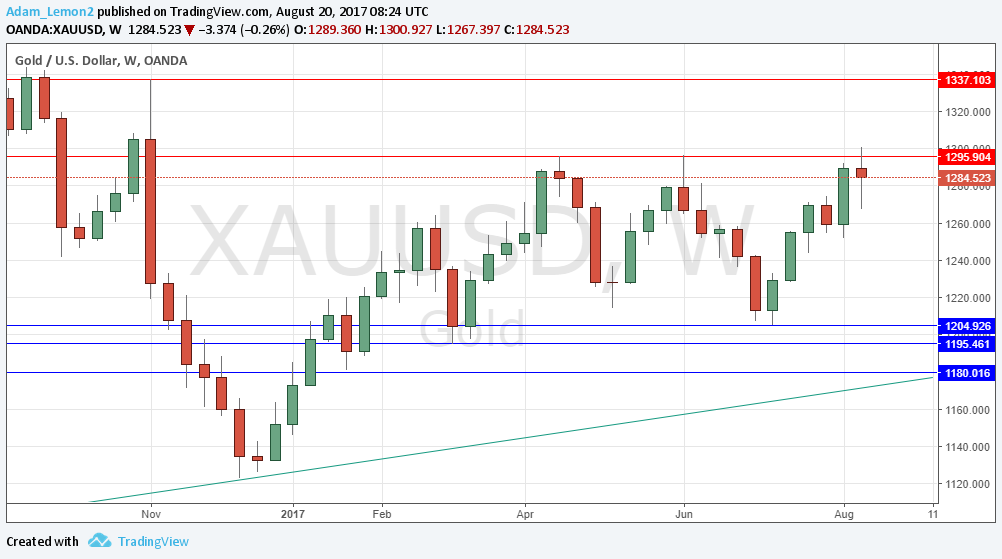

Gold

This pair printed a doji candlestick after rejecting a key resistance level at $1295.90, which has held over several months and has already produced a double top. This could be the start of a major bearish reversal, but it should be noted that there seems to be more bullish momentum than there was at the previous rejection of this level. The doji candlestick is also a little weak, as the close is some way from the middle of its range, and it is not notably larger or smaller than any previous candlestick.

Conclusion

Bullish Japanese Yen and the Swiss Franc; bearish on the U.S. Dollar.