Gold prices rallied to nearly $1280 an ounce on Wednesday as rising tensions between the U.S. and North Korea stoked demand for the safe-haven metal. Although the situation had not reached a crisis level yet, North Korea’s threat of retaliation pushed some investors away from stocks and other risky assets. A breach of some key technical levels also pushed gold higher.

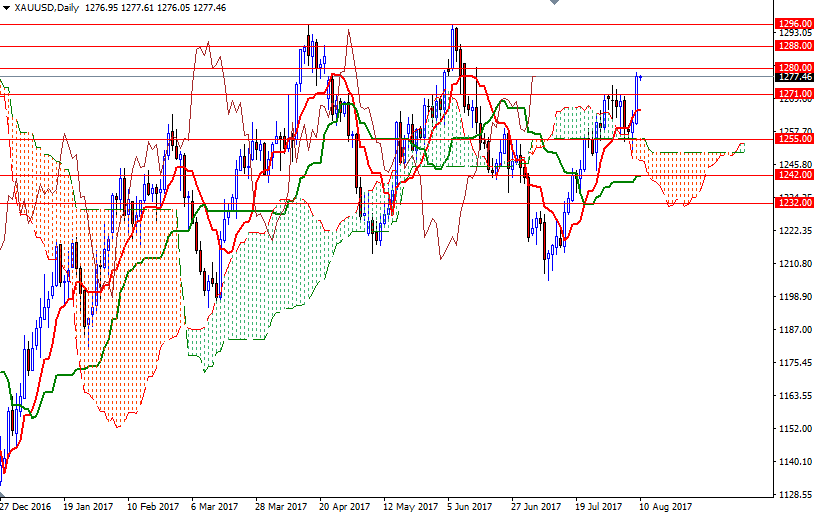

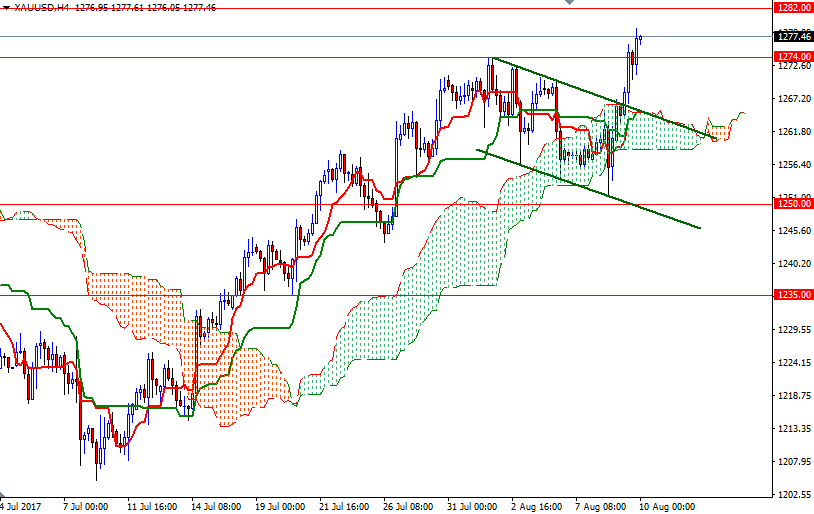

XAU/USD rocketed up after the resistance in the 1266.50-1264 area was broken. Once again, prices are above the clouds on almost all time frames, plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) are positively aligned. The next key level to the upside is located in the 1280/2 zone. If the bulls continue to dominate the market and push prices above 1282, look for further upside with 1288 and 1296/5 as targets.

A failure to pass through 1282/0, on the other hand, could result in some profit taking. In that case, it is likely that XAU/USD will pull back to test 1274 and 1271/0. A break below 1271/0 might lead to a drop to the 4-hourly cloud.