Gold prices ended a choppy, two-sided trading session slightly lower yesterday, with many investors in wait-and-see mode ahead of key U.S. economic data. In economic news on Tuesday the Institute for Supply Management reported that its manufacturing activity index fell to 56.3 from 57.8 the prior month and the Commerce Department said consumer spending rose 0.1% in June. XAU/USD is currently trading at $1265.82, lower than the opening price of $1268.81.

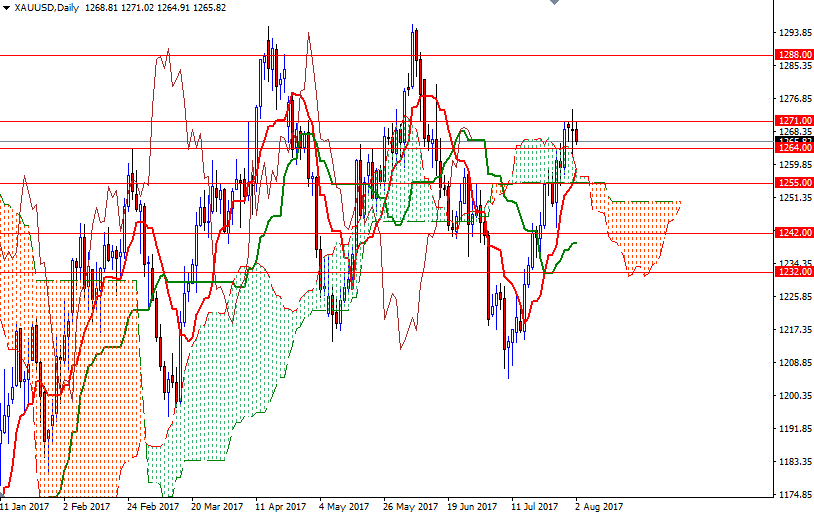

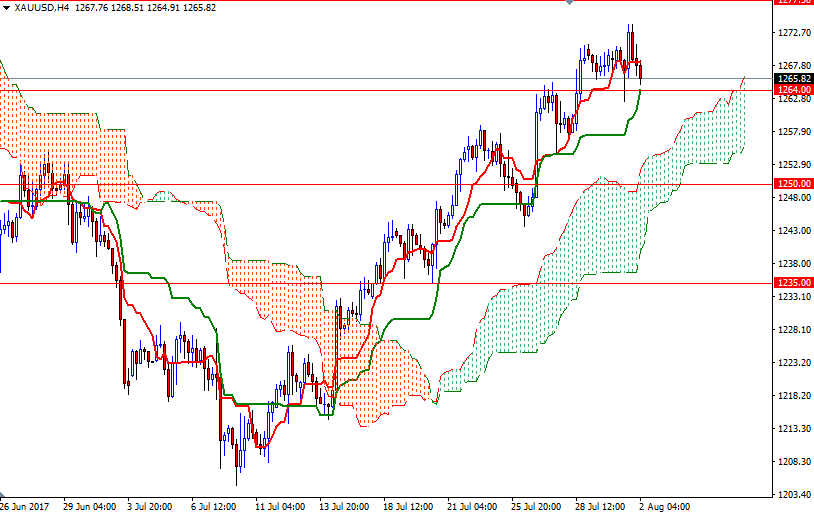

It seems that the market is heading back to the support in the 1264-1262.15 zone. In fact, this slight pull back is not so surprising as the short-term charts showed signs of exhaustion, a case that I pointed out last night. The bottom of the hourly Ichimoku cloud also resides in this area so the bears will need to drag prices below there to gather momentum 1257.50-1255, the area occupied by the daily cloud.

However, keep in mind that the weekly, the daily and the 4-hourly charts still suggest that the overall environment still looks bullish for gold (i.e. downside potential will be limited, at least until prices fall back below the 4-hourly cloud). If the bulls can defend their camp in the 1264-1262.15 area, they may have another chance to make a fresh assault on 1274/1. A break through there brings in 1279-1277.50.