Gold prices ended Monday’s session up $17.85, helped by a slumping U.S. dollar index that hit a 15-month low. Trump administration’s mounting problems and the recent turbulence in world stock markets are also working in favor of the precious metal. XAU/USD traded as high as $1324.34 an ounce as investors moved away from stocks and sought safe havens after North Korea fired a ballistic missile over Japan.

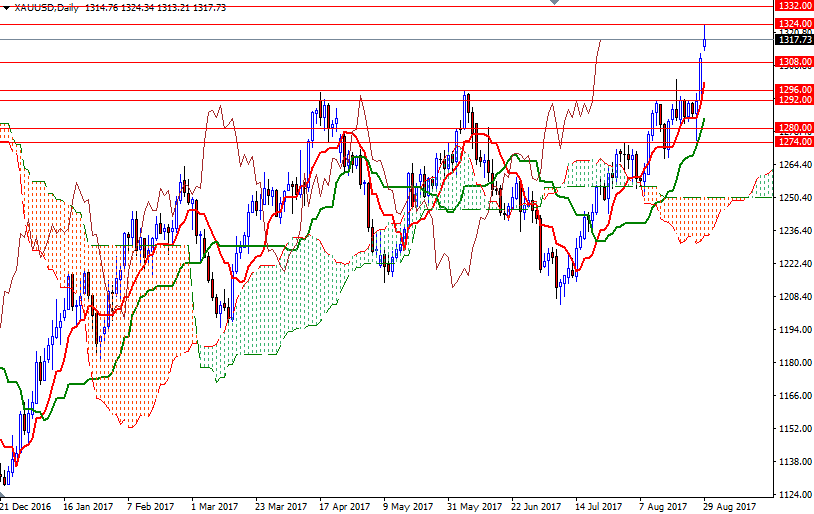

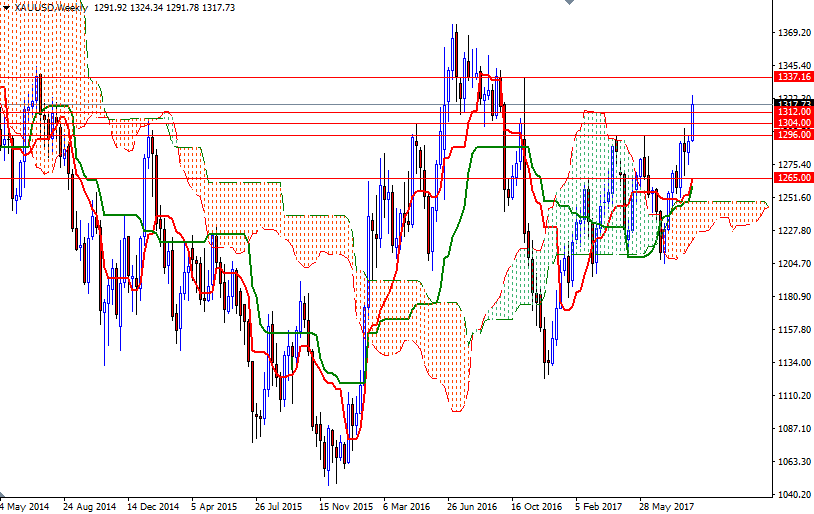

At the beginning of the month, I had pointed out that gold was likely to maintain bullish trend over the medium term based on the technical developments. Closing above the 1296 level, which had blocked the bulls’ way back in April and June, suggests there is still more room to the upside. However, bear in mind that prices are moving within the borders of the monthly Ichimoku cloud so it may be a bumpy ride.

To the upside, there is an anticipated resistance zone that stretches from 1324 to 1327.50. The bulls have to produce a daily close beyond that barrier so that they can march towards November 9 high of 1337.16. A failure to break through, on the other hand, will likely result in profit taking and a test of 1312-1311.50. If XAU/USD can’t hold above 1311.50, then the market may continue to drop towards the hourly cloud. In that case, 1308 and 1304 could be the next stops.