Gold prices ended Wednesday’s session down $1.12 as the dollar moved higher on the back of better-than-expected economic data. The Commerce Department Commerce said that gross domestic product expanded at an annual rate of 3.0% in the second quarter and Automatic Data Processing Inc. reported that the private sector added 173K jobs in May, broadly in line with expectations. ADP’s data is treated as a kind of preview for the monthly government report, though these figures aren’t always accurate in predicting the outcome.

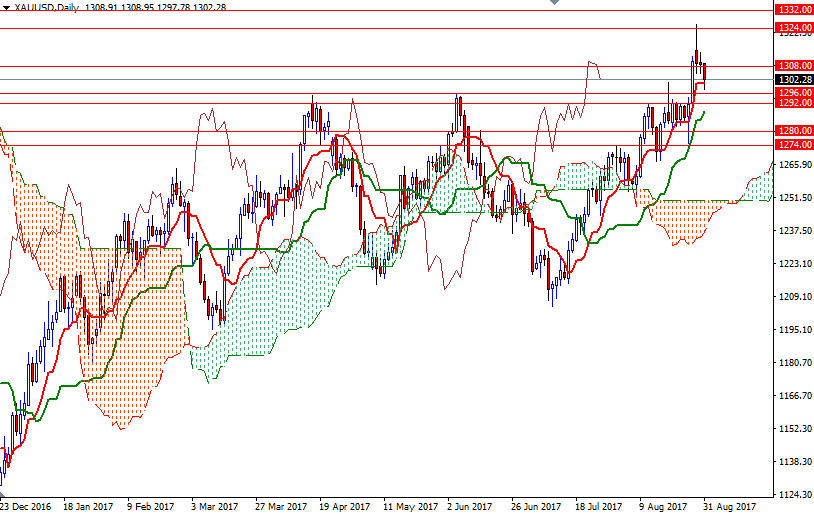

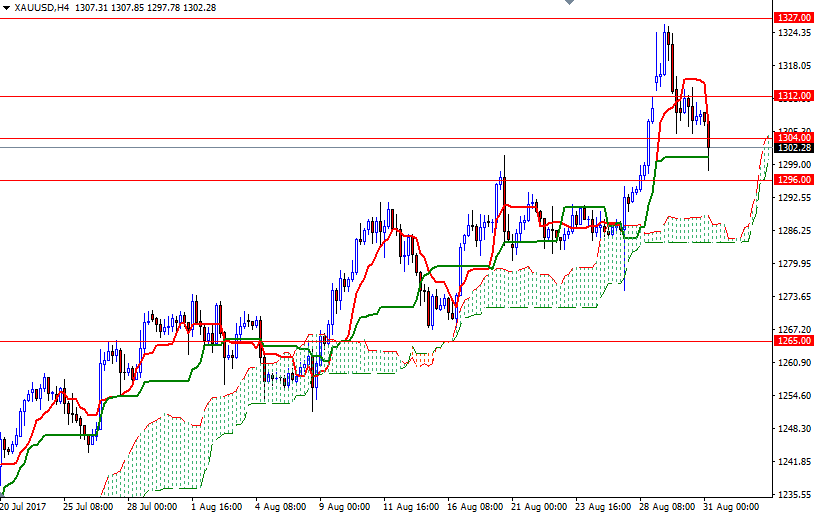

XAU/USD fell through the Ichimoku cloud on the H1 chart (also broke down below the 1304 level) in Asia session and headed towards the 1296 level. This area looks to have flipped from resistance to support but I would put the bottom of that support a little lower at 1292. If it remains intact and prices can climb back above 1304, then we may revisit 1309.40-1308. The market has to penetrate that barrier to test the resistance in the 1313.45-1312 zone, where the top of the hourly cloud sits.

On the other hand, if the crucial support in the 1296/2 area is broken, prices will continue to retreat to the 4-hourly cloud. In that case, the bears will be aiming for 1288/5. Once below there, look for further downside with 1282/0 as the next target.