Gold prices settled at $1269.35 an ounce on Monday, rising 2.3% on the month, as investors grew more cautious on prospects for U.S. growth and the path for higher interest rates. Developments in Washington and reduced inflation expectations weighed on the dollar for much of the month. Further Fed rate hikes are not seen as likely until December, and that is a bullish underlying element supporting the precious metal.

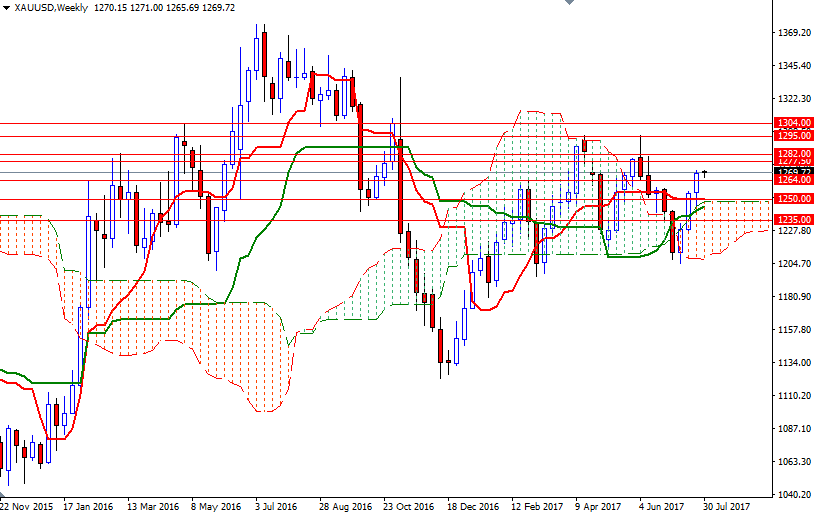

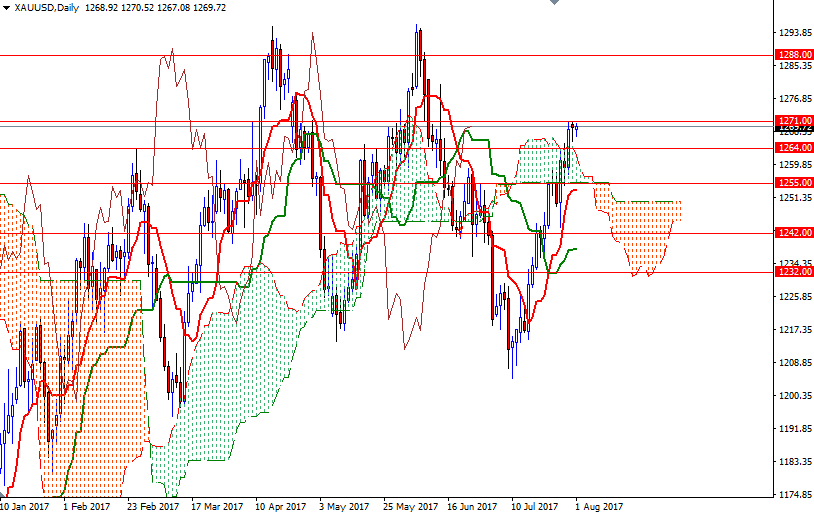

From a chart perspective, there are two things that catch my attention at first glance. First of all, the weekly Ichimoku cloud continues to be supportive. Secondly, the recent rally has pushed XAU/USD above the daily cloud. In addition to that, the daily and the 4-hourly Chikou-span (closing price plotted 26 periods behind, brown line) also reside above the clouds. These suggest that gold is likely to maintain bullish trend over the medium term.

The market is currently in the process of testing the resistance in the 1271/0 support zone, and if XAU/USD can anchor beyond there, it has the potential to rise all the way to 1296/5. The bulls have to produce a daily close above this strong barrier in 1296/5 to challenge the bears waiting in the 1308/4 region. Breaking through this key technical resistance would signal a push up to 1327.50-1324. However, if XAU/USD struggles to penetrate 1271/0 and drops below 1264, I wouldn't rule out the possibility of a pull back to 1255 or even 1250. A break down below the 4-hourly Ichimoku cloud could trigger further weakness. In that case, the 1243/2 zone will probably be the next port of call. Below there, the 1235 level stands out as an obvious key support.