Gold prices ended Tuesday’s session down $10.19 as the dollar strengthened after retail sales recorded their biggest jump in seven months. A separate report released by the Federal Reserve Bank of New York showed that manufacturing activity in the region climbed to 25.2 from 9.8 a month earlier. XAU/USD traded as low as $1267.19 an ounce but managed to close just above the $1271 level.

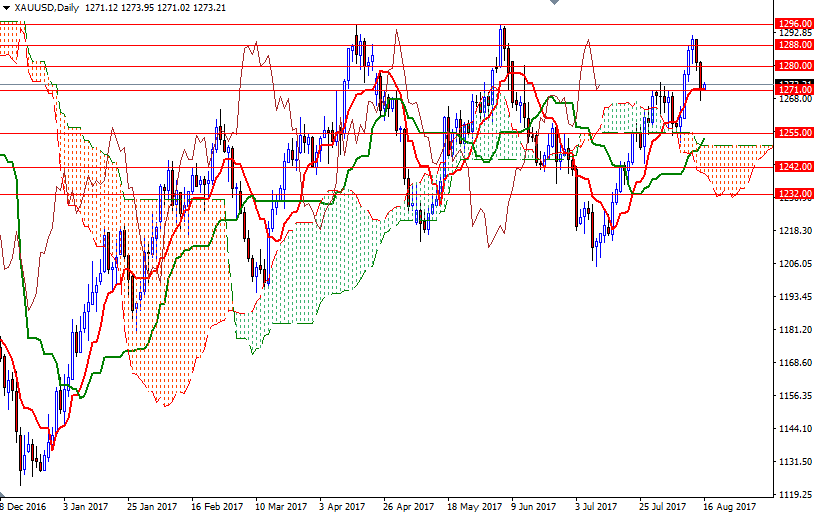

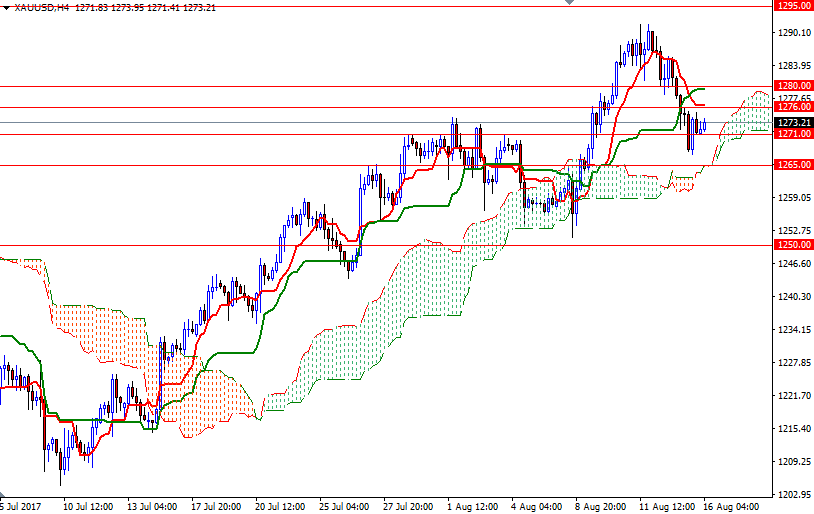

The medium-term charts are still bullish, with the market trading above the weekly and the daily Ichimoku clouds. However, despite this positive picture, the short-term charts are slightly bearish at the moment. If the market falls back below 1271, we may move towards the 4-hourly cloud. Closing below 1265/2 on a daily basis implies that the bears are aiming for 1255.

To the upside, the initial resistance stands in 1277/6, followed by 1282/0. The Kijun-sen (twenty six-period moving average, green line) on the H4 chart also sits in this area so the bulls have to push prices above there to take the reins and march towards 1288/6. Once above there, the market will be targeting 1292.