By: DailyForex

Gold prices are slightly lower in afternoon New York trading as some investors locked in gains at the end of the month. XAU/USD traded as low as $1265.69 an ounce but the U.S. dollar index weakened after the Chicago purchasing managers index came out softer than expected with a print of 58.9, and that did give gold a lift.

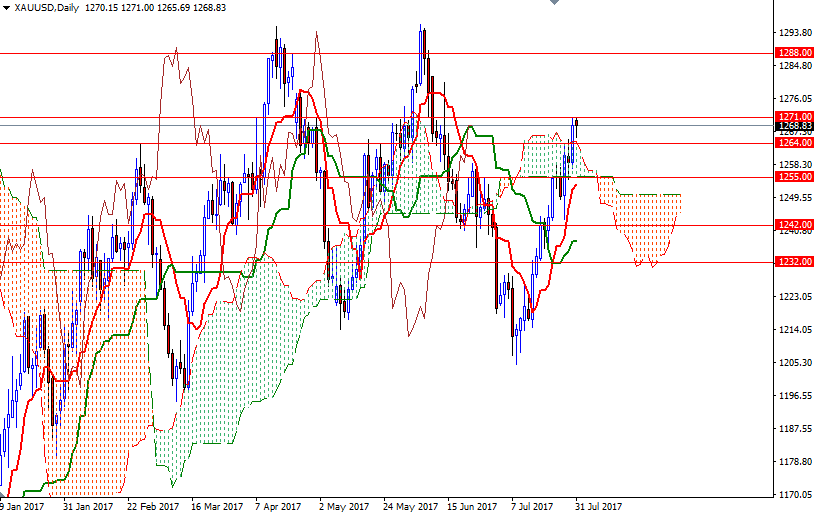

The key levels remain the same as the market is stuck within Friday’s trading range. So far, the resistance in the 1271/0 area has stopped the market from going higher, and down below we have the Ichimoku cloud on M30 chart acting as a support. The bottom of the cloud on M30 chart and the top of the daily cloud converge in the 1264.50-1264 zone so the bears will need to pull prices below 1264 to test the next support at 1261.

If the bulls win the fight and push the market beyond 1271, we might see a continuation targeting the next barrier in the 1282-1277.50 zone. A break through there would prolong the bullish momentum and clear the path towards 1288.