By: DailyForex

Gold is modestly higher in U.S. trading Thursday. XAU/USD climbed back above the $1264 level earlier in the day and ultimately reached the $1284 level as expected. Although we saw some profit taking after gold prices hit a six-week high earlier this week, long lower shadows on the daily candles suggest that pullbacks continue to attract buyers.

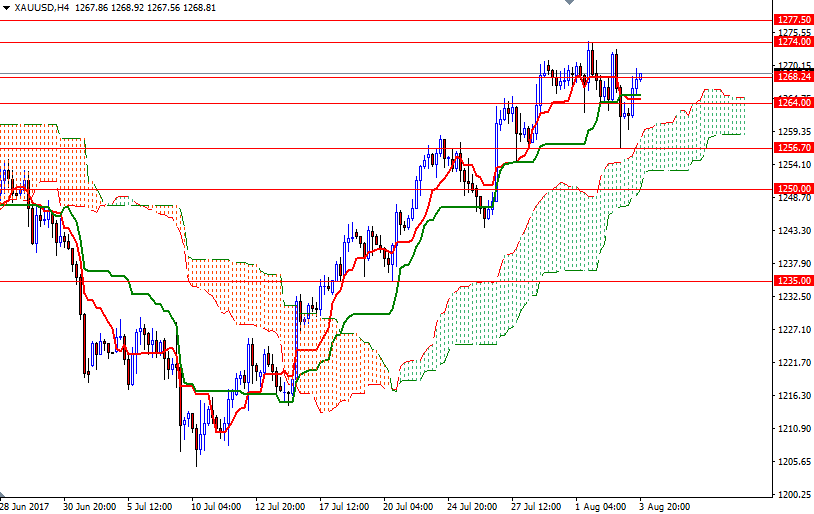

From a chart perspective, the bulls still have the medium-term technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly time frames, but as I pointed out earlier, some investors are still on the sidelines ahead of tomorrow’s key U.S. jobs report. We will probably have to wait until the data before prices get anywhere interesting.

The daily and the 4-hourly clouds currently overlap in the 1256.70-1255 area so the bears will need to pull XAU/USD back below there if they don't intend to give up. In that case, the 1253 and 1250 levels will be the next targets. However, if the market continues to stay above the 1264/2 area, we may revisit the 1274/1 resistance ahead.