By: DailyForex

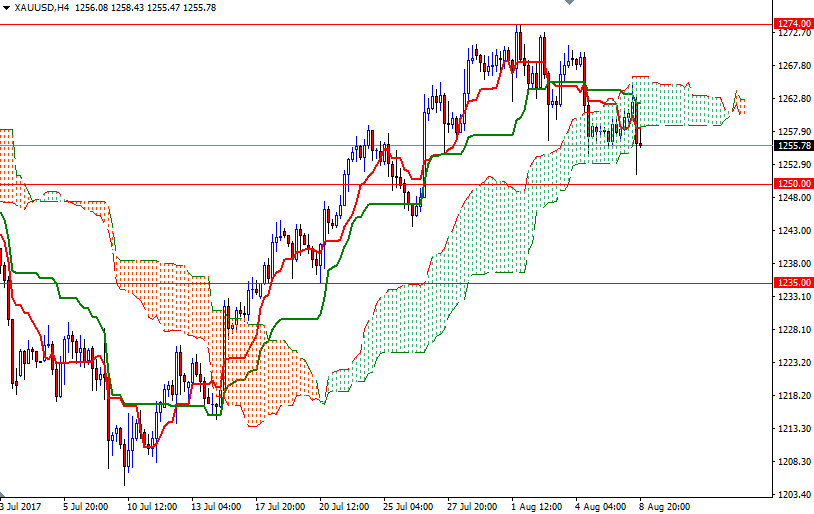

Gold prices are higher in U.S. trading Wednesday as investors sought safety from rising tensions between the U.S. and North Korea. XAU/USD was able to break the anticipated resistance at 1266.50, the top of the Ichimoku cloud on the 4-hour chart, and challenge the next barrier standing in the 1274/1 zone. Gold’s advance came after the impact of strong employment data last week diminished.

From a technical point of view, trading above the Ichimoku clouds indicates that there is more strength and volume behind the bulls. If the market ends the day beyond the aforementioned 1274/1 area, that would be another bullish sing and foreshadow a move up to 1282/0.

To the downside, keep an eye on the 1266.50-1264 area where the top of the 4-hourly cloud and the broken short-term bearish trend line converge. The bears will have to drag prices below there to tackle the intra-day support at 1258.85. A break below 1258.85 could see a fall to 1255/3.