By: DailyForex

Gold prices are slightly higher in U.S. trading Wednesday, following the disappointing ADP jobs report. XAU/USD started the day on the back foot, testing the support around the 1262.15 level, but recovered after the slowdown in hiring raised concerns about a weakening economy. Not surprisingly, we have seen sideways action in gold recently as investors awaited non-farm payrolls figures, but ultimately we are going to break out of this relatively tight range.

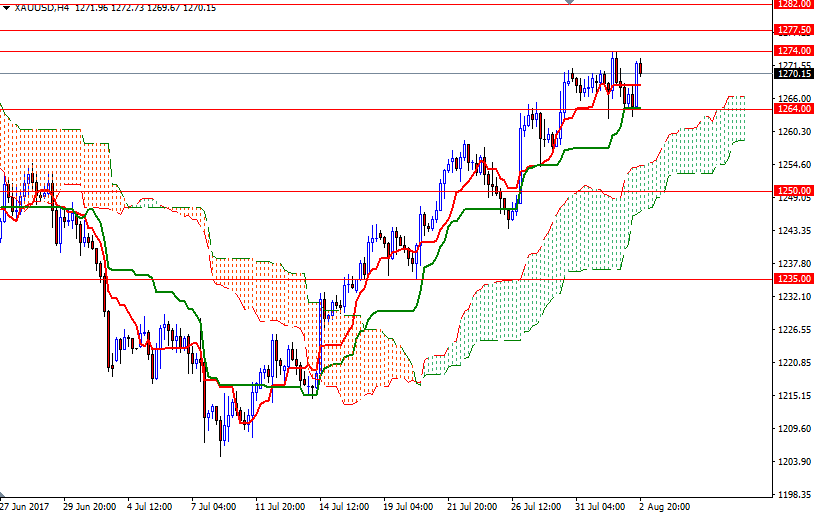

The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) on both the H4 and the H1 charts are flat, indicating lack of momentum. It appears that the market may continue to witness a steady to range-bound movement until Friday afternoon.

To the upside, the initial resistance stands in 1274/1, followed by 1277.50. A break up above 1277.50 is essential for a push up to 1282. Down below, the 1264-1262.15 area acts a support - i.e. the downside potential will be limited as long as it holds. If this support if broken, it looks like XAU/USD will get back to 1257.50-1255.