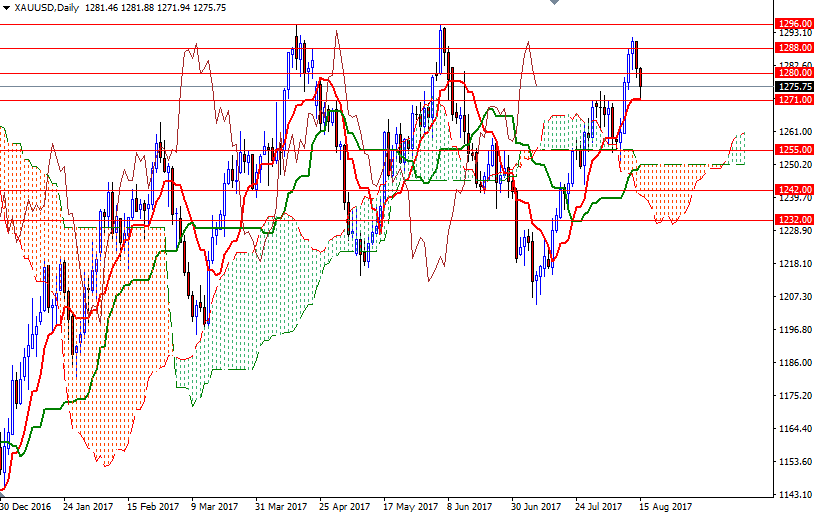

Gold prices fell $8.59 an ounce on Monday as easing tensions between the United States and North Korea boosted appetite for riskier assets. The support at $1280 initially held yesterday but finally was broken. The market pulled back to test the $1271 level as anticipated. Investors will be looking ahead to the retail sales report due out later today.

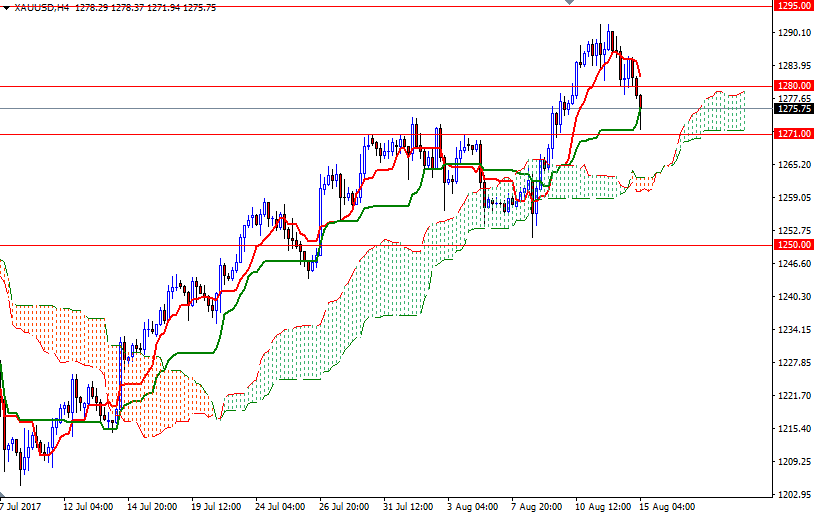

Today, prices continue to feel bearish pressure from the Ichimoku clouds and negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the H1 and M30 charts but the bulls are trying to hold market above the 1274/1 area. If the market doesn’t recover and climb back above the 1282/0 zone, this support will be in danger. A break down below there opens up the risk of a move towards the 4-hourly cloud. The bears have to drag prices below 1265/2 to increase pressure and make an assault on 1255.

If prices can anchor somewhere above 1182, on the other hand, it would be a bullish sign. In that case, look for further upside with 1288-1286.46 and 1292 as targets. XAU/USD has to push its way through 1292 to gather momentum for 1296, which is the next solid resistance on the charts.