Gold prices ended Wednesday’s session up $11.85 as the precious metal got a boost after the release of minutes from the Federal Reserve’s July 25-26 meeting indicated that officials were conflicted on whether to raise interest rates again this year. “Many participants ... saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside,” the Fed said.

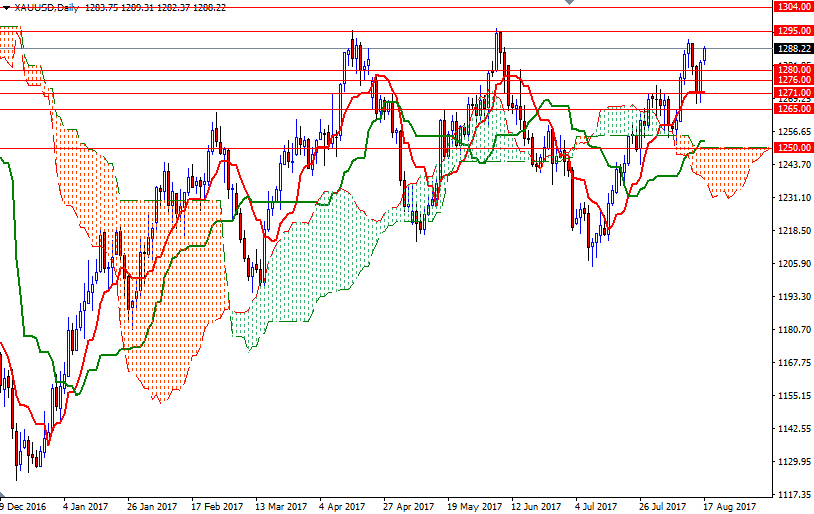

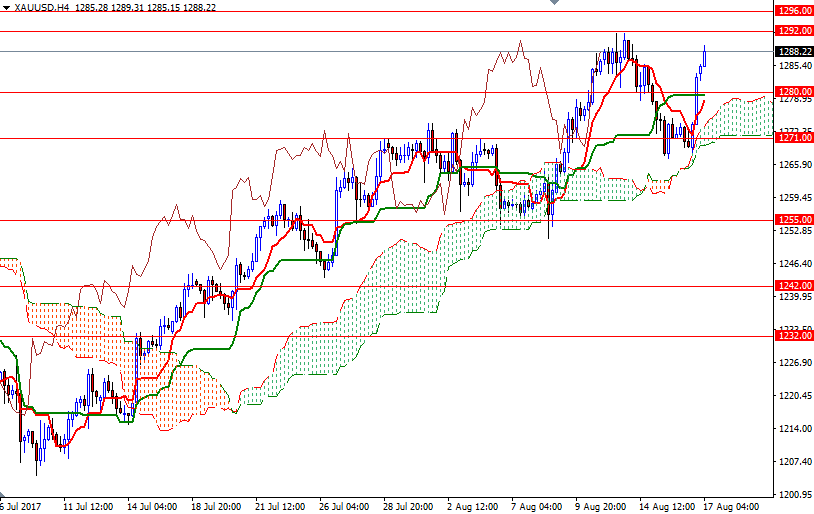

Technical buying pressure was also behind gold’s advance. Not surprisingly, penetrating the hourly Ichimoku cloud pushed prices higher and today the market is testing the resistance around the 1288 level. If the bulls continue to dominate the market and successfully break through 1288/6, then look for further upside with 1292 and 1296/5 as targets. Clearing the resistance at the 1296 level, which caused prices to reverse back in April and June, should prolong the bullish momentum and pave the way for a test of the 1308/4 area.

To the downside, the initial support sits in the 1282/0 zone. If the bears can pull the market below 1280, they may have a chance to revisit 1276/5. Below there, the bulls will be waiting around the 1271 level. A daily close below 1271 would be bearish sign and open a path to 1265/2.