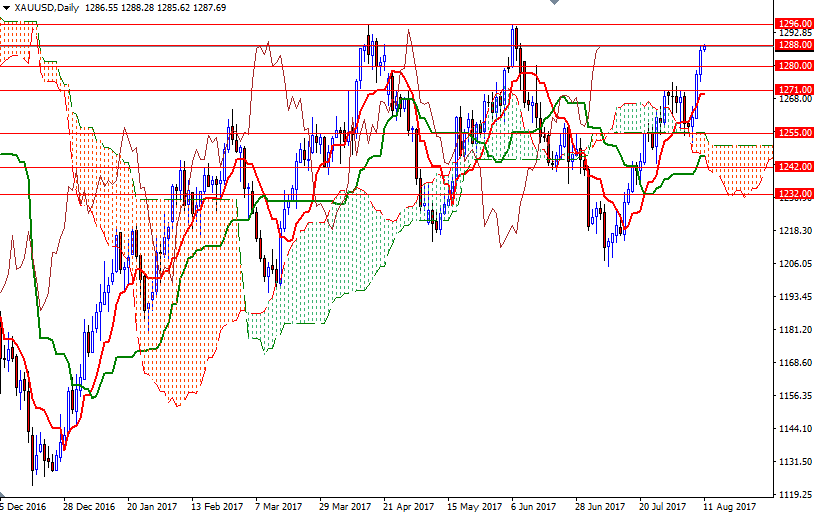

Gold prices rose $9.30 an ounce on Thursday, extending their gains to a third-straight session, as geopolitical risks hit equities and the dollar index fell. The greenback weakened after the Labor Department said its producer price index slipped 0.1% in July and the number of people filing new claims for unemployment benefits climbed by 3K to 244K. XAU/USD is currently trading at $1287.69 an ounce, slightly higher than the opening price of $1286.55.

The market is in the process of testing the 1288 resistance level, which prompted some profit taking yesterday. If the market successfully passes through, the 1296/5 area will probably be the next stop. Otherwise, prices may return 1283.50-1282 to gather momentum for a fresh attempt.

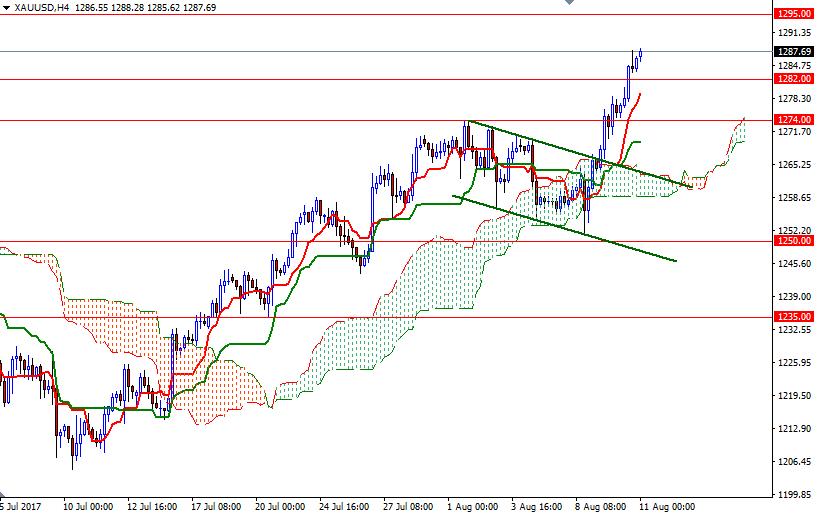

On the 4-hour chart, the Tenkan-Sen (nine-period moving average, red line) sits at 1280, so the bears will have to pull prices below there to challenge 1277/6 and 1274/1. Closing below 1271 on a daily basis would open up the risk of a fall to 1263/0, the area occupied by the Ichimoku cloud on the H4 chart.