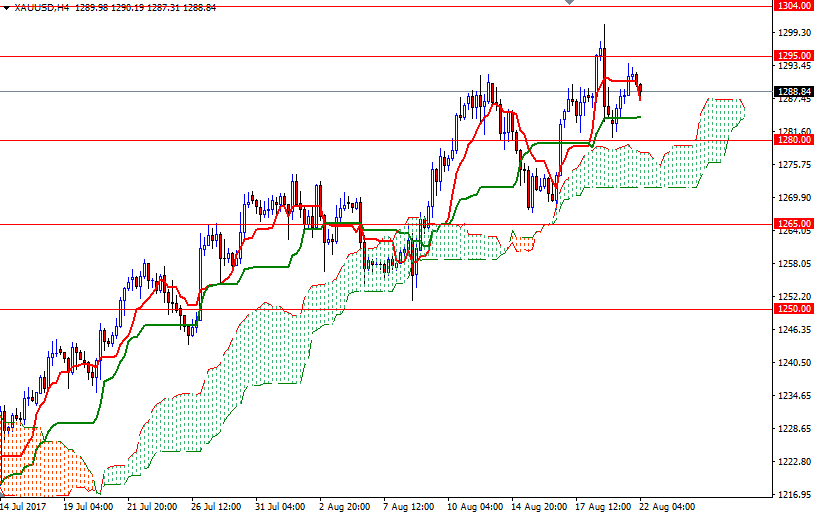

Gold prices rose $8.18 on Monday to settle at their highest level since June 6 as the greenback continued to weaken and equities edged lower. XAU/USD started the week on the back foot but found support just above the $1280 level and headed back to $1292. Disappointing inflation data and minutes from the Fed’s July meeting fanned speculations the Fed will not be in any rush to hike interest rates again in the coming months.

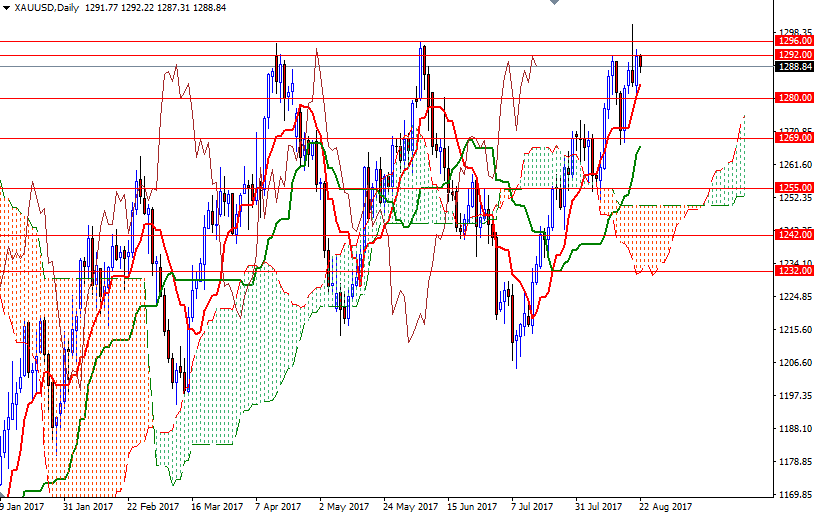

Trading above the Ichimoku clouds, along with the positive Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses, suggests that the bulls still have the overall technical advantage. However, the upside potential will be limited until the market breaks through 1296. A daily close beyond this barrier could provide buyers the extra fuel they need to tackle the next key resistance in the 1308/4 zone.

Intra-day supports are located at 1287 and 1284. If XAU/USD drops through 1284, we may pay a visit to 1280. The bears have to drag prices below 1280 in order to gather momentum for 1274. Eliminating this support is essential for a continuation towards 1271/69, where the bottom of the 4-hourly cloud sits.