Gold prices ended Monday nearly unchanged after a quiet session as investors await speeches from Federal Reserve officials. Aside from Fed speakers this week, traders will focus on economic data, including producer price index on Thursday and inflation on Friday. “The current level of the policy rate is likely to remain appropriate over the near term,” St. Louis Fed President James Bullard said. The XAU/USD pair is currently trading at $1259.88 an ounce, slightly higher than the opening price of $1257.36

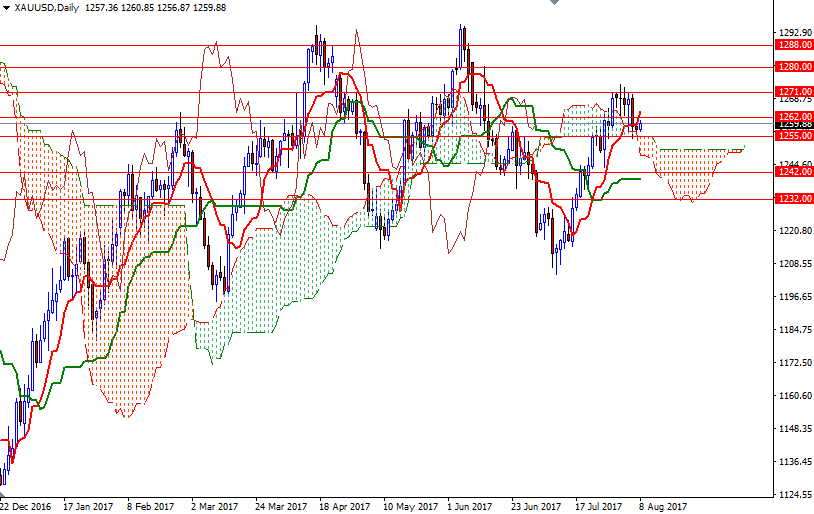

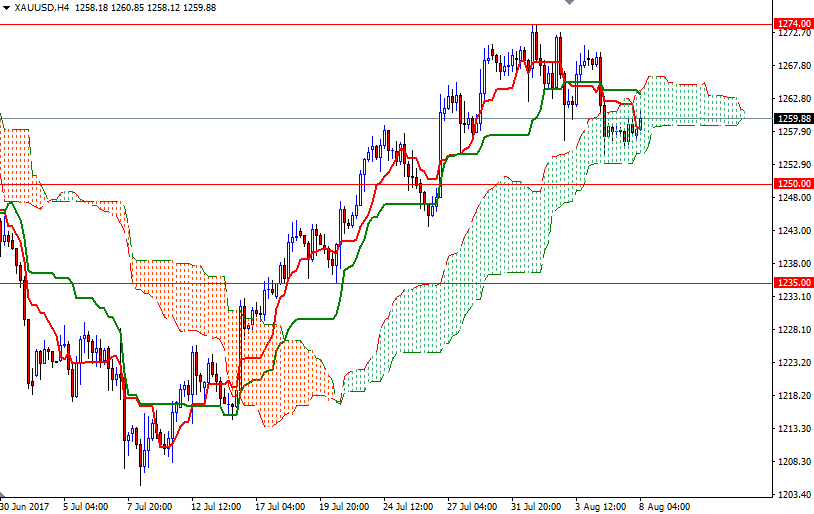

The market is trading above the weekly and the daily Ichimoku clouds and we have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines on both charts. The Chikou-span (closing price plotted 26 periods behind, brown line) which is above prices also suggest that the bulls still have the medium-term technical advantage. However, note that prices are currently within the borders of the 4-hourly cloud; plus the Tenkan-sen and the Kijun-sen are flat.

To the upside, the initial resistance stands in 1264/2. If the daily cloud continues to provide support, XAU/USD may march towards the top of the 4-hourly cloud. A sustained break above 1267 would be a positive sign, although the real hurdle sits in the 1274/1 zone. The bears have to pull prices back below 1255 to add some pressure and challenge the 1250-1247.89 area. If XAU/USD can confidently break below there, it is likely that it will proceed to 1242.