Gold prices fell $6.89 an ounce on Tuesday but remained within the trading range of the past four sessions as the battle between the bulls and the bears continued. Investors cautiously await Fed Chair Janet Yellen’s speech at the central bank’s annual symposium in Jackson Hole at the end of the week. July's disappointing inflation data had wiped out expectations for a Fed interest rate hike in September.

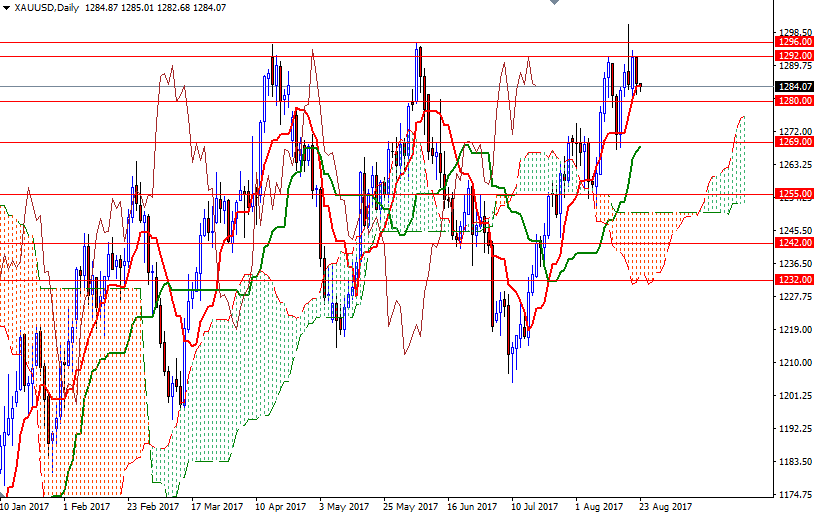

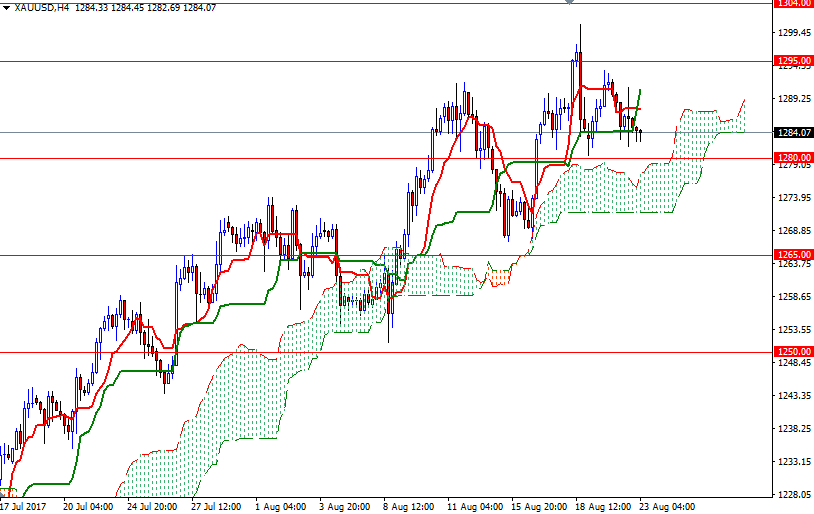

From a chart perspective, the bulls still have the overall technical advantage, with the market trading above the weekly and the daily Ichimoku clouds. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. However, flat Tenkan-Sen and Kijun-Sen lines on the H4 time frame indicate lack of a strong momentum.

Down below, we have the 4-hourly Ichimoku cloud, which should continue to be supportive. If XAU/USD falls through 1280/79, we may head towards 1274. The bears will need to capture this strategic support to make an assault on 1271/69. To the upside, the initial resistance stands at 1292, followed by 1296/5. Closing above 1296 on a daily basis implies that the market will be aiming for 1308/4.