Gold prices ended a choppy, two-sided trading session higher yesterday as tensions between the U.S. and North Korea escalated. XAU/USD traded as high as $1267.12 an ounce after a sell-off in Japanese shares prompted investors to seek shelter in safe-haven assets. Gold usually benefits temporarily from geopolitical risks but a strong correction in equities markets could be the missing catalyst that gold needs to break resistance in the $1274-$1271 zone.

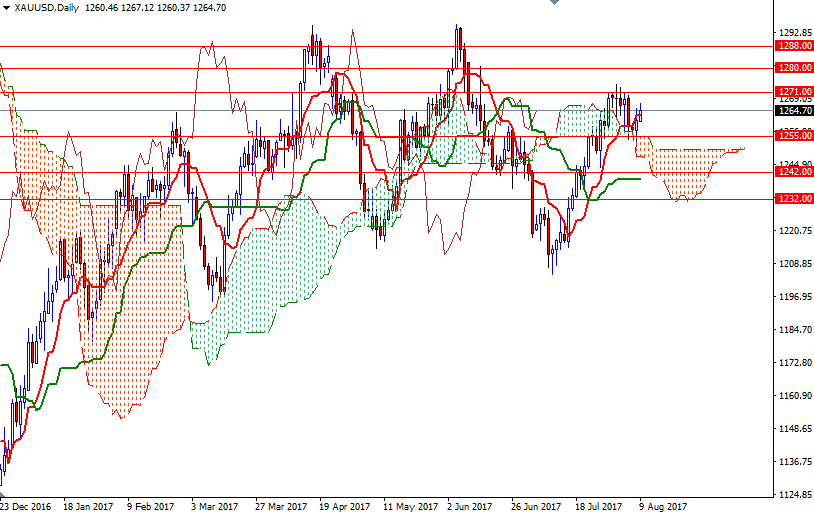

XAU/USD is still trading above the Ichimoku clouds on the weekly and the daily charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both time frames, along with Chikou Span/price crosses in the same direction. All these suggest that the bulls have the medium-term technical advantage.

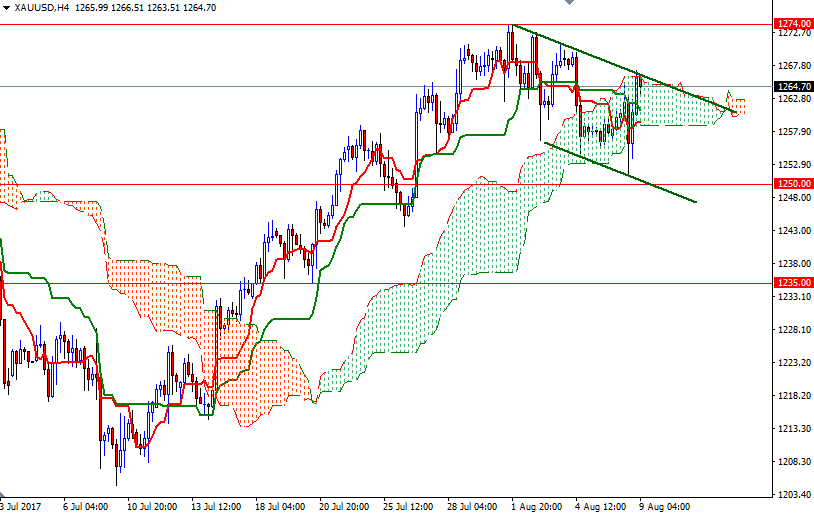

At this point, keep an eye on the top of the 4-hourly cloud, which is confluent with the upper trend line of the descending channel. If the market anchors somewhere beyond 1264, then the next stop will be 1274/1. Closing beyond 1274 on a daily basis makes me think that the market is on its way to 1282/0. However, a failure to break out of the channel would weigh on the market. In that case, XAU/USD may test 1258.85 (the bottom of the cloud on H4 chart) or even 1255/3. The bears have to capture that strategic camp to make an assult on the 1250-1247.89 area.