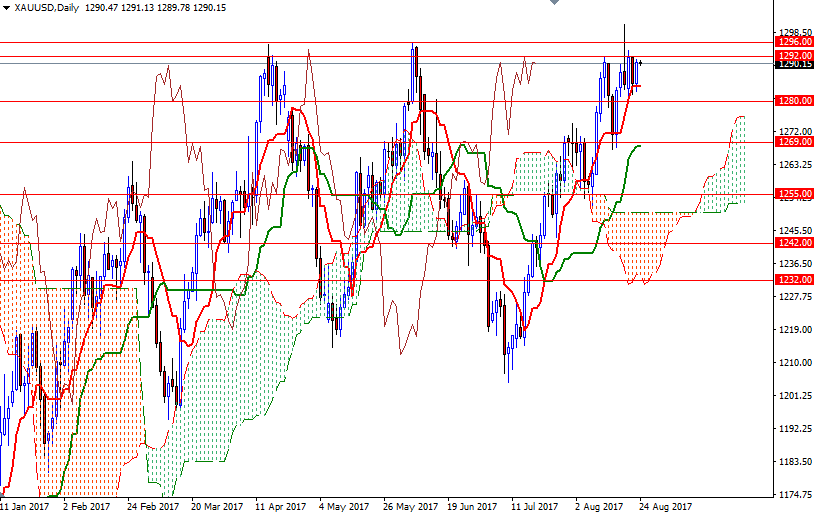

Gold prices ended Wednesday’s session up $5.71 as disappointing U.S. economic data and political uncertainty weighed on the dollar. In economic news, the Commerce Department said sales of new homes declined 9.4% to an annualized pace of 571K homes from 630K. Market participants will closely watch the Jackson Hole speeches for clues on future monetary policy decisions by the world’s major central banks. Traders are pricing in a 32% chance that the Fed will raise rates at its December meeting.

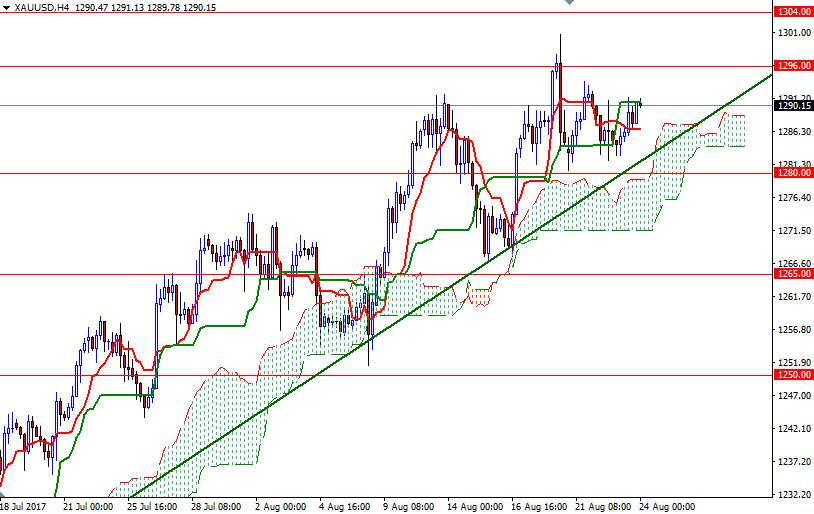

We have seen pretty much sideways action in gold lately but we are going to break out of this relatively narrow range eventually. At this point, the bulls have to hold the market above the 4-hourly Ichimoku cloud and ultimately push prices above 1296/2 so that they can march towards 1308/4.

The bears, on the other hand, will need produce a close below the 1280/79 area to put some pressure on the market. In that case, it is likely that XAU/USD will retreat to test the support at 1274. A break down below 1274 suggests that 1271/69 will be the next port of call.