Gold ended the week down by 0.9% at $1258.72 as investors took profits from a recent rally that pushed the market to the highest level in six weeks and the dollar got a boost from a massive gain of 209000 jobs in July. The Labor Department’s monthly jobs report also showed that average hourly earnings jumped 0.3% percent last month. Buoyant equities markets, along with another report showing a sharp drop in the trade deficit in June, contributed further pressure on gold. The Federal Reserve is likely to announce a plan to start reducing its balance sheet at its next policy meeting in September but delay raising interest rates again until December.

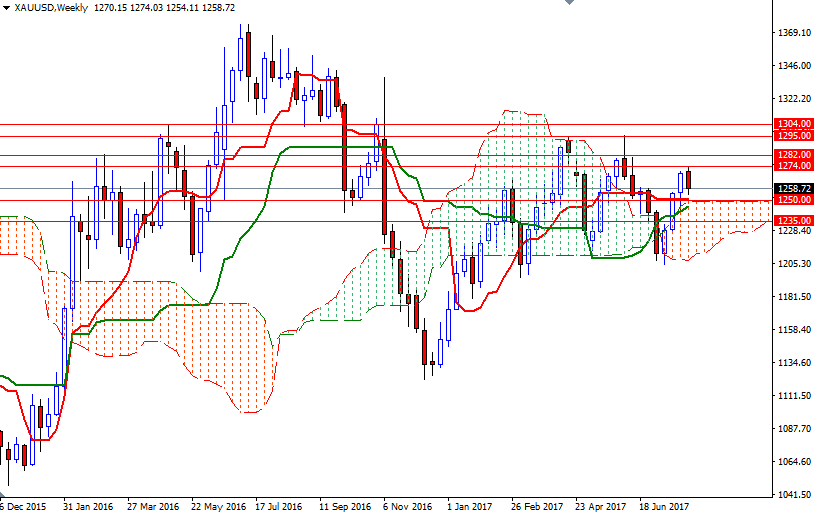

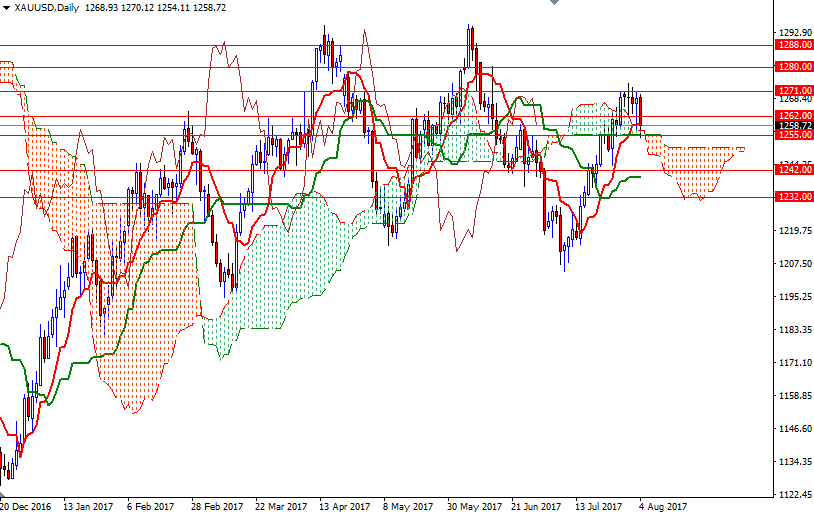

Prices are above the weekly and the daily Ichimoku clouds and we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on both time frames, indicating that the medium-term trend is still bullish. To the upside, the 1274/1 area remains as a strong barrier. A break up above 1274 would be a bullish sign and imply that 1282/0 could be the next stop. Closing beyond 1282 on a daily basis could foreshadow a move all the way up to 1295

The short-term charts, on the other hand, suggest that a test of 1250-1247.89 is on the table if XAU/USD fails to hold above the 1255/3 area. Breaching that support makes me think that the market is going to revisit 1242-1239.33. Down below there, the 1235/2 zone stands out as a key support. The bears will have to capture this strategic camp so that they can challenge the bulls on the 1227/4 battlefield.