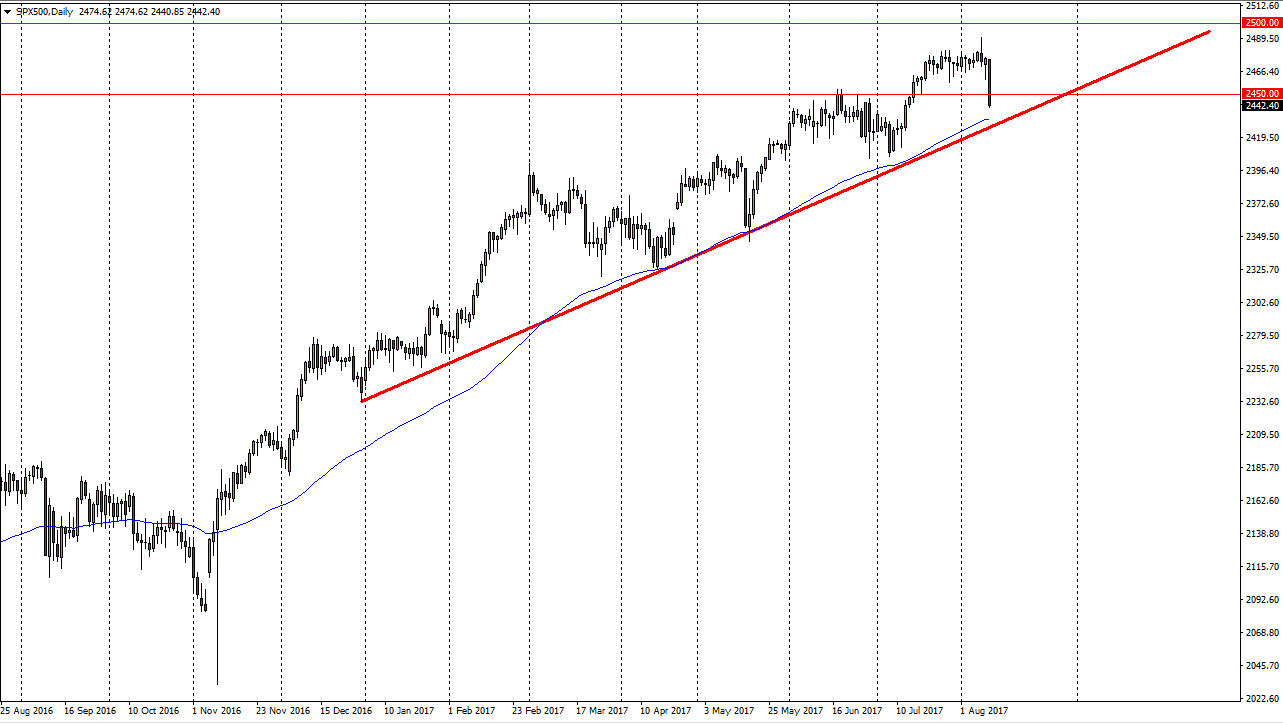

S&P 500

The S&P 500 broke significantly during the day on Thursday, slicing through the 2450 handle. Because of this, looks like we are going to continue to see a bit of bearish pressure but I also have an uptrend line on the chart that I believe will hold. Ultimately, I’m looking for some type a supportive candle or a bounce to take advantage of, as the market may be overreacting to the whole Korean situation. Part of this also is going to be due to the arguments between Congress and the president, but at the end of the day earnings are still strong in America. With this being the case, eventually the buyers will return and I look at this as an opportunity to pick up value. However, we may have to wait a couple of days to get a nice bullish move to take advantage of.

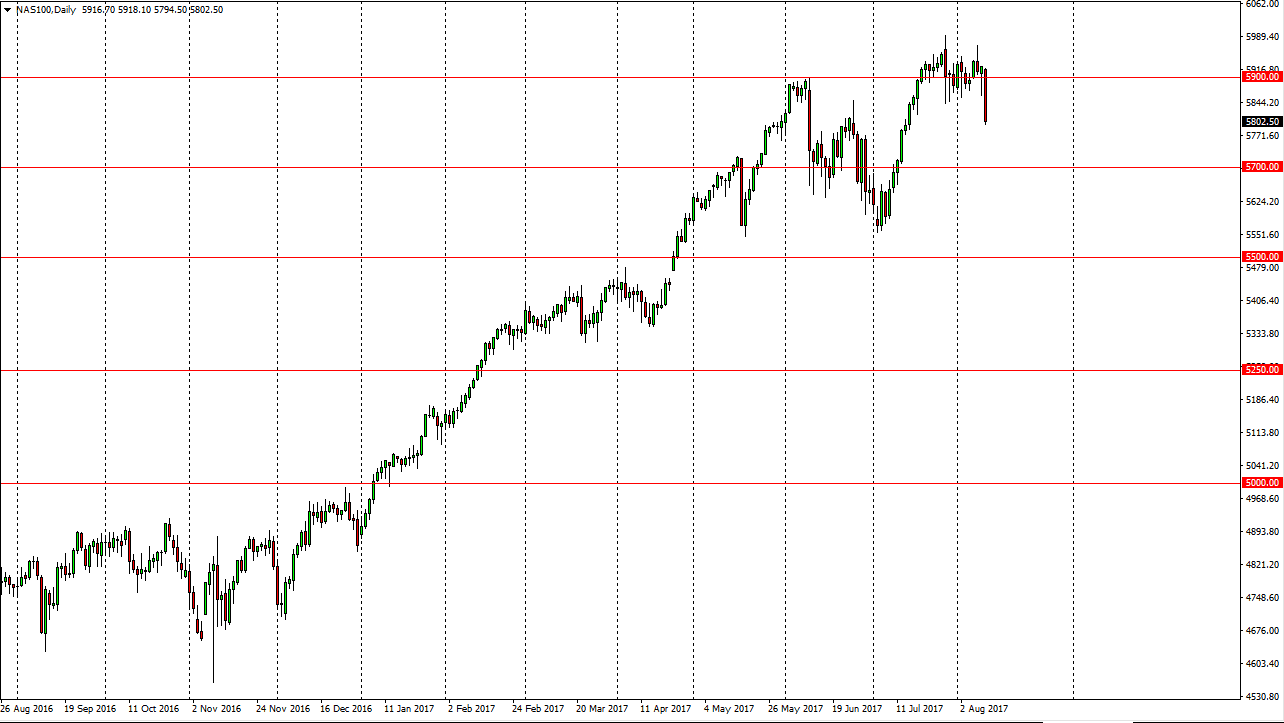

NASDAQ 100

The NASDAQ 100 look horrible during the day as we crashed into the 5800 level. That’s a sign that we could go a bit lower, but I would anticipate that this will be a buying opportunity before it’s all said and done. Because of this, you would not be ridiculed at all by me if you are on the sidelines waiting for some type of value or supportive candle to take advantage of. I would suspect that the 5700 level should be supportive, just as the 5500 level will be. I’m waiting to see a supportive candle so I can take advantage of it over the next couple of sessions. In the short term, I look at this pullback is very healthy and an opportunity to pick up value once we get some type of resilient reaction. As of yet, I have no interest in shorting.