GBP/USD

The British pound initially tried to rally during the week but found quite a bit of resistance above. This was exacerbated by the Bank of England suggesting the interest rate hikes are coming till 2018, and therefore sent the British pound tumbling in general. I think that the shooting star for the week suggests that a move below the 144 handle should bring sellers back into the market and could lead to a significant fall.

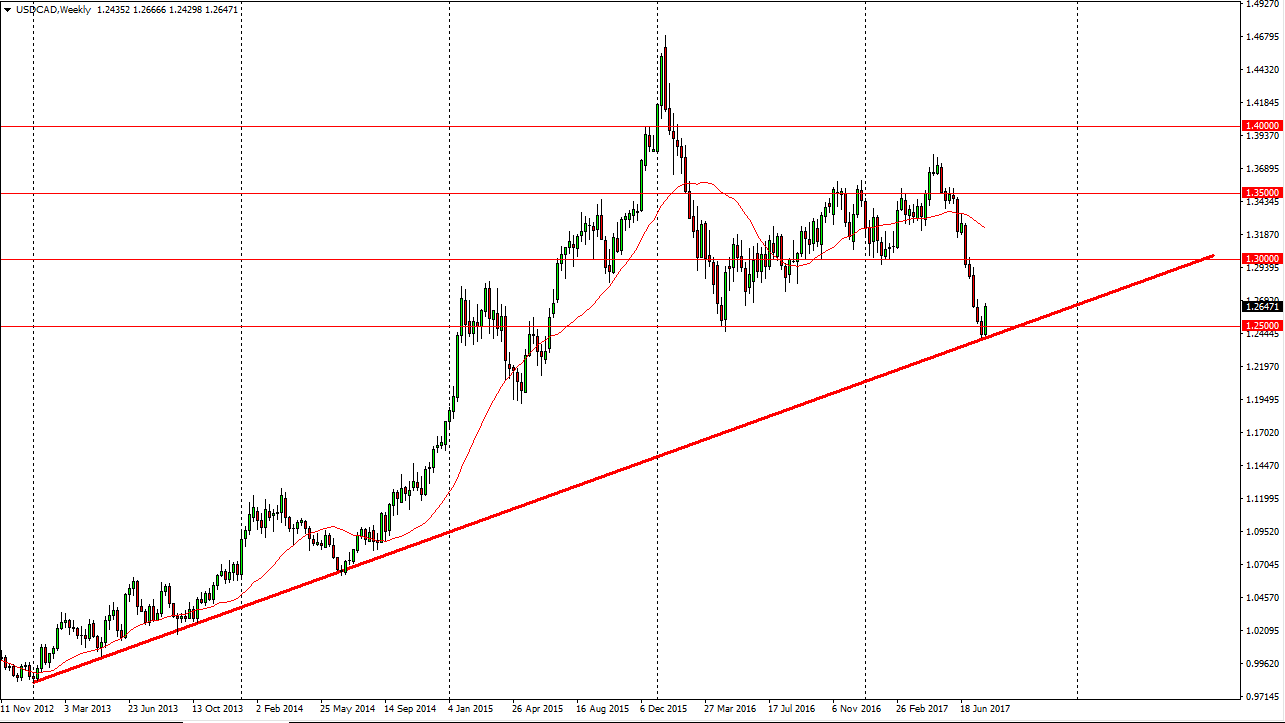

USD/CAD

The US dollar bounced from a major uptrend line on the weekly chart, and formed a very bullish candle after the jobs number on Friday. Because of this, I believe the market continues to go higher, and we should then go looking to the 1.30 level. The Canadian housing bubble is starting to pop, so this could have an effect on the market as well. I believe that we go higher and that pullbacks offer value that people will be taken advantage of.

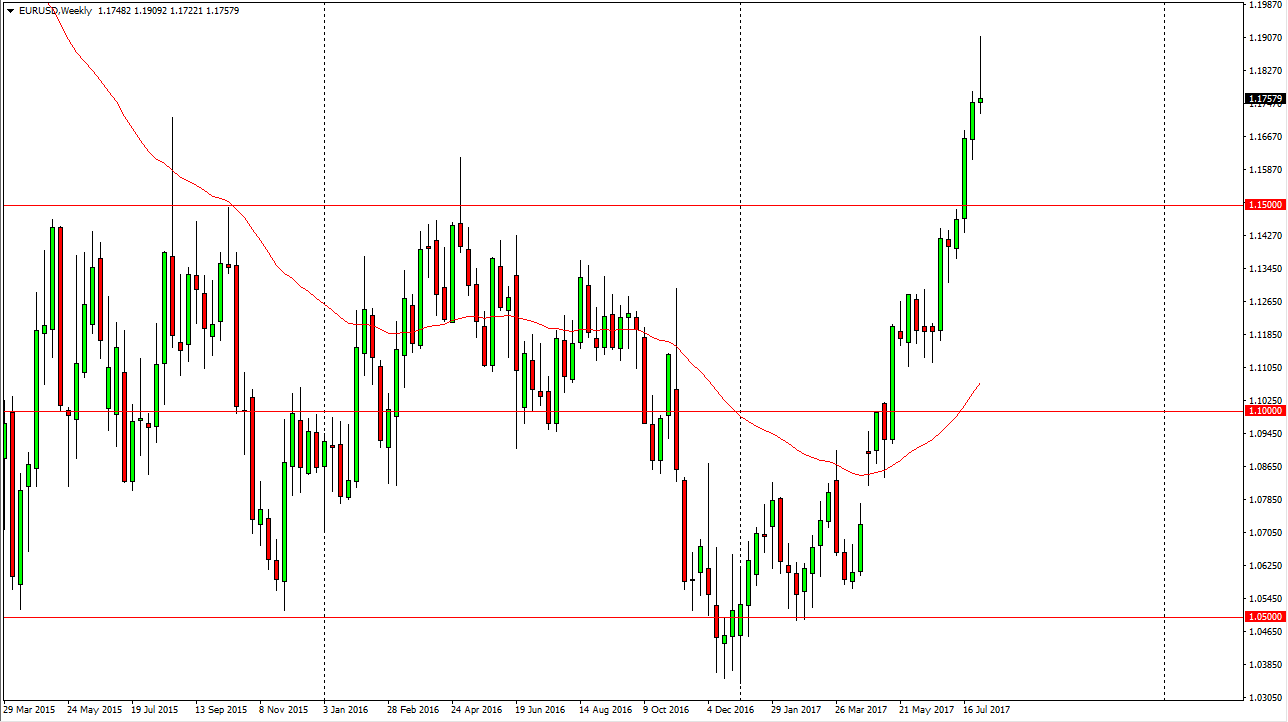

EUR/USD

The EUR/USD pair tried to rally during the week but turned around to form a massive shooting star. Because of this, looks as if we are finally running out of momentum, and that the market may spin the next couple of weeks pulling back. The 1.15 level underneath should be the floor though.

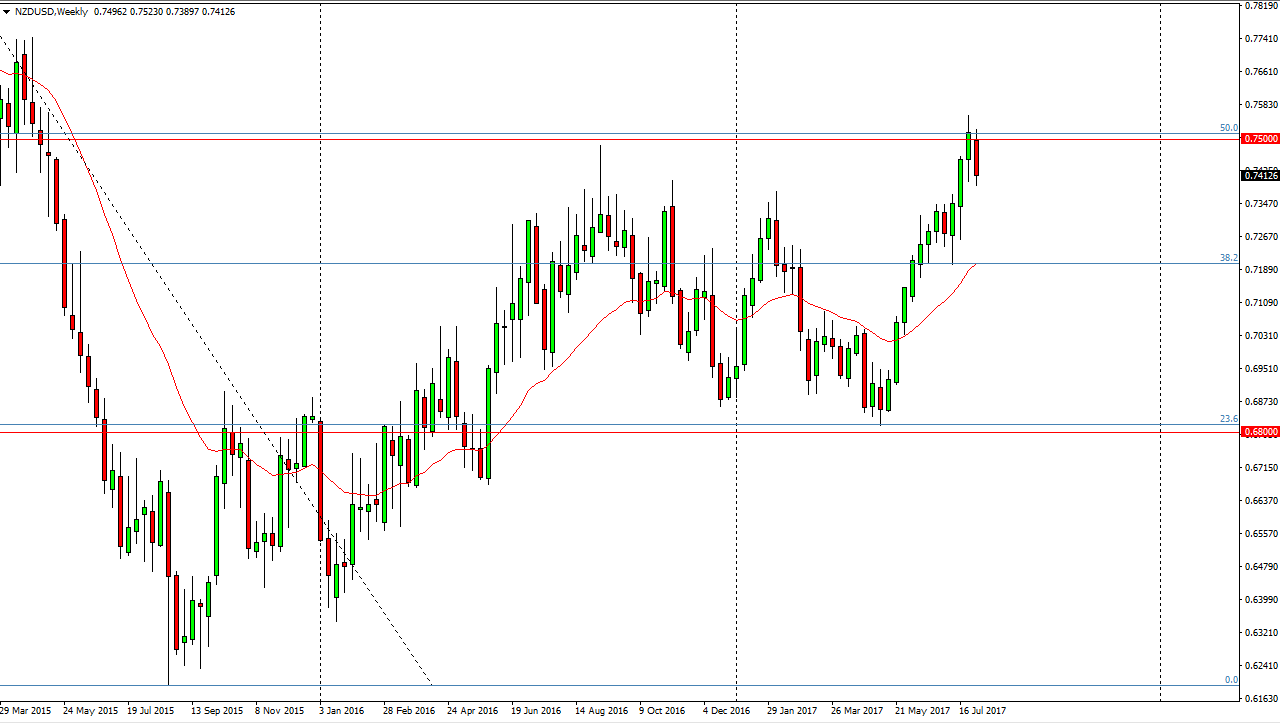

NZD/USD

The New Zealand dollar fell during the week, reaching towards the 0.74 level. It looks as if we are going to pullback from here, and I expect the NZD/USD pair to go down to the 0.72 handle. Short-term rallies could be selling opportunities, as the 0.75 level should offer significant resistance.