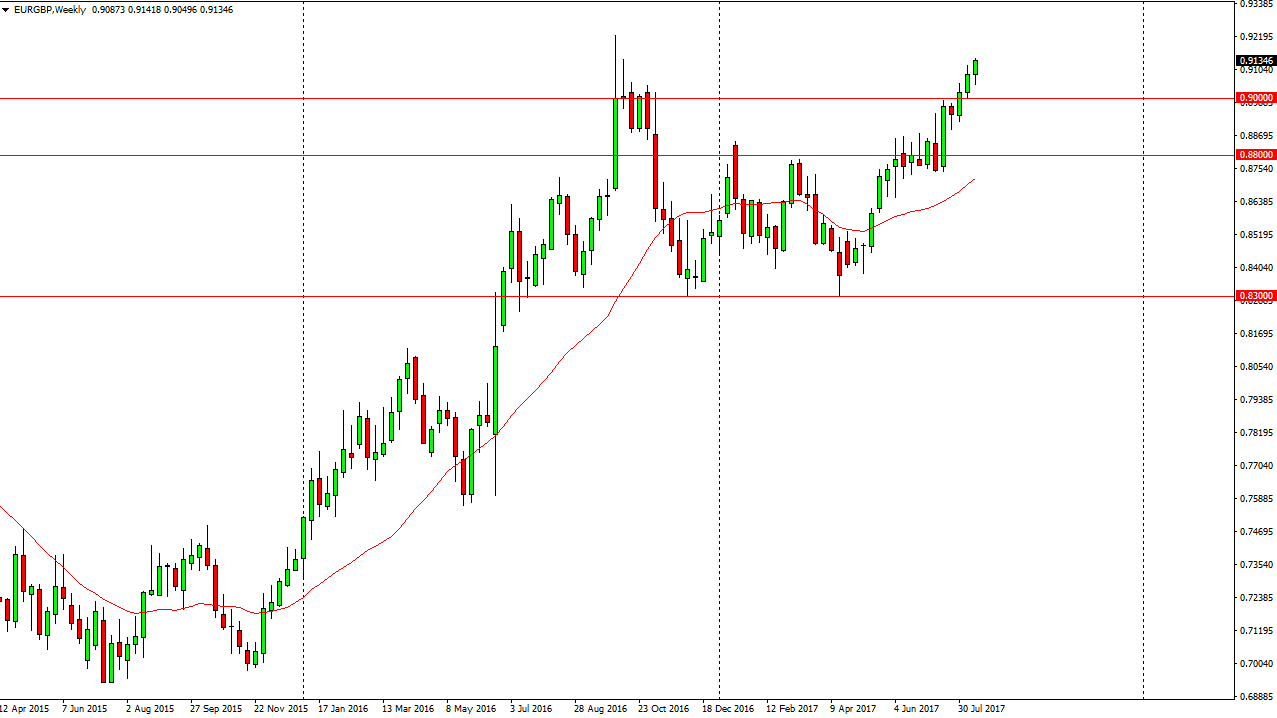

EUR/GBP

The EUR/GBP pair continue to show bullish pressure during the week, and resiliency on short-term dips. I believe that there is a “floor” in the market temporarily at the 0.90 level, so I like buying dips as it more than likely will be a market that trying to build up enough momentum to break above the 0.92 level and go much higher.

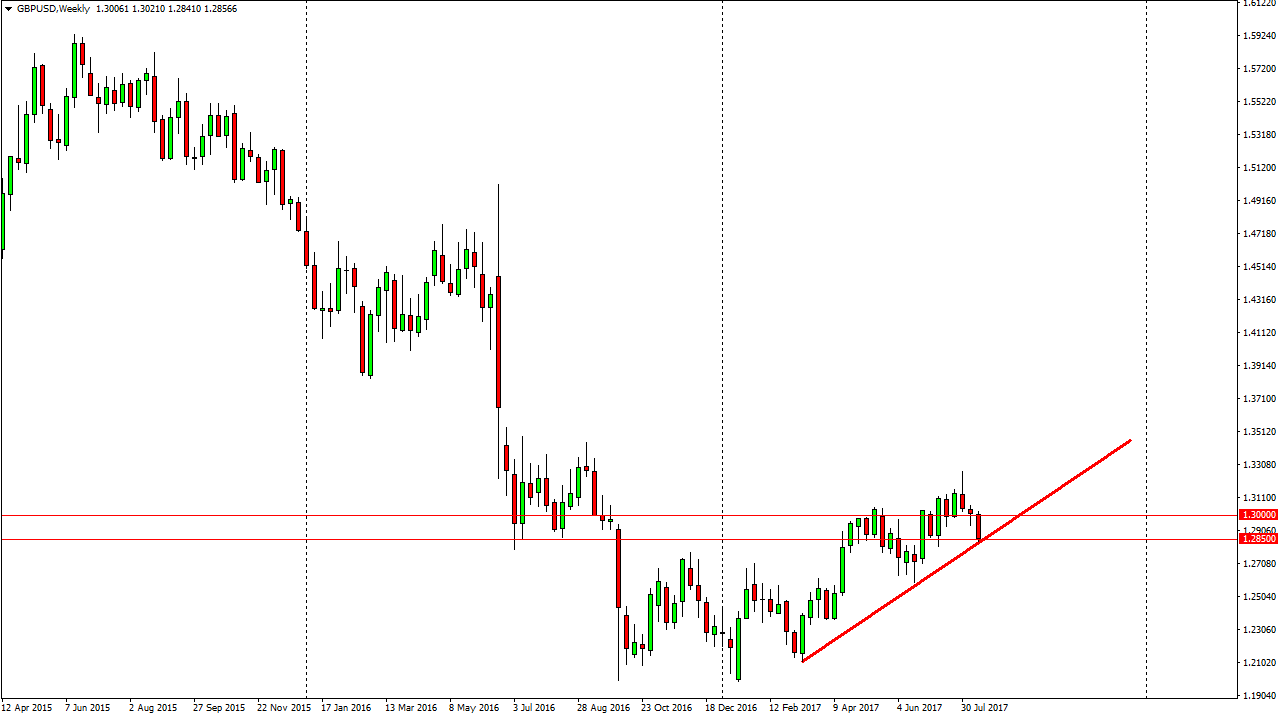

GBP/USD

The British pound has gotten hammered over the course of the week, and is now testing the 1.2850 level against the US dollar. There is an uptrend line on the weekly chart that I have drawn, and if we can break down below that uptrend line and more importantly the 1.28 handle, I think that the market goes down to the 1.25 level. In the meantime, I do not trust rallies until we clear the 1.30 handle.

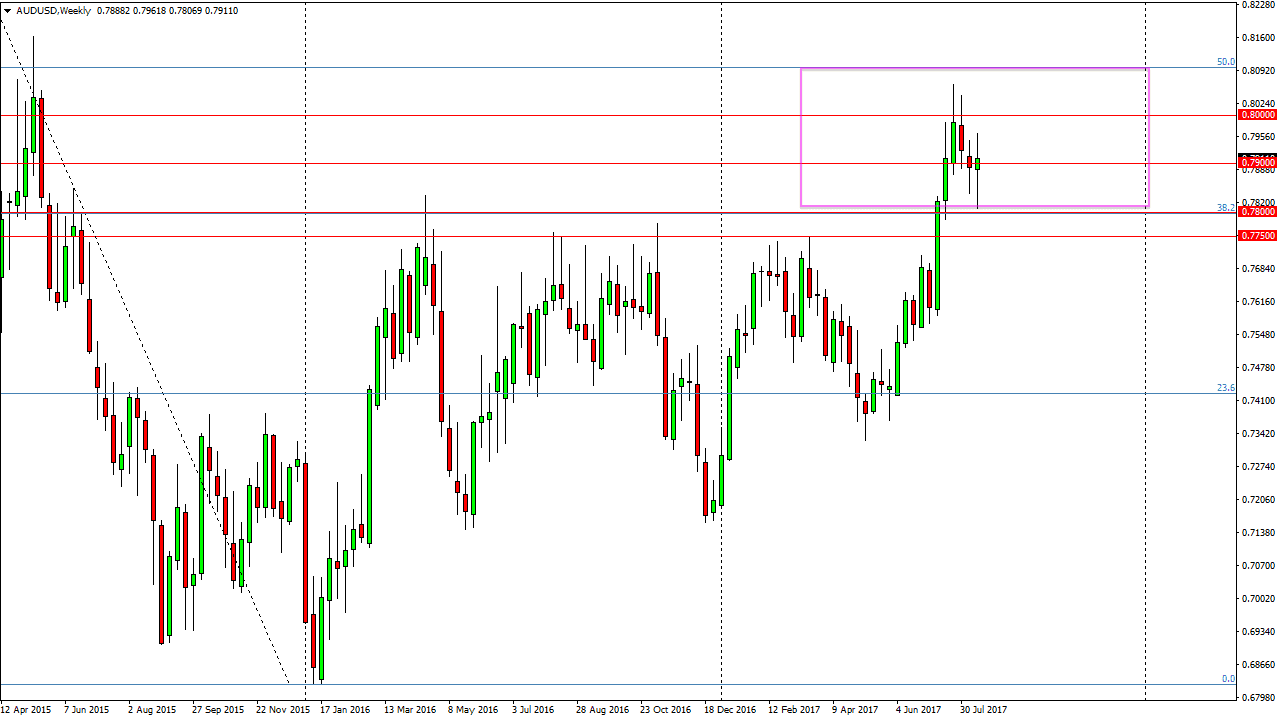

AUD/USD

The Australian dollar spent quite a bit of time going back and forth during the week, but most importantly tested the 0.78 level for support. We bounce from there, and it looks as if the recent breakout of the ascending triangle is valid. Because of this, I feel that the market will continue to be a “buy on the dips” situation, as the market goes looking for the 0.80 level above. A break above there would be very bullish as it is important on charts going back decades.

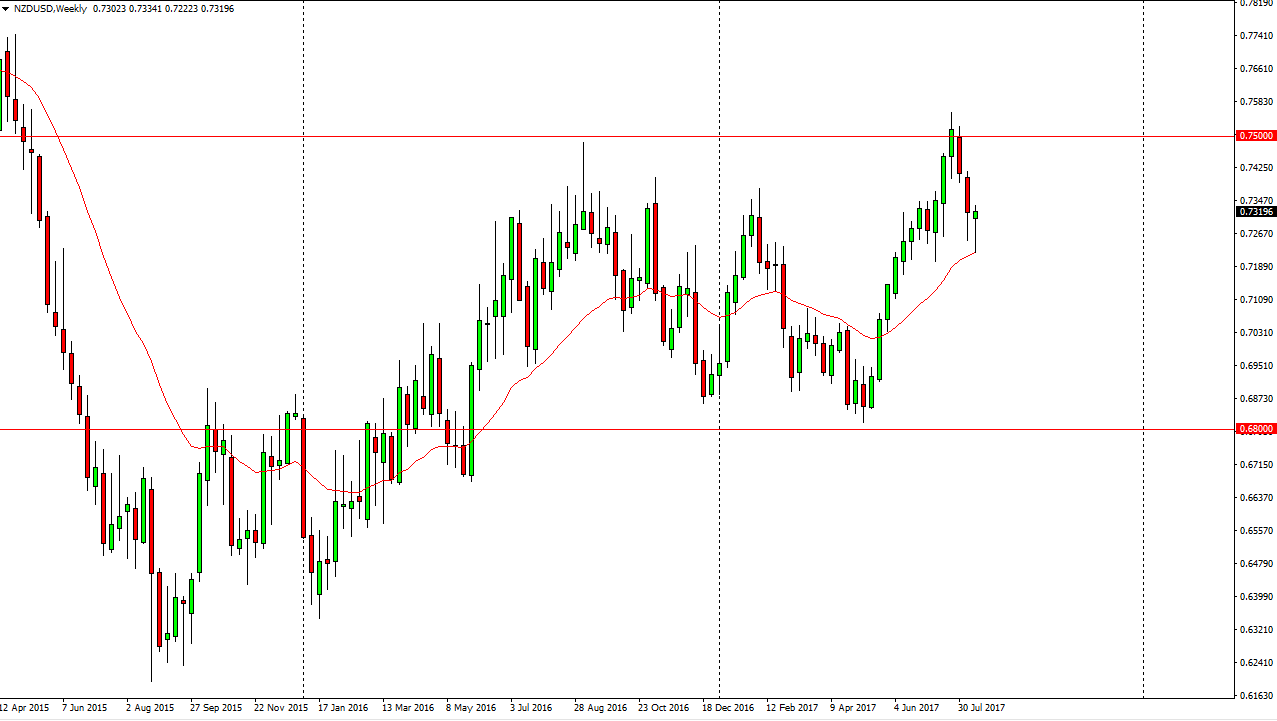

NZD/USD

The New Zealand dollar spent most of the week falling, but found enough support at the 0.7250 level to turn around and form a hammer for the week. Because of this, if we break above the top of the range for the week, I think that the market then goes looking towards the 0.75 level as the US dollars being sold off against almost everything currently.